Investment products backed by XRP saw $3.697 billion flow in during 2025, which is way up from just $608 million a year earlier — a 508% year-on-year increase. This puts XRP among the most heavily weighted names in the institutional altcoin segment, according to new data from CoinShares.

This increase in allocation started well before the mid-November launch of full-fledged spot XRP ETFs in the United States and continued through the end of the year without slowing down. From Nov. 14 to early January, those ETFs saw $1.18 billion in net inflows.

But even without that post-launch stretch, XRP's trajectory had already separated from the rest of the altcoin pack by mid-2025.

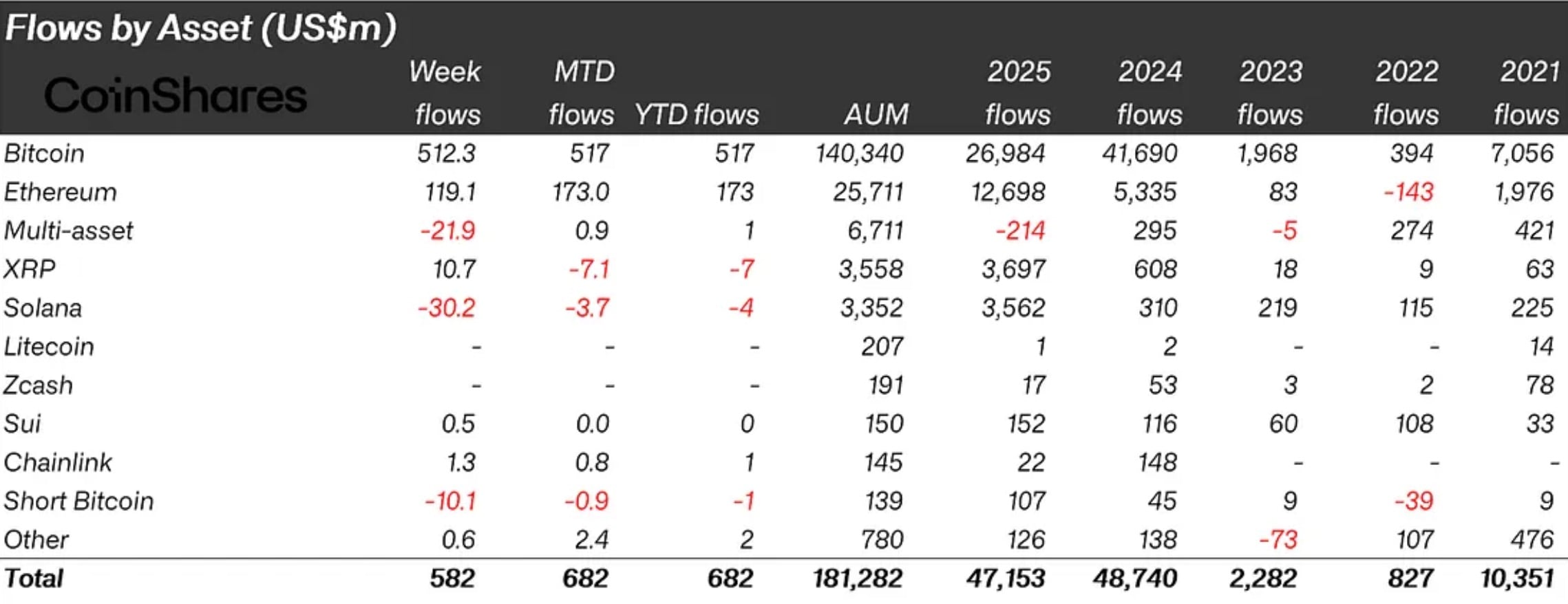

Around $47.2 billion in digital assets were flowing into the global economy this year, which is pretty close to the $48.7 billion we saw in 2024.

XRP enjoys capital rotation

Yes, Bitcoin flows dropped 35% to $26.9 billion, but at the same time, Ethereum raked in a whopping $12.7 billion, marking a staggering 138% year-on-year surge. Solana's inflows surged from a modest $300 million to a jaw-dropping $3.6 billion.

Outside of these top performers, most altcoins saw a drop in interest, with flows falling 30% across the rest of the segment.

Germany went from $43 million in net outflows to $2.5 billion in inflows. Canada's numbers turned around completely, going from -$603 million to +$1.1 billion. The U.S. was still on top, but money was spreading out to different regions and types of assets. And for XRP too.

By early 2026, the fourth biggest cryptocurrency had transitioned from being a small part of the crypto ETF to being its headliner, with great demand, access to regulated products and real institutional positioning.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin