Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bloomberg Intelligence strategist Mike McGlone continues his series of analyzing the emerging tendencies in financial markets with a fresh prediction of what may come after Bitcoin at $100,000 and gold at $4,000.

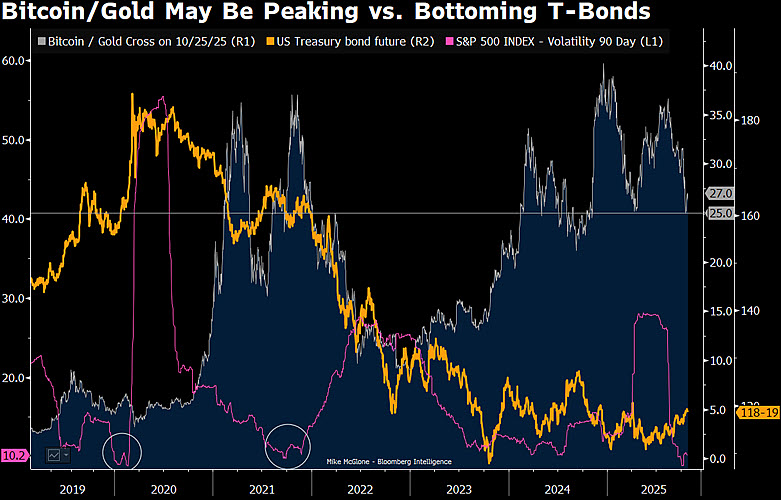

According to him, these milestones do not indicate the end of the cycle but a signal that capital could rotate toward U.S. Treasury bonds after years of weakness dictated by high Fed rates and QT policy.

Bitcoin’s ascent to six figures in 2024 was followed by gold’s run through $2,500 and up toward $4,000 per ounce. McGlone says this symmetry reflects how assets take turns driving market attention.

In his view, gold’s push to $4,000 may set the stage for bonds to recover, positioning U.S. Treasuries as the next winner while speculative trades begin to cool off.

His commodity breakdown underscores the same pattern. Gold’s upside case still points to $5,000, but he warns that a pullback to $3,000 cannot be ruled out if equities reverse, so it is rather a limbo situation.

Next pivot?

McGlone has earned himself McDoom and McGrim nicknames in the crypto circles due to his conservative views on the digital asset market, but his newest message is clear: Bitcoin’s parabolic run and gold’s surge both show stretched conditions. Prices are at peaks, not floors, and the next shift may redirect money flow into the most overlooked but stable asset — U.S. government debt.

Bonds, after years of selling, could emerge as the main beneficiary once the speculative momentum in crypto and metals loses steam.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov