Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

It is Monday, Feb. 9, 2026, and crypto opened the week trying to recover its footing after days of violent swings. But beneath the surface, one asset is breaking ranks. XRP printed a rare, almost isolated $63.1 million inflow surge through ETP products, while Bitcoin and Ethereum continued to bleed capital.

At the same time, a massive Shiba Inu transfer worth billions of coins linked to Coinbase vanished from the major U.S. exchange, and a half-joking Super Bowl comment from Dogecoin’s creator aged into an uncomfortable reality for the crypto market just hours later.

TL;DR

- XRP pulled in $63.1 million in weekly ETP inflows while Bitcoin and Ethereum posted heavy red figures.

- 23.79 billion SHIB moved out of a Coinbase-linked wallet into an unknown address.

- Billy Markus's Super Bowl comment echoed a risk-off mood across crypto.

XRP gets its own bull market with $63.1 million in ETFs

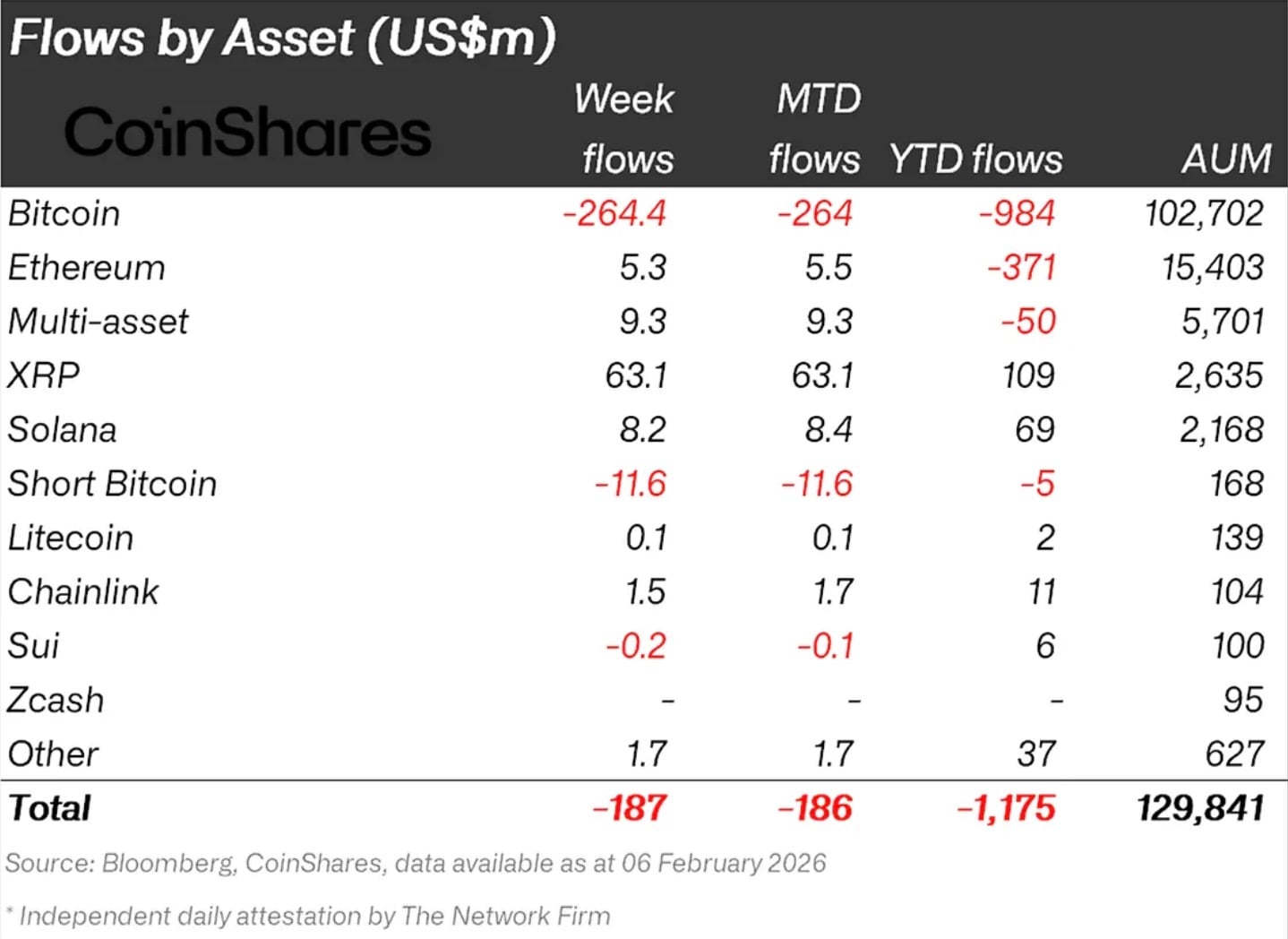

According to CoinShares, XRP attracted $63.1 million in inflows the previous week. While not the biggest record, it is the single largest positive flow across all crypto assets for that week, at a time when total crypto investment products recorded a net weekly outflow of $187 million.

Bitcoin alone saw $264.4 million exit in the same period. Ethereum barely stayed positive on the week at $5.3 million, while its year-to-date balance remains deeply negative at minus $371 million. XRP, by contrast, shows $109 million in year-to-date inflows, with total assets under management at approximately $2.64 billion.

One week earlier, total crypto products bled too — $1.696 billion, with Bitcoin down $1.321 billion and Ethereum down $308 million. XRP did see a weekly outflow of $43.7 million at that time, but even then it maintained positive month-to-date and year-to-date figures.

This pattern matters. It suggests that XRP flows are not simply momentum chasing but part of a consistent long-term reallocation. While capital exits Bitcoin and Ethereum exposure through ETPs, it selectively gets deployed into XRP products.

In the current market environment, this is what an “own bull market” looks like. Not explosive price action across the board but rather persistent, measurable demand through institutional-grade vehicles while the rest of the sector draws down.

Dogecoin creator’s Super Bowl prophecy hits crypto market

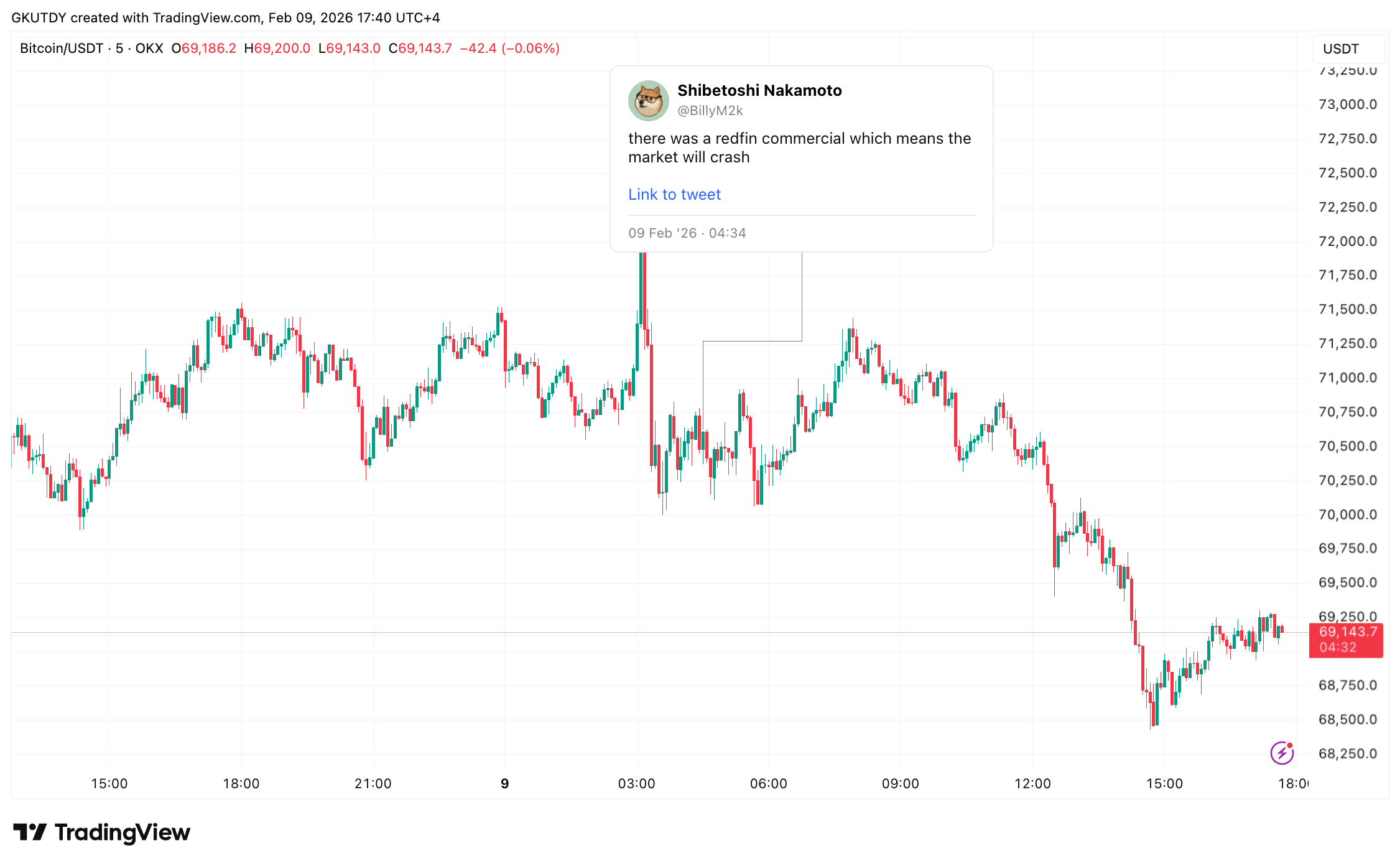

During Super Bowl night, Dogecoin co-creator Billy Markus made a tongue-in-cheek observation that, however, quickly turned into brutal reality. Known for his humorous takes, Markus pointed to a Redfin commercial airing during the game as a sign that the market might be getting "red" next.

By Monday morning, the comment felt less like humor and more like mood-setting. Bitcoin failed to hold above $71,000, Ethereum briefly slid again to $2,000 and risk assets struggled to extend rebounds. While there is no causal link between a Redfin commercial and market structure, such remarks resonate when confidence is already damaged.

What gives the comment weight is timing as it landed after a week defined by multibillion liquidations, intraday reversals and heavy outflows from major crypto investment products. In that environment, even ironic commentary from well-known industry figures can reinforce a defensive mindset.

Narratives are fragile, and market participants are highly sensitive to signals, whether they come from macro data, flow reports or cultural touchstones like the Super Bowl. Dogecoin itself did not experience exceptional flows in the CoinShares data, but the psychological impact of the comment fit organically into a risk-aware Monday open.

Coinbase Shiba Inu whale moves 23,799,579,141 SHIB into dark

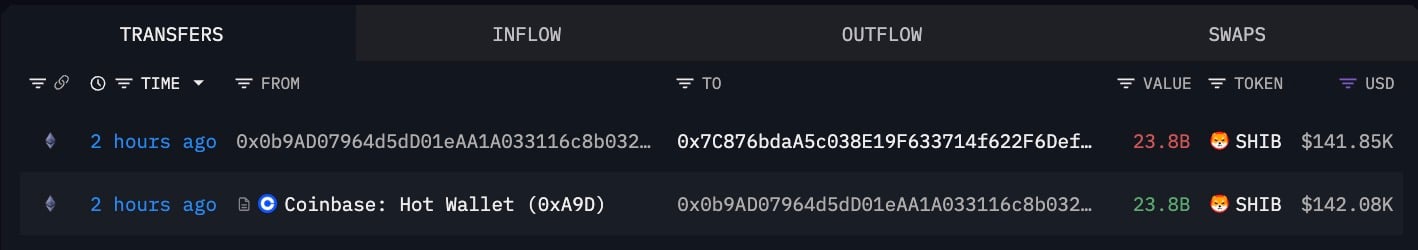

A single Coinbase hot wallet transferred 23.8 billion SHIB worth $142,000 into a private wallet just two hours ago, blockchain records by Arkham confirm.

Data shows the receiving wallet now holds just $0.058 in ETH, meaning it likely swept SHIB out entirely or moved it elsewhere post-withdrawal.

This is not the first time this wallet ID has pulled massive quantities of Shiba Inu off-exchange. On-chain records show it previously moved over 48.53 billion SHIB from Coinbase, with additional signs of major withdrawals across January. In several cases, transfer amounts exceeded 200 billion SHIB, suggesting ongoing cold storage behavior.

What makes this event stand out is not just the size; it is the silence. No redistribution to other addresses, no swaps and no further movement have been logged since the $141,000 transfer. That is usually a flag for stealth accumulation or long-term cold storage, both typical whale tactics ahead of volatility.

Given that SHIB’s price is still pinned below key resistance at $0.000006-$0.0000065, this kind of off-exchange flow could fuel supply-crunch narratives. But retail reaction remains tepid: SHIB is still down by more than 85% from the cycle peak, and whales are not offering much clarity.

Crypto market outlook: XRP, BTC, SHIB, ETH price update

Looking ahead, the market remains in a recovery attempt rather than a confirmed bullish reversal. Flows, sentiment and volatility all point to selective positioning rather than broad conviction.

Key levels to watch:

- Bitcoin (BTC): immediate resistance near the $71,000 to $72,000 zone, with downside risk back toward the mid-$60,000s if buying activity does not stabilize.

- Ethereum (ETH): At a critical juncture around $2,000. Failure to hold that area would reinforce underperformance relative to Bitcoin and could extend negative year-to-date flow dynamics seen in investment products.

- XRP: As long as weekly data shows net positives and the price holds above recent consolidation zones near $1.40 to $1.60, the “own bull market” narrative remains intact.

- Shiba Inu (SHIB): Further exchange outflows similar to the 23.8 billion SHIB move would support a base-building case at $0.000006.

Gamza Khanzadaev

Gamza Khanzadaev Alex Dovbnya

Alex Dovbnya Tomiwabold Olajide

Tomiwabold Olajide Godfrey Benjamin

Godfrey Benjamin Yuri Molchan

Yuri Molchan