Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

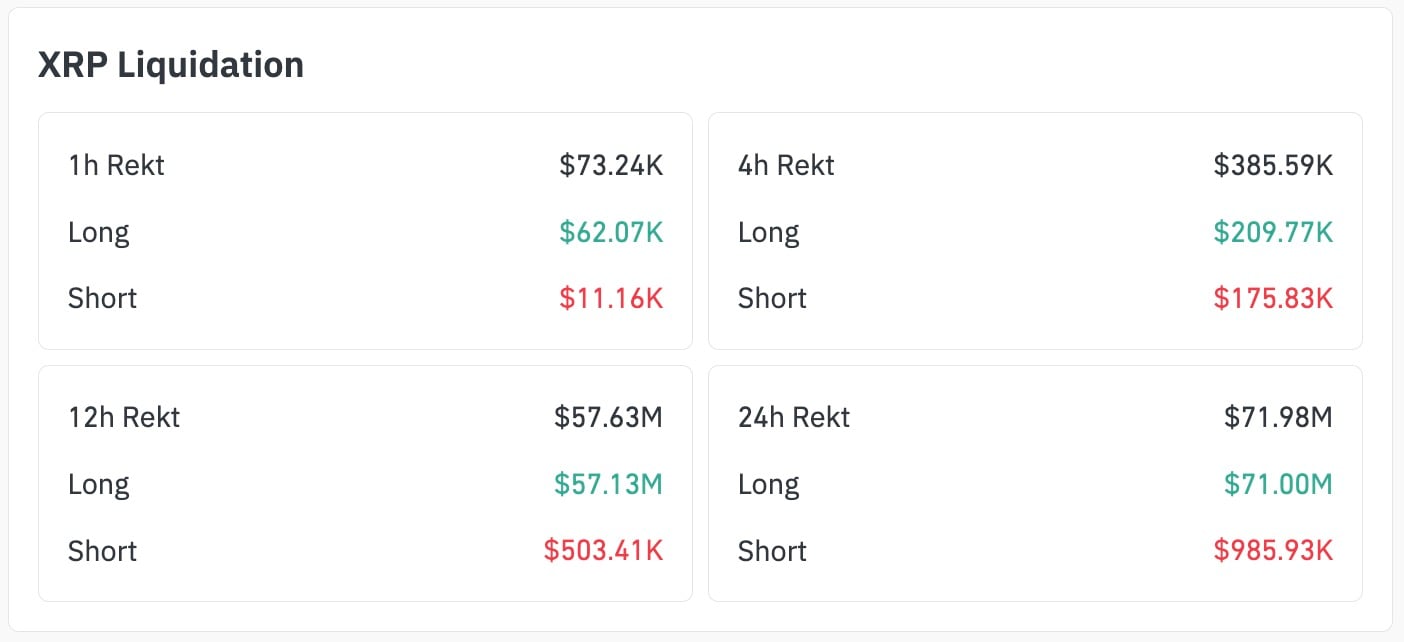

The end of January has been anything but boring. Following all the turbulence, XRP underwent one of its most severe liquidation imbalances in recent memory - a ratio of 11,348% between longs and shorts over the past 12 hours, as represented by CoinGlass.

Over $57 million in long positions were liquidated versus just $503,000 in shorts, exposing an aggressive, one-sided leverage buildup that collapsed as XRP broke below key support.

This cascade occurred during a rapid sell-off that took the XRP price from $1.81 to $1.71, eliminating over-leveraged longs and clearing shallow bid depth.

The liquidation footprint matches the chart: a vertical breakdown with no defensive wick, followed by a flat, indecisive drift near the $1.77 zone. The short-term structure is now broken, and the bulls are absorbing losses with no reason to hope for a recovery.

XRP price prediction: More pain, until funding stabilizes

The 24-hour picture does not soften the blow. Long liquidations total $71 million, while short-side exits barely reach $985,930. Derivatives positioning remains distorted, and no counterflow has materialized to suggest a bottom is forming.

Every attempt to bounce above $1.77 has been met with only more brutal selling pressure for the XRP token, and the $1.81 zone now functions as heavy resistance rather than a potential recovery launchpad.

This is not an anomaly; it is a leveraged washout, with poor risk management by late bulls chasing upside without support retests.

What one willing to buy XRP there should do is watch if funding normalizes and open interest resets without a price collapse, so the price may stabilize. Until then, the risk of another flush toward $1.68 is as real as the 11,348% liquidation imbalance.

Gamza Khanzadaev

Gamza Khanzadaev Godfrey Benjamin

Godfrey Benjamin Arman Shirinyan

Arman Shirinyan Yuri Molchan

Yuri Molchan