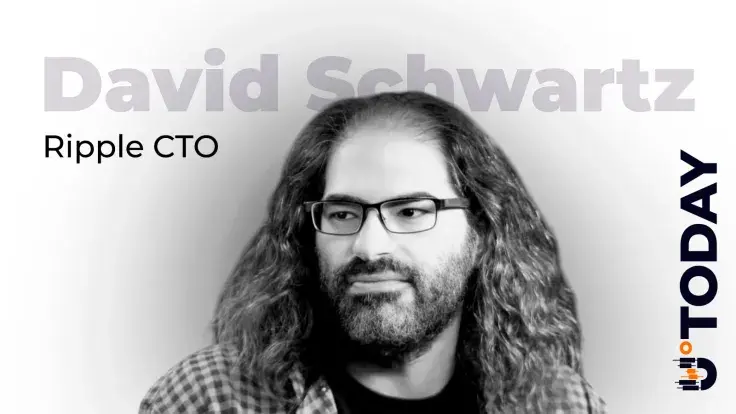

Ripple Chief Technology Officer David Schwartz denied claims that Ripple's large XRP holdings are keeping the token's price down.

In a heated X debate, Schwartz said the argument "doesn't make sense," as if XRP were worth more without Ripple — its value would be lower when you buy and lower when you sell — that cancels out." Unless Ripple somehow changes its level of influence in the future, argues Schwartz, there is no reason to believe its holdings depress the market.

Ripple currently has 34.75 billion XRP locked in escrow, and the plan is to release it gradually. Critics often say that this reserve gives the company too much control over the asset's flow. Schwartz said that Ripple's role does not affect how XRP Ledger itself operates or how users transact on it.

Previously, the Ripple CTO explained that validators on XRPL do not earn money for confirming transactions, unlike Bitcoin miners or Ethereum stakers. The design, he noted, aims to eliminate middlemen and ensure that no single party benefits directly from user activity or transaction fees across the network.

Ripple's XRP issues

Some thought Ripple was acting like a "macro-miner" selling XRP to fund itself, while others said the company's presence is what's helping the network grow. This precisely was the focal point of the long-lasting SEC v. Ripple case, which was partially won by the crypto company.

Schwartz made it clear that anyone can use XRPL without going through Ripple, and that transaction fees — worth only fractions of a cent — are purely for spam protection.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov