Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Every October, the crypto community repeats the same slogan: "Uptober." For Bitcoin, at least, it sometimes finds support in the charts. For XRP, however, the story is far more complicated. Examining more than a decade of price history, the numbers don't justify optimism.

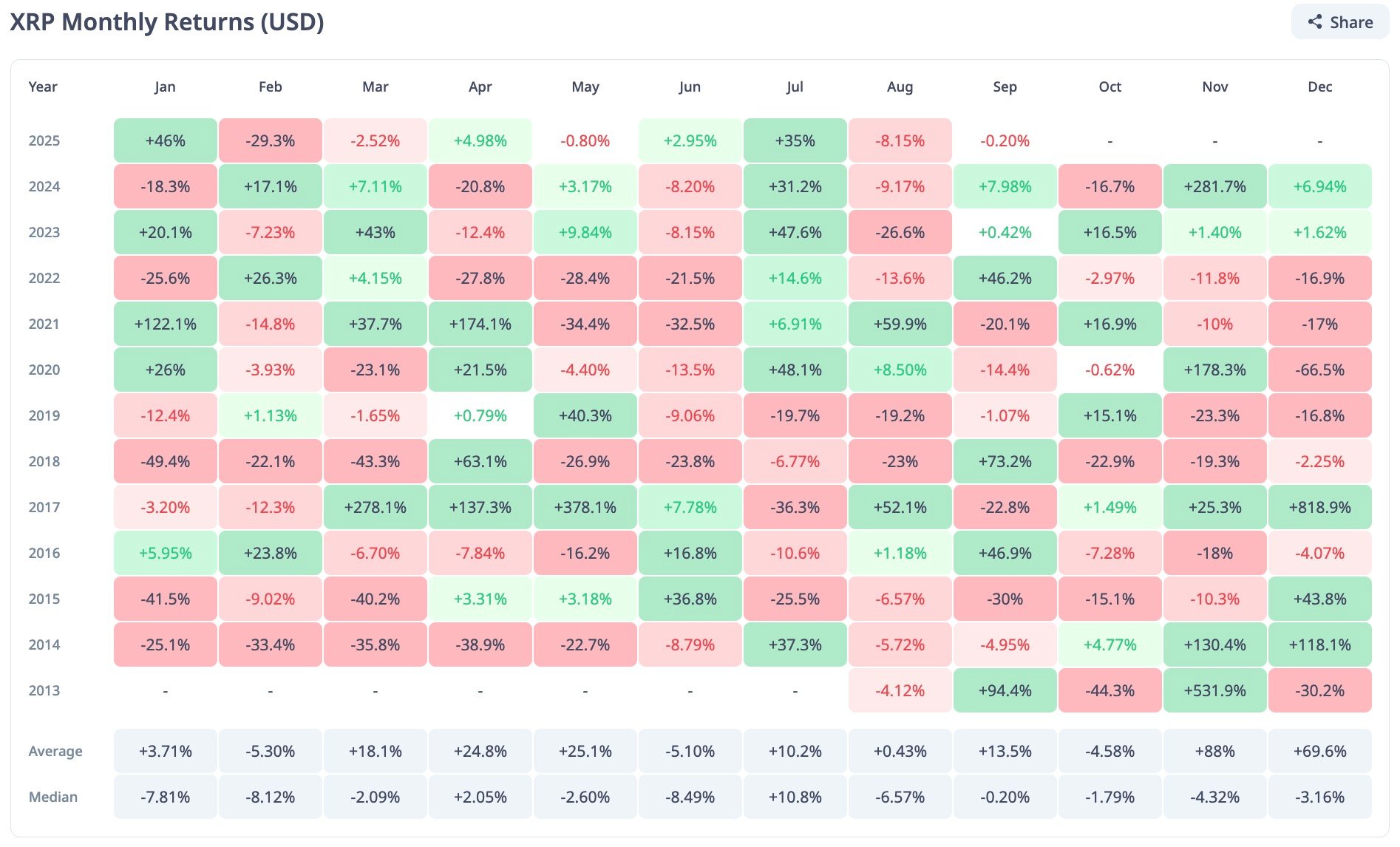

Monthly data shows that October has produced some of XRP’s most dramatic price fluctuations. In 2013, for example, the token soared by more than 94%. In 2014, it jumped by 130%. In 2015, there was a milder 4.7% gain, and in 2017, there was only a 1.49% increase, as per CryptoRank.

On the other hand, years like 2018 and 2021 delivered double-digit losses. The most explosive October was in 2020, when XRP spiked by almost 179% in just four weeks. However, these isolated events create a distorted picture.

Strip away the extremes, and the median October return is a loss of 1.79%. The average is even worse: -4.58%. This suggests that history shows October is more likely to disappoint XRP holders than reward them, despite the occasional blockbuster year that fuels the "Uptober" myth.

Quarterly data reinforces this warning

While Q4 has historically been the strongest period for XRP, with an average gain of nearly 88%, the median shows a loss of 4.32%. This again highlights that the results are heavily distorted by a few extraordinary runs rather than consistent seasonal strength.

The pattern is clear — "Uptober" is not a reliable trading strategy for XRP. Past years prove that, while outsized rallies are possible, the typical outcome is modest or negative.

Investors expecting green candles every October are relying on folklore, not probability. While history doesn't eliminate the possibility of another upside surprise, it does emphasize the risk of treating a single month as a guarantee.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov