Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

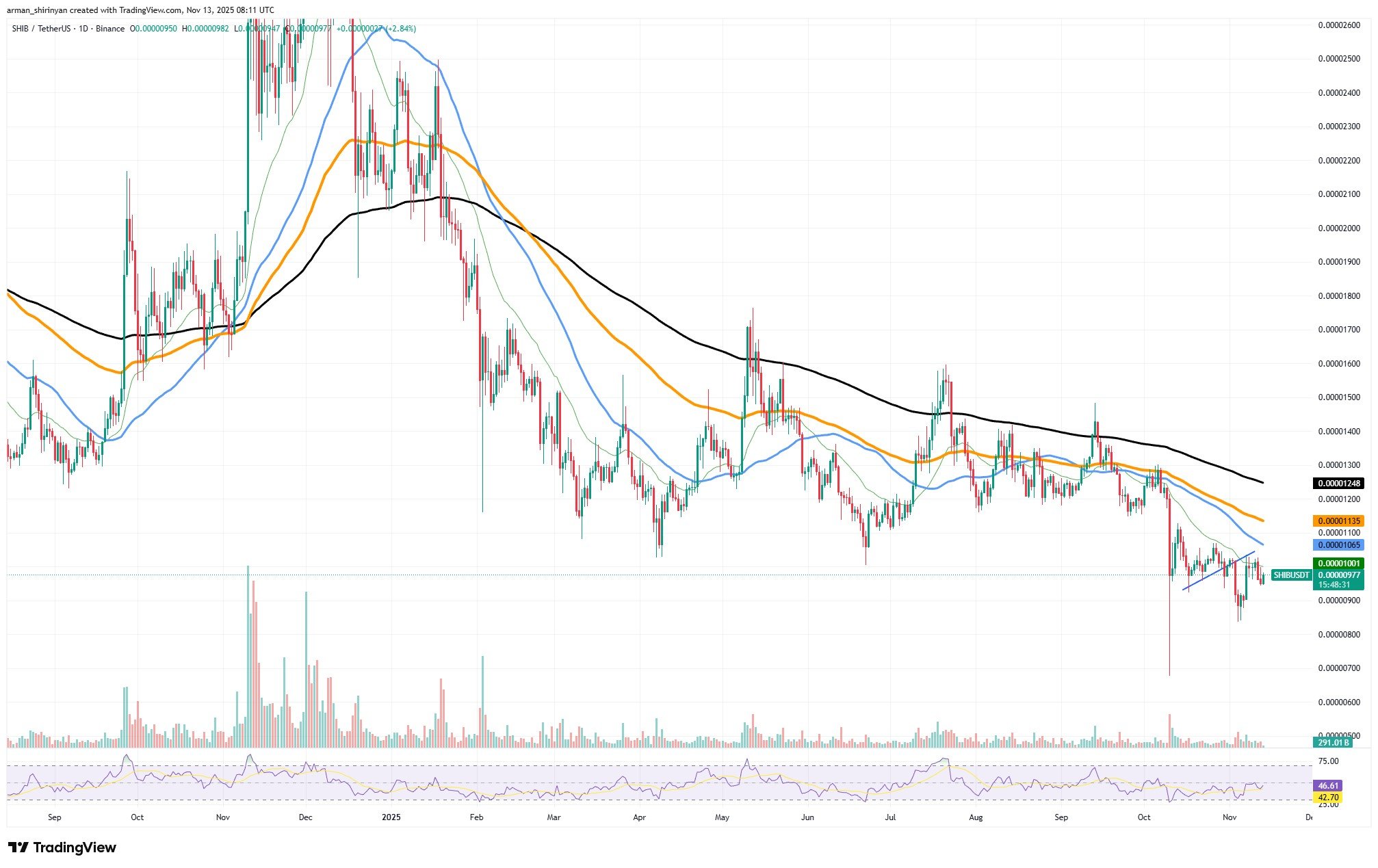

Every time the chart dips beneath another support cluster, the notion that Shiba Inu is headed straight for zero reappears. However, that prediction is not supported by even the most basic examination of the current structure. Indeed, SHIB is weak. Buyers are hardly resisting, momentum is flat, and it is trading below its major moving averages. However, considering the token's multibillion-dollar market capitalization and the liquidity structure surrounding it, it is practically impossible for it to collapse to literal zero. Assets of this size do not just vanish.

How it can really happen

They chop, bleed and stagnate, but zero is a fantasy scenario only found in projects that have stopped trading. SHIB does not fall into that category. Whether recovery is possible sooner rather than later is the more pertinent question. It can, in theory. The price is close to a local exhaustion zone and the market is oversold enough to cause a reflex bounce.

The tight consolidation range between $0.0000090 and $0.0000100 typically precedes expansion. SHIB can break back toward the 20-day EMA and test the heavier resistance near $0.0000105-$0.0000110 if momentum shifts even slightly, for instance, if Bitcoin stabilizes or risk appetite returns.

Whales are not selling

This is supported by whale behavior. There is no distribution of large wallets. They are either adding lightly or sitting motionless. Aggressive exchange inflows would occur if whales genuinely thought SHIB was about to implode. On-chain data, on the other hand, reveals almost no inflows into significant exchanges. This implies that no one of significant size is getting ready to enter the market.

The crash-to-zero narrative is completely refuted by a lack of inflows, which is not bullish in and of itself. It merely demonstrates the asset's lack of conviction on both sides — there is neither pressure to make a large purchase nor to sell in bulk. Right now, a wipeout is not the true threat to SHIB.

Stasis is what it is. The token may move sideways for months if volume stays low and the project does not produce any new catalysts. However, the foundation is still strong enough structurally to allow for a recovery wave whenever the overall state of the market improves. Zero is not an option but a gradual process until an attitude change occurs.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov