Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As Wednesday begins, Bitcoin sits at $104,100 after 24 hours of forced selling that erased $408 million in positions and trimmed total open interest by almost $1 billion. Ethereum’s chart shows liquidations worth $103 million, confirming broader stress in the altcoin field.

Popular cryptocurrency XRP is flat around $2.40, with several ETFs on it expected to begin trading this week, but the coin faces technical pressure from the Bollinger Bands that usually break violently. The indicators on the daily and weekly frames show that buyers are losing their grip near the $2.40-$2.50 ceiling.

TL;DR

- XRP setup points to a drop under $2 before month's end if the midband fails again.

- Bitcoin printed a 400% long-to-short liquidation imbalance with $408 million total.

- Satoshi-era whale Owen Gunden cashed out about $1.5 billion BTC after 15 years of silence.

Prepare to see XRP under $2, Bollinger Bands warn

Looking at the daily chart, XRP is trading within a range of about $2.17 to $2.70, with the price holding steady at the midpoint of $2.44. Each retest of that line has been rejected for three weeks straight. The lower band is at $2.17; if that breaks, there is room to go as low as $1.94 or even $1.80.

The weekly structure remains bearish too. The price is below its 20-week moving average at $2.82 and has not been able to get back above the August range top around $2.60. That keeps the short-term bias negative until a strong close above $2.55 appears.

in the monthly view, XRP has printed two lower highs since it peaked at $3.40 in July. The current candle is -4% and sits right on the 20-month average near $2.40. If this month closes below that line, it is likely that the market will continue to drop toward the $1.70-$1.80 zone.

The range of prices has hit its lowest point since the first quarter of 2024. In the past, this kind of compression has led to moves of 25-40% in just a matter of weeks.

Thus, if the next leg breaks south, the chart has targets of $1.92 in the short term and $1.65 in the medium term.

Bitcoin prints 400% liquidation imbalance

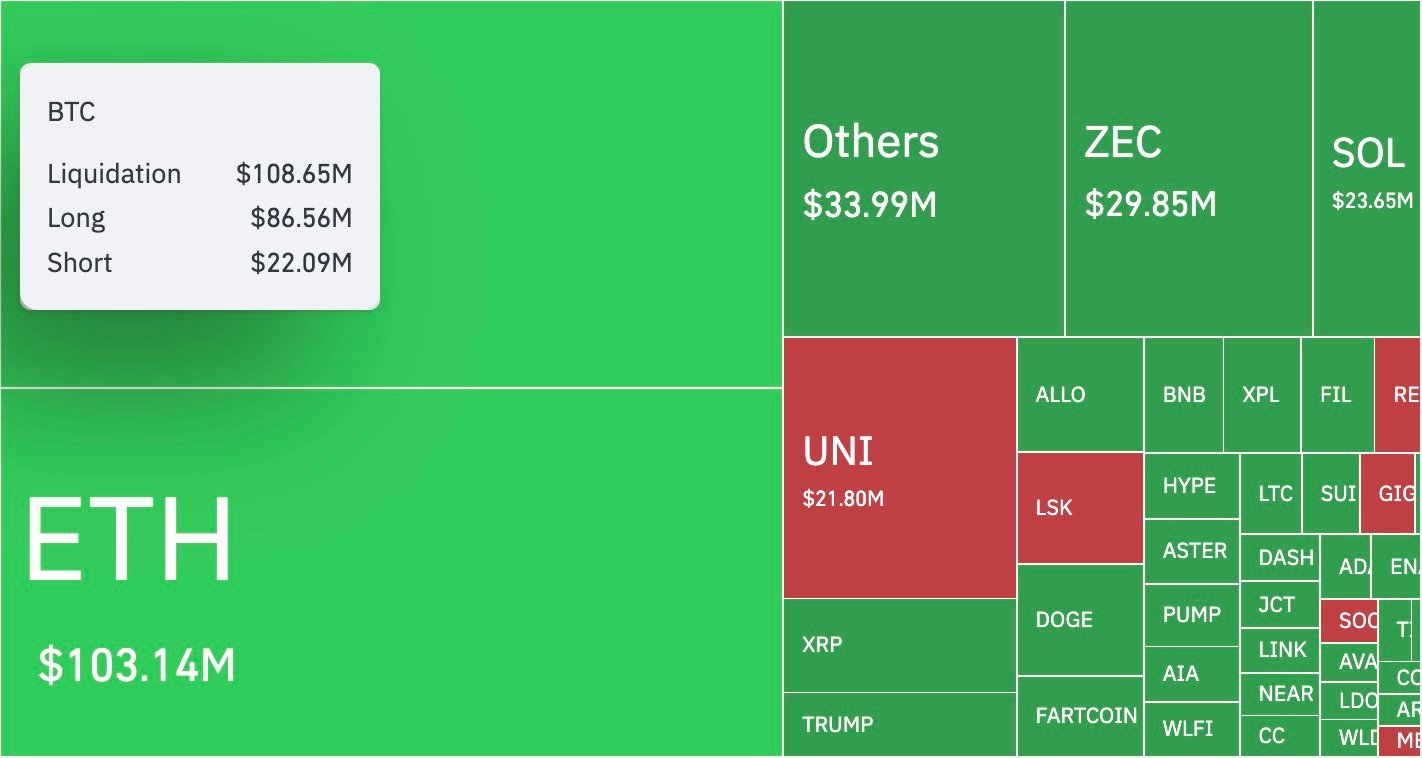

CoinGlass's data shows that $408.13 million were liquidated in 24 hours — $321.26 million from longs versus $86.87 million from shorts, for a ratio of about 4 to 1. BTC alone accounted for $108.65 million of those losses — $86.56 million longs, $22.09 million shorts. Ethereum added another $103 million, while ZEC and SOL saw $29.8 million and $23.6 million, respectively.

The sell-off started late Tuesday when BTC fell through $105,000 and triggered stop-losses around $104,500. Prices hit $103,000 before recovering to $104,100. Funding rates have dropped by half since then, which is a sign that excessive leverage was finally cleared.

If Bitcoin does not manage to stay above $103,000, there could be another wave of liquidations hitting the $101,500 and $99,000 zones — the next two major liquidity pools. But if it closes over $105,500, it could lead to short covering toward $108,000.

The market's pain has been reset, so it is possible for it to bounce back over the weekend, as long as the macro data does not cause any major shocks to risk assets.

Satoshi-era whale sells all his BTC for $1.5 billion

Arkham data shows that early miner Owen Gunden sold most of his long-dormant holdings — about 5,350 BTC, worth about $1.5 billion at current prices. There have been transfers to Kraken and several OTC desks over the past two weeks.

His wallet balance dropped from about $1.4 billion to $556 million, with the rest of the coins priced at $104,924 each. This is one of the biggest movements of pre-2011 BTC we have ever seen.

People are speculating about the sale for all sorts of reasons, like quantum security concerns and tax-year rebalancing. Whatever the reason, if a 15-year holder cashes out at the cycle peak, it adds psychological pressure and may signal an intermediate top forming around $107,000-$110,000.

If follow-through selling from similar vintage wallets shows up, Bitcoin could revisit its September base around $95,000 before new institutional demand absorbs supply.

Crypto market outlook

The mid-November setup points to more volatility before things settle down, especially this Friday's U.S. PPI print, changes how risky the market feels.

XRP: Key trigger at $2.18, losing it unlocks $1.80-$1.92 zone.

BTC: Defend $103,000 or risk another $99,000 sweep, upside capped at $108,000.

ETH: Stable above $3,000, but break below $2,940 opens short window.

Right now, derivatives leverage is being burned off, whale wallets are moving and the market feels ready for one more flush before any December rally attempt.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov