On Monday, Bitcoin’s price demonstrated a 13-percent growth, despite the reports of the SEC delaying its decision on the ETF offered by VanEck Associates Corp. and SolidX Partners Inc., and submitted by the CBOE exchange.

The SEC requires more data

On Monday, the SEC officially demanded more data from CBOE on how it intends to list the exchange-traded fund (ETF) made by VanEck Associates and SolidX Partners. Bloomberg has shared the details in its recent article.

Delaying the official status of the ETF from the SEC does not “indicate that the Commission has reached any conclusions with respect to any of the issues involved,” says the regulatory body.

The regulator has taken 35 days for more comments.

Current BTC market situation

On Sunday morning, BTC quotes went in a direction different to what analysts had expected and spiked 9 percent.

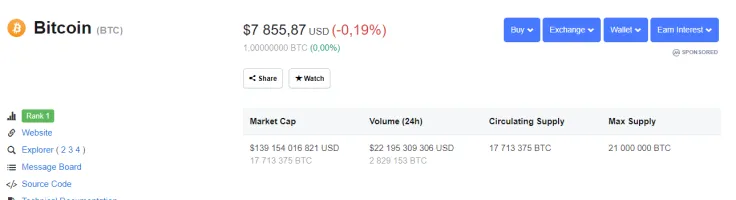

On Monday, BTC price managed to rise above the $8,000 mark but then a retracement took place. At press time, Bitcoin is trading at $7,855.

Last week, Bitcoin’s price showed momentum, adding more than $1,000 since the same time last Monday. Within a week, BTC soared almost 15 percent and seems ready to break higher up.

Crypto analyst ‘The Crypto Dog’ confirms that on Twitter.

Hell of a bullish weekly close on #Bitcoin with near record breaking volume, solidifying the strength and validity of this rally. $BTC / $USD is full ?

— The Crypto Dog? (@TheCryptoDog) May 20, 2019

Weekly resistance: ~8215

Weekly support: ~7300 pic.twitter.com/NpMIPxkcaY

The CEO of BitMEX, Arthur Hayes, has pointed out that since the market has managed to recover back to $8,000 so quickly, it is a clear sign that we are witnessing a bull run.

The bull market is real. A momentary dip below 7k, and a few days later we are back above 8k and the Sep and Dec contracts are in contango. Booyah! pic.twitter.com/qknhDQ8i7p

— Arthur Hayes (@CryptoHayes) May 19, 2019

Tomiwabold Olajide

Tomiwabold Olajide Alex Dovbnya

Alex Dovbnya Arman Shirinyan

Arman Shirinyan