Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

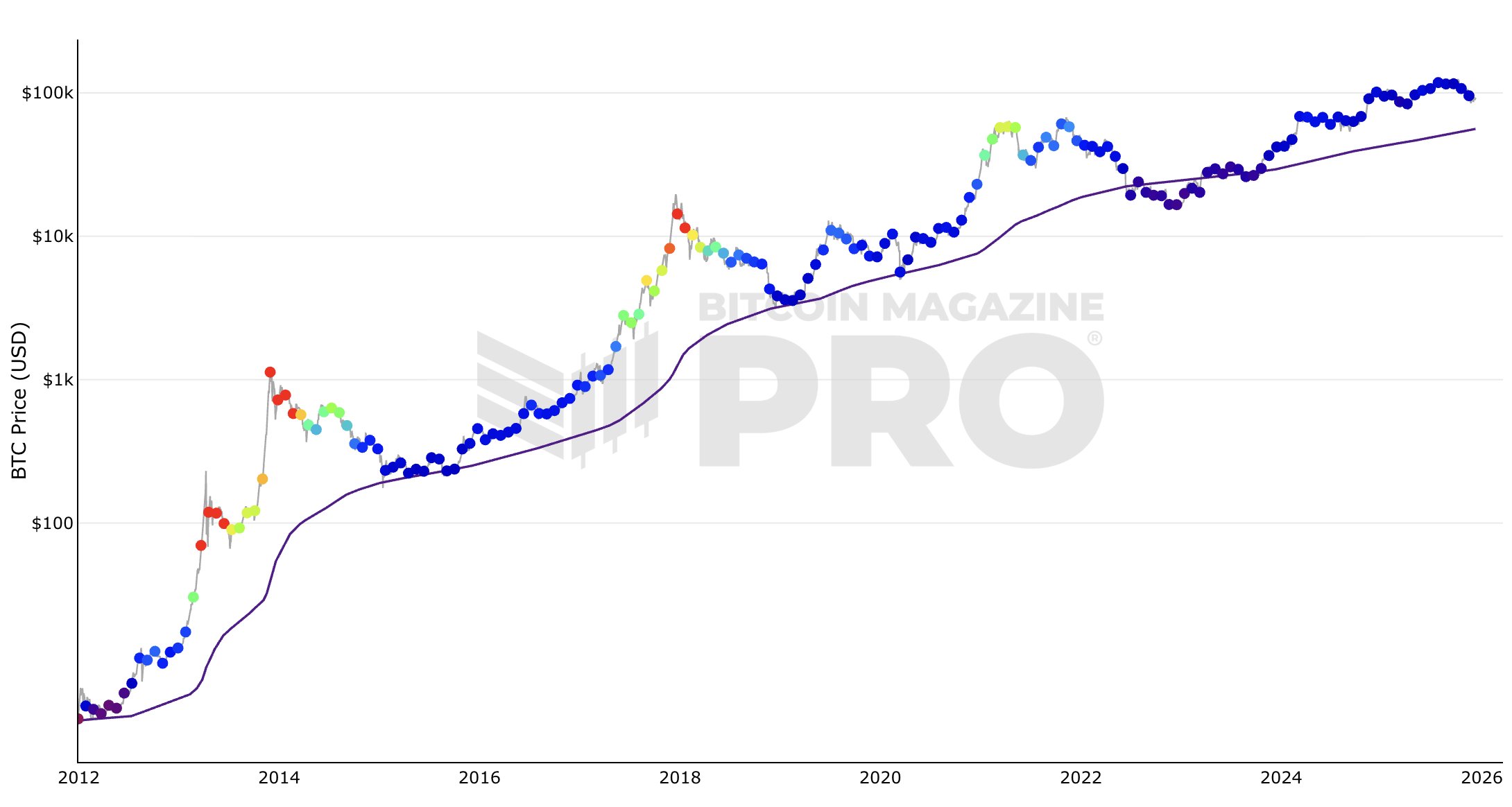

Adam Back, a longtime cryptographer and one of the top candidates to be the real Satoshi Nakamoto, once again highlighted the Bitcoin price chart extrapolated over the 200-week moving average, which now stretches above $56,000.

The essence of the developer's message is that the floor for the Bitcoin price is rising; that is how he interprets the current long-term trend for the cryptocurrency.

Whether the market is moving in line with that reading is open to debate. Right now, Bitcoin is trying to get above $90,000. In the meantime, the $82,000 zone stopped two pullbacks, $80,600 caught another and the deeper $74,110 level has not been revisited since the November drop.

Thus, it may be said that the price of BTC has found a stable base and has been moving within a tighter range. But that suggests reduced selling pressure rather than active momentum.

Bottom line

The indicator Back referenced has been showing us Bitcoin's deeper cycle resets for years. The 200-week moving average hit its last low in 2015, again in 2018 and once more in 2022. When the market hit that point, things started to level off and recover. With the line now above $56,000 and still going up, it sets a higher baseline for this cycle than it did earlier in the year.

For traders, the bottom line should be found in how the long-term average keeps climbing, which supposes that any deeper retracements below it are becoming less likely — unless, of course, the general structure breaks.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov