Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

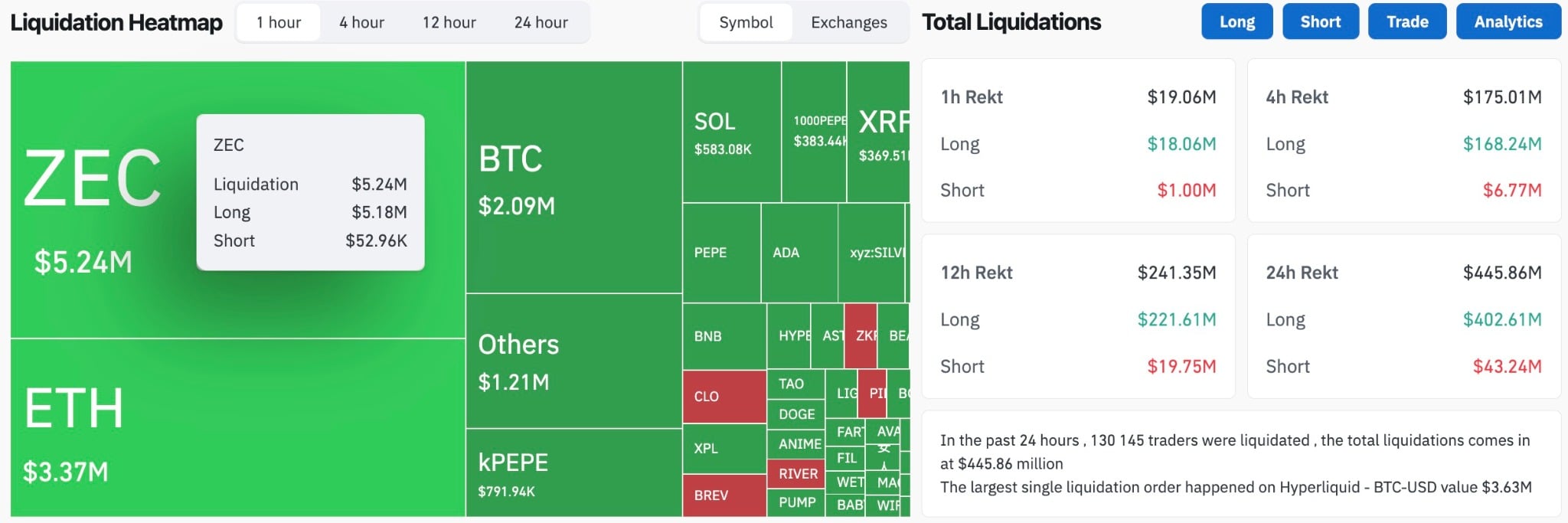

The crypto market is under bearish pressure heading into Thursday. Over the last 24 hours, liquidations hit $445.86 million, and most of that went to longs, who took in $402.61 million as traders unwound upside bets that did not work out.

Bitcoin and Ethereum are still pretty stable, but the real action is happening behind the scenes. XRP is in a bit of a tricky spot, where the structure still favors the bulls, but only just. Zcash shows what happens when governance shocks meet one-sided positioning. At the same time, Binance makes it very clear that it wants exposure beyond crypto cycles.

TL;DR

- XRP remains above its biggest long liquidation cluster, but the cushion keeps getting smaller.

- Zcash posted a 9,780% liquidation imbalance after its full development team stepped down.

- Binance adds 24/7 gold and silver futures, getting deeper into TradFi markets.

XRP bulls dodged a bullet, for now

XRP is entering Thursday weaker, but not broken. According to CoinGlass data on liquidation, the biggest bunch of long liquidations for XRP is around $1.80. That zone has $14.64 million in potential forced selling, and it is still 13.83% below the current trading area near $2.10.

That gap is important in the current environment. In the last day, crypto derivatives longs lost $406.83 million out of $445.86 million in total liquidations. XRP was part of that unwind, but the structure shows that the most damaging level for bulls has not yet come into play.

On the other hand, bearish pressure is closer. XRP's short max-pain level is near $2.33, about 11.31% above spot, with $9.57 million concentrated there. To put it simply, if you want to stress bears, you need to make a smaller move higher. If you want to fully punish longs, you need to make a lower move.

Price action explains why this balance feels unstable. In the last couple of days, XRP has dropped about 11%, as can be seen on the daily chart. That slide helped with the long exposure, but it did not change the bigger setup. The bulls still have some room to run, but it is not as comfortable as before.

Time is the key variable. If XRP keeps dropping without buyers doing anything about it, the $1.80 zone is going to be a real problem. When the price starts moving in that direction, forced selling will replace voluntary exits. For now, bulls are safe from the worst, but the margin for error is smaller than it was earlier this week.

Zcash (ZEC) spikes 9,780% in liquidation imbalance as core team jumps ship

Zcash is delivering one of the most extreme leverage events of the new year, and it is happening with a governance shock that caught the market off-guard. The entire Zcash developer team quit, so now there are all these questions about where the company's headed and who's in charge of ZEC.

Josh Swihart, the CEO, said the departures happened after disagreements with the nonprofit board, Bootstrap, about governance structure and employment changes. He said it was more of a misalignment than a technical glitch, and that the Zcash protocol is still solid and there are not any fork risks.

Markets reacted faster than explanations. ZEC dropped about 10% after the news, and leverage collapsed almost right away. CoinGlass data from the liquidation heatmap shows that Zcash had a liquidation imbalance of 9,780% in just one hour. Long positions were hit for $5.18 million, while shorts lost just $52,960.

The scale of that imbalance tells the story. The position was tilted heavily toward the long side, and liquidity was thin. Once prices started going down, there was not much pushback, and liquidations led straight to more selling.

Swihart said they are planning to keep working on the Zcash protocol through a new company structure, without the constraints of a nonprofit, with the focus staying on privacy features and shielded transactions. Until that change is clearer, ZEC is probably going to remain sensitive to leverage and headlines rather than fundamentals.

Binance announces gold and silver listings for 24/7 trading

While parts of the crypto market are dealing with internal stress, Binance is keeping an eye on what is going on outside. The exchange has launched perpetual futures for gold and silver, making both metals available for 24/7 trading on Binance Futures.

The timing lines up with what's happening in the financial world in general. Gold and silver were among the strongest performers of 2025, with prices doubling and securing the top two spots among the world's most valuable assets. Right now, gold is estimated to be worth $30.875 trillion and silver $4.263 trillion.

For Binance, this move is less about novelty and more about expansion. The exchange's assets are estimated at around $170.653 billion, which is small compared to traditional commodity markets but large enough to support meaningful crossover demand. By offering metals in a crypto-native format, Binance keeps traders inside its ecosystem while tapping into macro-driven flows.

Trading 24/7 means there are no more traditional market hours, and metals are now traded at the same time as crypto because they are both always open. If there is more liquidity, gold and silver could be useful tools for traders who want to balance risk during volatile periods, combining crypto and TradFi behavior.

What's next for crypto market?

The next sessions will show whether market participants adjust risk or lean back into the same overleverage patterns. For now, derivatives continue to dictate behavior, with the price reacting more to exposure than to new capital.

Key levels to watch:

XRP: Price sits around $2.10 after sliding about 11% in less than three days. The first line that matters is $2.00, with the real pressure point lower at $1.80, while any upside attempt runs into the next friction zone near $2.33.

Zcash (ZEC): The $396 low printed after the 10% drop and now defines near-term support, while upside attempts face resistance. The ultimate price magnet remains at $300 per ZEC.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin