Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The crypto market has just been hit by its largest liquidation wave since Dec. 9, 2024, with $1.68 billion in leveraged positions being wiped out in a single day and 390,029 traders being forced out, as per CoinGlass.

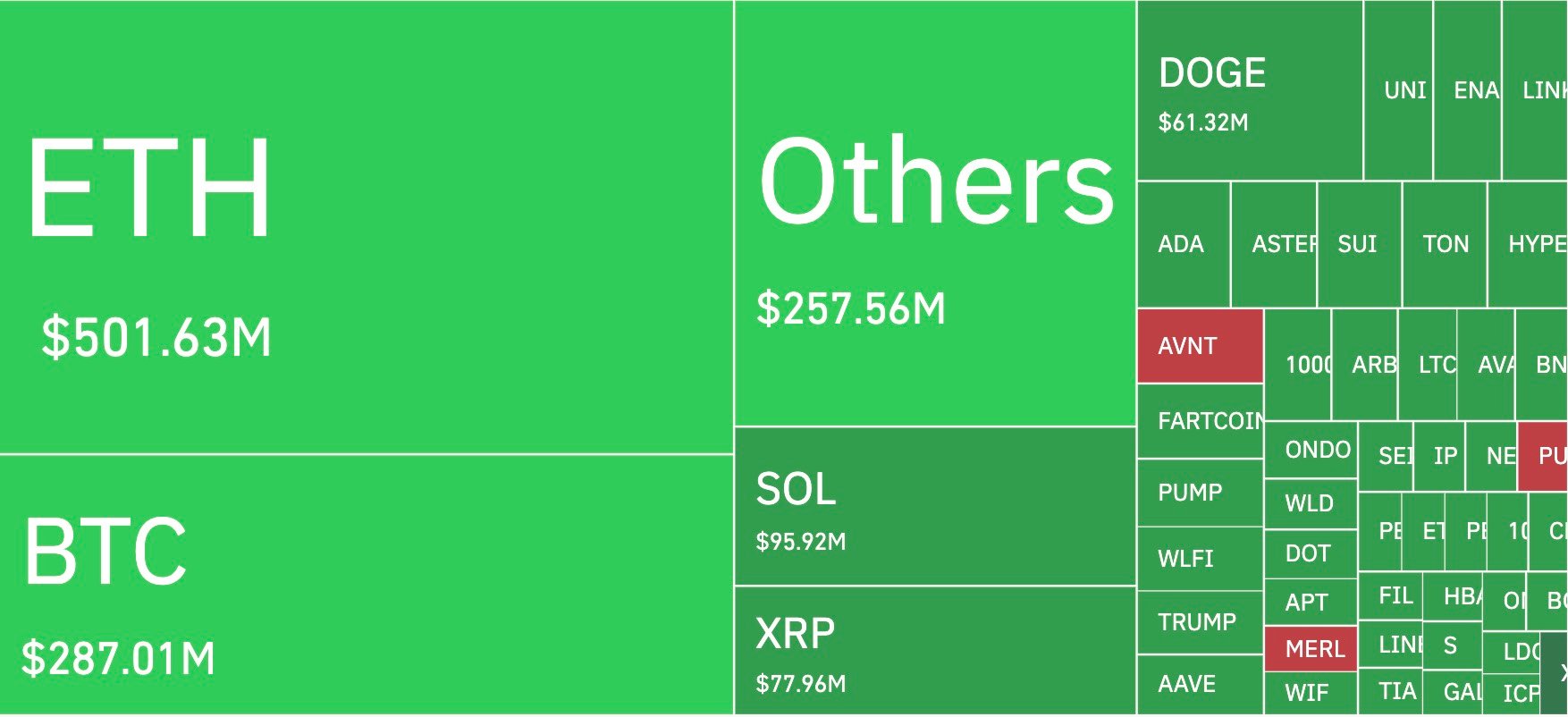

Ethereum took the worst of it, with $501.63 million liquidated, while Bitcoin lost $287.01 million, Solana $95.92 million, XRP $77.96 million and Dogecoin $61.32 million. Smaller altcoins together added $257.56 million more, and the largest single strike was on OKX, where a BTC-USDT swap worth $12.74 million was taken out in one go.

The imbalance was heavily skewed, with $1.6 billion in losses on the long side compared to just $85.9 million from shorts, and the same pattern appeared in every time frame, with $1.53 billion of $1.59 billion lost over 12 hours coming from longs, and even in the past four hours, $30.22 million in longs were flushed against $10.85 million shorts.

Cryptocurrency market background

Binance founder CZ summed it up with one line, saying that drops are important for setting support levels, like the foundation of a house, and that only after brutal shakeouts do you get durable price floors.

The background of the sell-off speaks for itself. While Ethereum was down almost 10%, gold was hitting new record highs, which is the biggest difference between crypto and gold in over 10 weeks. But then there were some rumors that Bybit had been hacked, which it quickly denied. It said that all funds were safe and that trading systems were operating normally.

"Uptober" is coming?

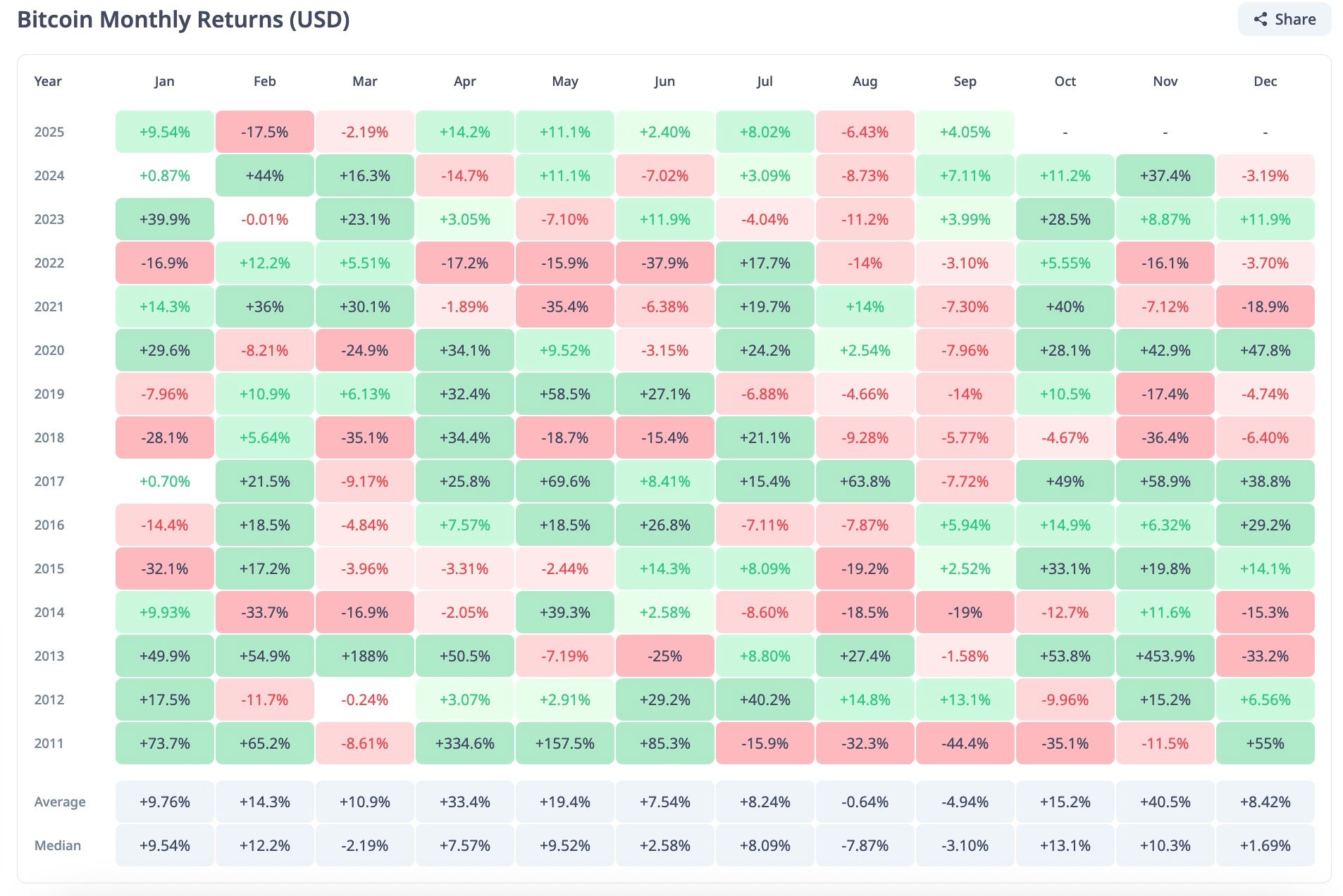

September has been a bit of a tough month for Bitcoin and Ethereum in the past, with past records showing heavy red months like -37.9% for BTC in 2020 and -17.5% for ETH in 2018. But October has often been the opposite, averaging +15% for Bitcoin and delivering monster green candles for Ethereum, like +42.8% in 2021 and +58.7% in 2020.

That is why traders call it "Uptober," and why this $1.7 billion liquidation purge right before the start of a new month could either clear the books for a rally or mark the start of deeper fragility.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin