Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

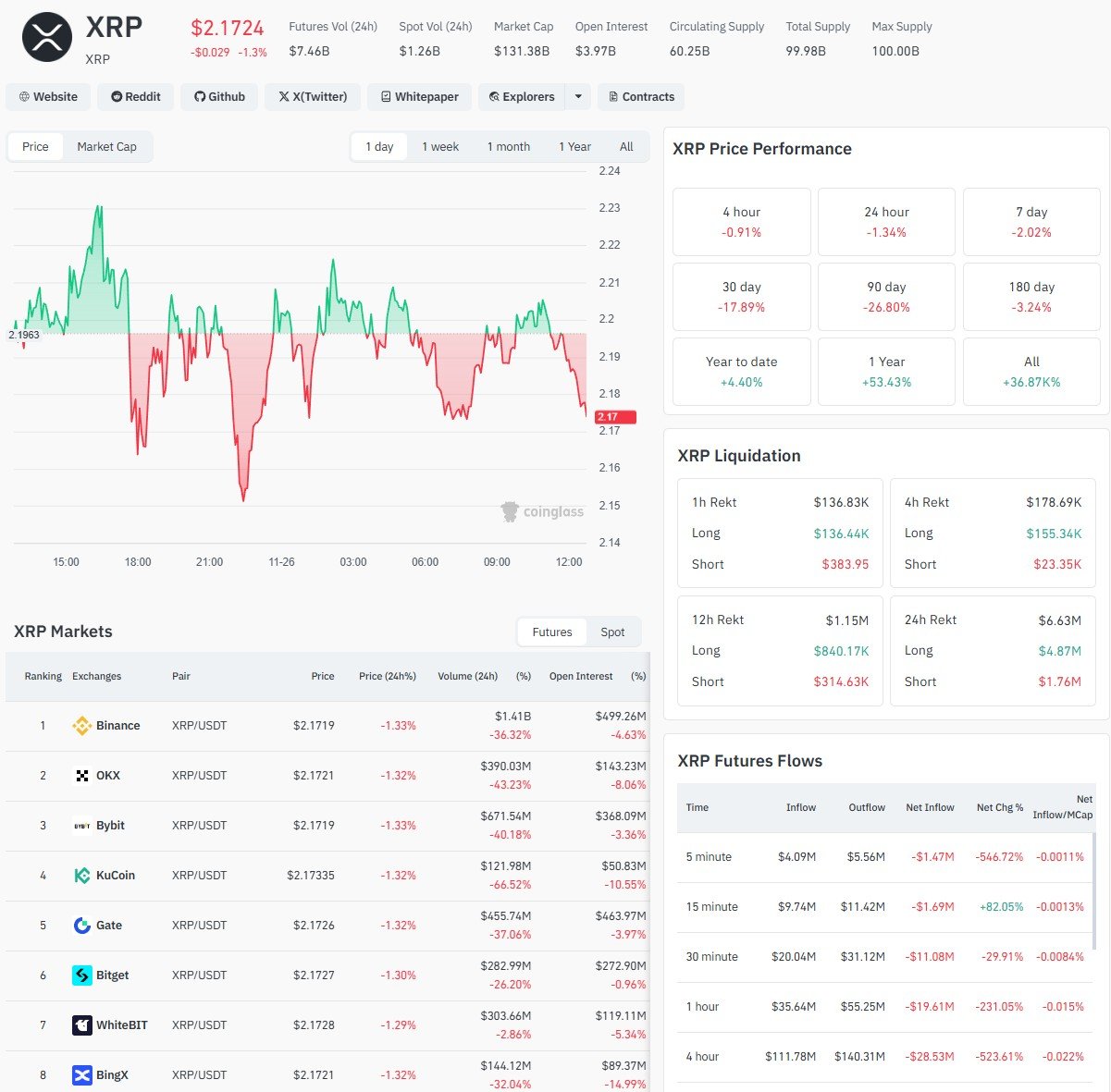

XRP recently experienced one of the most severe short-term drops of the year, falling about 30% overnight before making an effort to partially recover. The price chart illustrates the exact course of events: XRP broke below the lower edge of its descending channel, sliced straight through support between $2.15 and $2.20, and only then discovered sufficient liquidity to return to the channel.

XRP longs position dropping

This type of move necessitates a wave of liquidations and forced selling, which the data supports. It does not occur on thin trading. Over a number of time periods, the CoinGlass metrics show a sharp increase in liquidation activity. Over $1.14 million in XRP liquidations occurred in just a 12-hour period, with the great majority of those liquidations hitting long positions.

A similar pattern can be seen in the 24-hour liquidation tally: short liquidations remained comparatively muted, while long traders took a hit. The rapid decline can be explained by this imbalance; leveraged long traders were completely eliminated.

Volume distribution among exchanges is another important factor. According to the XRP Spot Volume Heatmap, MEXC and Binance have the highest trading loads, both reporting volume of over $1.7 billion. These are typically the first locations where cascading liquidations lead to follow-through sales, and this instance was obviously one of those.

The long/short ratios had an impact as well. Even as the price declined, Binance’s long-to-short ratio (2.55 to 1) remained significantly skewed toward longs. This kind of lopsided market is always susceptible to liquidation cascades, where liquidation engines take over when support fails.

XRP is not that bad

The price chart’s only indication of bullish structure is that XRP recovered above the lower trendline of its descending channel in spite of the decline. Additionally, the RSI recovered from almost oversold levels, indicating that sellers might be losing steam.

Whether or not volume stabilizes will determine what happens next. XRP might try to grind back toward $2.30-$2.40 if network and exchange flows return to normal. However, if futures flows continue to be skewed toward outflows and inflows continue to be negative, another retest of the $2.00 zone is likely.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin