Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

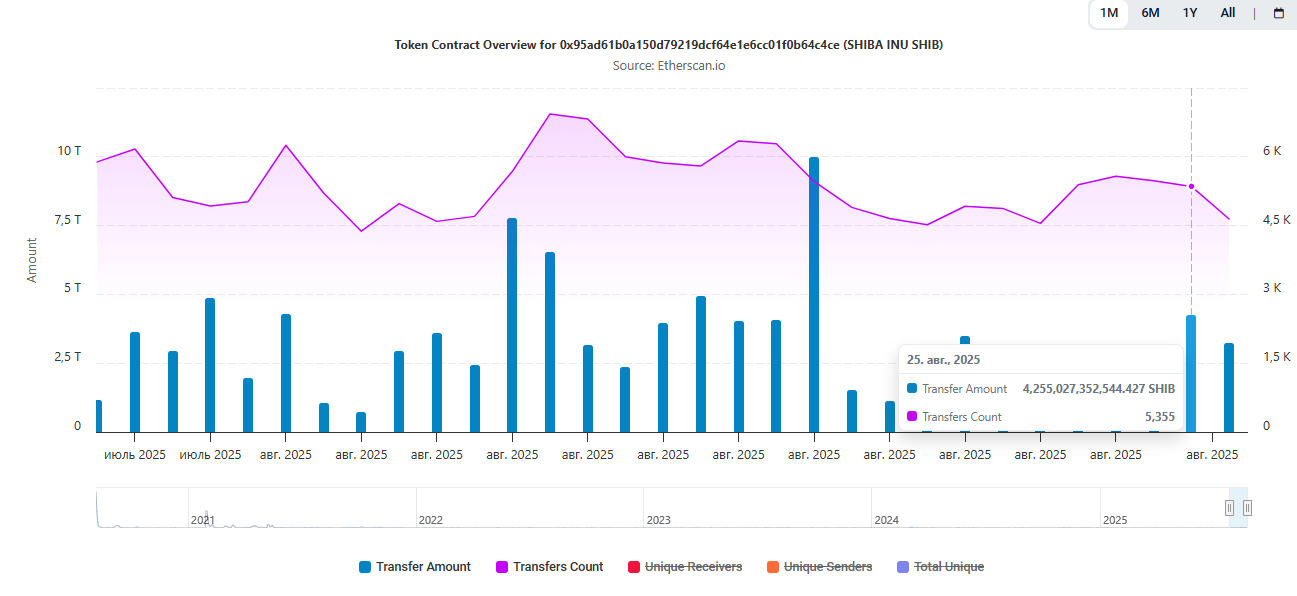

On-chain activity on Shiba Inu has skyrocketed, with token transfer volumes skyrocketing by over 300% in a matter of days. Etherscan data shows that on Aug. 25, SHIB's transfer amount skyrocketed to over 4.25 trillion tokens, a significant increase from the previous reading of 1.1 trillion. Market attention has been drawn to the sheer volume of transactions, even though the actual number of transfers (roughly 5,355) remained largely unchanged. Usually, this type of spike indicates that there have been active large holders, or whales.

SHIB activity recovers

It is unclear if this indicates accumulation, wallet redistribution or market action readiness, but historically, volume fluctuations frequently occur before price volatility. Despite the spike in on-chain activity, SHIB's market price has held steady, settling into a daily chart symmetrical triangle pattern. SHIB is pinned between the 50-day and 200-day EMAs and is currently trading close to $0.0000125. Support around $0.000012 has so far held firm, while attempts to break above the $0.000014 zone have repeatedly failed. As the triangle gets smaller, a breakout appears more likely.

Though a downside break is equally likely due to ongoing overhead resistance, increased on-chain activity may sustain bullish momentum. Trading volume on exchanges is still low compared to earlier this year, which adds to the outlook. The RSI's neutral position indicates hesitancy. Put differently, although the 4.25 trillion SHIB transfer volume spike indicates that capital is moving, there has not been any immediate price action as a result of it. Longer term, a more stable market with less selling pressure might be the result of decreased exchange reserves and steady whale engagement.

While waiting for the triangle to resolve, SHIB's price is still stuck in technical consolidation in the short term. In conclusion, the on-chain surge of Shiba Inu, which saw trillions of tokens move in a single day, indicates that there is activity going on below the surface. The way SHIB handles its tightening technical structure in the coming weeks will determine whether this results in a breakout rally or a significant correction.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin