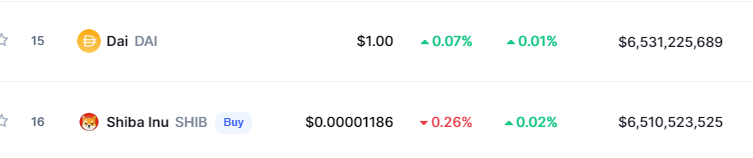

Meme coin Shiba Inu (SHIB) has slipped below the Dai (DAI) stablecoin, according to data provided by CoinMarketCap.

The two cryptocurrencies are currently valued at roughly $6.5 billion, with Dai having a slight edge over the Dogecoin competitor.

In March, Do Kwon, the trash-talking founder of the Terra blockchain, tweeted that Dai, the oldest decentralized stablecoin, would die by his hands.

Needless to say, the prediction didn’t age well. TerraUSD (UST) collapsed earlier this month after decoupling from its peg. It is currently sitting below the $0.10 level.

Following the demise of UST, Dai, which first appeared back in 2017, has once again become the biggest decentralized stablecoin.

The DAI stablecoin is powered by MakerDAO, a popular decentralized autonomous organization.

The MRK governance token saw an impressive rally after the crash of Terra.

The UST token collapsed once Terra’s built-in arbitrage mechanism stopped functioning properly due to collapsing demand for the LUNA token, which plunged to virtually zero in days.

MakerDAO Rune Christensen famously called UST a “solid Ponzi” in January. The comment, which attracted plenty of criticism back in the day, ended up being very prescient.

After the implosion of Terra, Christensen resisted the urge to gloat over

the demise of Terra. Instead, he said that he was sorry for those who invested in the project.

Shiba Inu (SHIB) has so far had a rough year, recently dropping the $0.00001 level. The meme coin is now down 86% from its record peak of $0.00008616 that was achieved last October.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov