Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The crypto market is in wait-and-see mode this Friday, Jan. 23, 2026. Total capitalization stuck around $3.1 trillion after a rather quiet overnight session, with Bitcoin near $89,200 and Ethereum lagging at $2,930.

Alts are mixed, with no breakout, while everyone digests $2.3 billion in expired BTC and ETH options and eyes tariff news out of Davos. Volatility remains suppressed, but some tokens defy the lull. Dogecoin revives the "to the moon" cry with a rare $1.10 setup. Solana airdrop coin SKR explodes 400%. And XRP is on the edge near key support, holding back $1.37 billion in ETF ammo that could flip bearish in hours.

TL;DR

- Dogecoin wedge fractal points to $1.10 moonshot, but downside spikes possible first.

- Solana Seeker (SKR) jumps 400% post-airdrop as user-farmers post record ROIs.

- $1.37 billion in XRP ETFs could flood the market fast if $1.91 breaks.

Dogecoin teases "to the moon" scenario to $1 DOGE

Beloved meme coin king Dogecoin is once again baiting breakout optimists, this time with one of its most textbook wedge structures to date.

Chartist Ali Martinez shared a fractal showing how DOGE continues to obey descending wedge patterns on the weekly time frame — just as it did in 2024 and 2025. If it plays out, the breakout target extends past $1 and even touches $1.10 for Dogecoin, a level of scale not seen since the meme coin’s last retail-driven mania phase.

It cannot be all so simple, though, as even such an "evergreen" structure suggests a final downside move, potentially dragging DOGE toward the $0.08-$0.12 zone before a potential parabolic reversal. As press time, DOGE is quoted at $0.124 — the breakout trigger area, according to Martinez’s chart.

On-chain and sentiment metrics remain uncertain, but the presence of a new 21Shares DOGE ETF — backed by the Dogecoin Foundation and listed on the Nasdaq as of yesterday — could provide a much-needed boost if flows materialize.

This latest ETF debut adds structural legitimacy to DOGE’s meme narrative, and if the pattern is confirmed, the chart itself will become a self-fulfilling prophecy for those chasing symmetry.

The last time DOGE broke from a wedge of this magnitude, the price multiplied 10x in a matter of weeks.

Solana phone coin skyrockets 400% overnight

From meme to mobile, the Seeker token (SKR), airdropped to users of Solana’s Saga phone, just posted one of the most explosive overnight performances in early 2026. Up 400% in under 24 hours, SKR rocketed from sub-$0.02 lows to above $0.065.

The move crowned SKR as the top gainer by open interest growth and exchange inflows, according to data from TradingView and CoinGlass.

What made this run different is that it did not just reward holders — it rewarded users. Airdrop eligibility required actual usage of Solana’s Saga phone, not just passive holding. That filtered out opportunists and enabled genuine network engagement.

For many recipients, the drop was worth over $8,000, considering that the price of the phone was around $450, triggering new interest in hardware-linked token mechanics. Some users even set up full Saga-farm operations, grabbing dozens of devices in anticipation of Seeker's market entry.

As Solana expands its ecosystem in 2026, SKR may prove a test case for hardware-token symbiosis. Overnight, it also became the top-traded Solana token across centralized exchanges, and it is clear that Solana got its "shiny new token."

$1.37 billion XRP may flood market if XRP price fails here

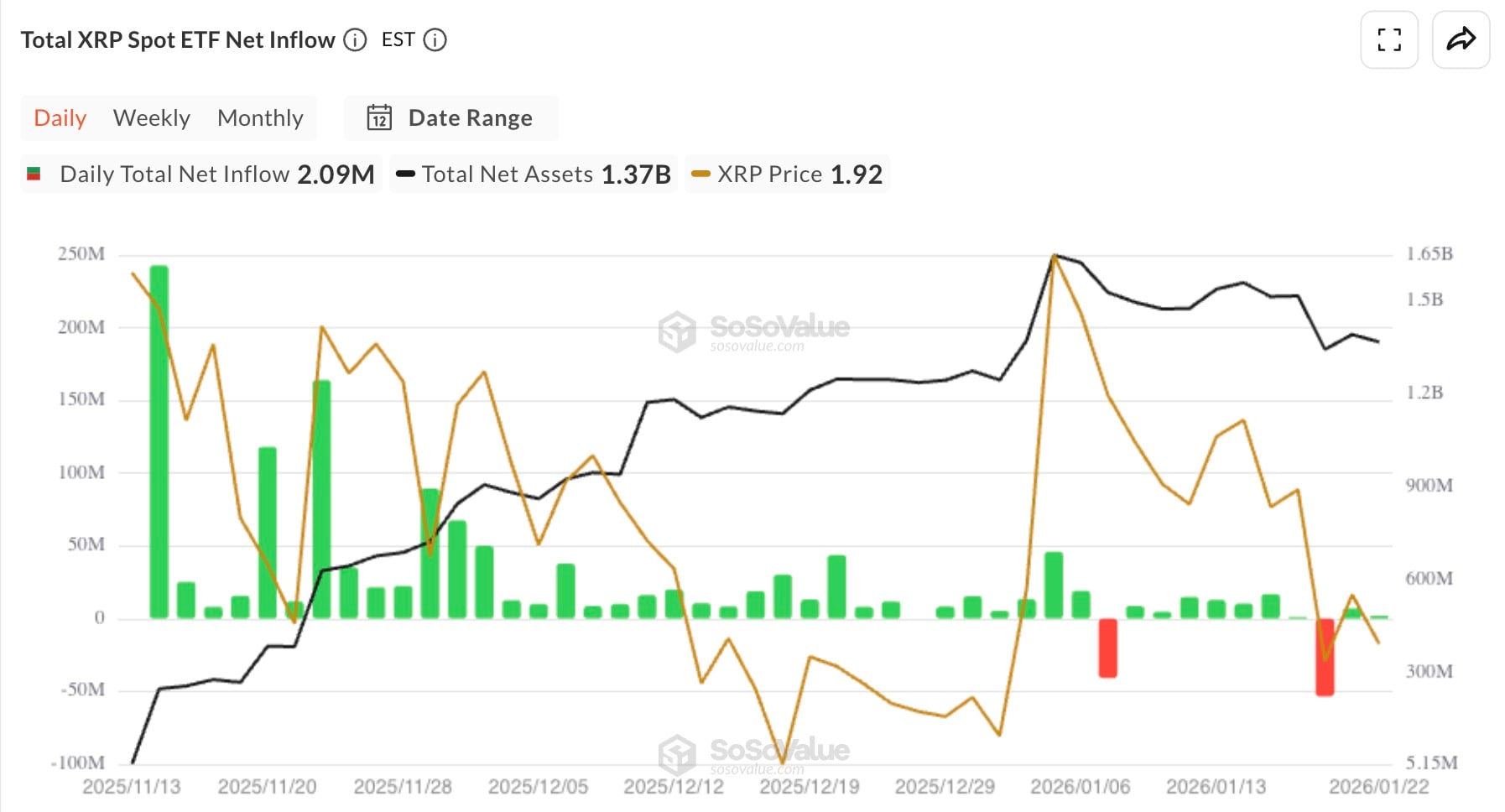

XRP ETF momentum is real, but it may also become a double-edged sword. As of Jan. 22, 2026, total assets held across U.S. spot XRP ETFs reached $1.37 billion, based on SoSoValue data. That represents about 1.17% of the entire XRP market cap and includes inflows from major issuers like Grayscale, Bitwise, 21Shares and Canary.

No doubt institutional appetite has been strong for XRP, with $7.16 million flowing in on Jan. 21 and another $2.09 million on Jan. 22. But price action is not confirming the same strength.

XRP failed to break cleanly above the $1.97-$2 resistance and is now weak around $1.91, down 2-3% on the week. Should $1.90 break down further, the $1.71-$1.80 support zone will become critical.

The risk is in the fact that ETF holdings represent real tokens. If sentiment sours and stop-loss or redemptions are triggered, up to $1.37 billion in XRP could become active supply — not theoretical, but actual tokens moved to market. That risk is especially large during low-liquidity sessions like today’s, with altcoins bleeding and attention focused elsewhere.

On the plus side, exchange wallet balances remain thin and ETF inflows continue. But ETF buyers are surely watching the $1.85-$1.90 line as the last firewall before heavier liquidation risk. Any close below that could escalate into a full-blown flush, especially if the $1.70 area does not hold.

Crypto market outlook: What comes next?

Thus, the crypto market continues drifting sideways, with post-expiry fatigue and macro threats present. Key catalysts this week include the U.S.-EU trade updates, further institutional tokenization talk in Davos and potential commentary on the CLARITY Act.

Key levels to watch:

- Dogecoin (DOGE): $0.124 for wedge confirmation, $0.08 downside risk, $0.29-$1.10 upside if breakout holds.

- SKR: Watch $0.048-$0.065 for retest or continuation zones as volume profile extremely thin above $0.07.

- XRP: $1.91-$1.97 short-term resistance, $1.85-$1.90 critical for support, sub-$1.80 unlocks ETF sell risk.

- Bitcoin (BTC): $88,500 support, $90,000 psychological resistance.

Arman Shirinyan

Arman Shirinyan Gamza Khanzadaev

Gamza Khanzadaev Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin