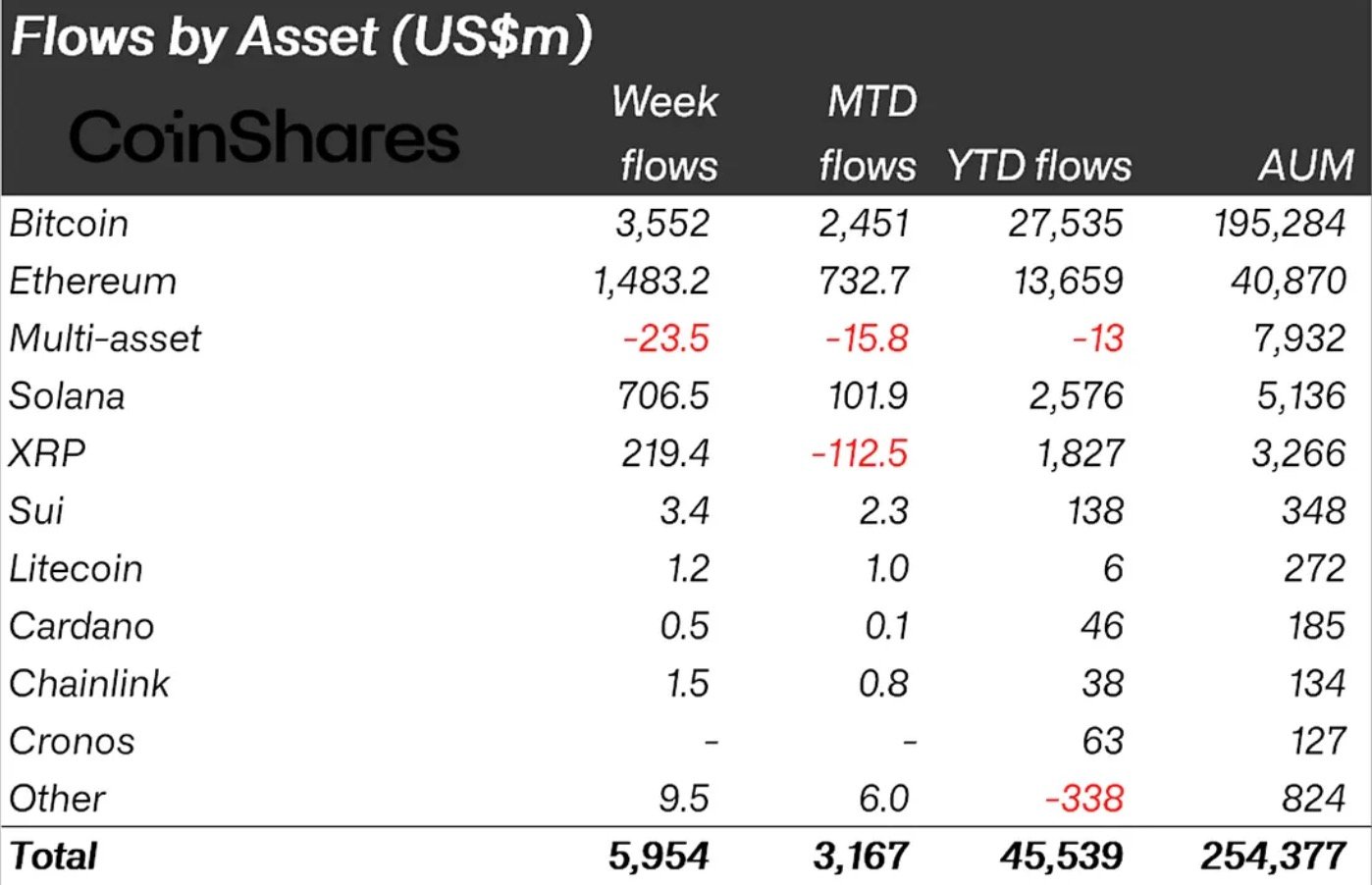

XRP just had its strongest week ever in the investment products field, pulling in $219.4 million — a jump of 235% from the week before. The staggering numbers were revealed by CoinShares in a new report, and they show that while Bitcoin and Ethereum are still the best of the best, XRP is literally the third consensus crypto play for investors right now.

All in all, digital asset funds registered a crazy $5.95 billion last week — the biggest influx ever seen. James Butterfill from CoinShares thinks the "rush" is probably down to the Federal Reserve's recent interest rate cut, weak U.S. jobs data and worries about government stability after the funding fight in Washington.

All of these things together mean that total assets under management in crypto funds hit a new record high of $254 billion, as these very assets seek either hedge or beta to traditional markets.

For XRP, the timing of these inflows is everything. This month, October, carries a deadline in which the SEC is going to make a decision about a bunch of spot XRP ETF applications from the likes of Grayscale, 21Shares, Bitwise, CoinShares, Canary Capital and WisdomTree.

100% for XRP ETF?

Eric Balchunas, the Bloomberg ETF analyst, says the odds of approval are now pretty much 100%. Ripple's CEO has also said that a spot XRP ETF is only a matter of time. The scale of the latest inflows into XRP ETPs already in place is stark proof that institutions are already preparing for ETF decisions.

With some important rulings set for Oct. 18-24, the market is treating XRP as the next big test case. If approval comes through, XRP could be on the same level as Bitcoin in terms of getting mainstream institutional investment.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov