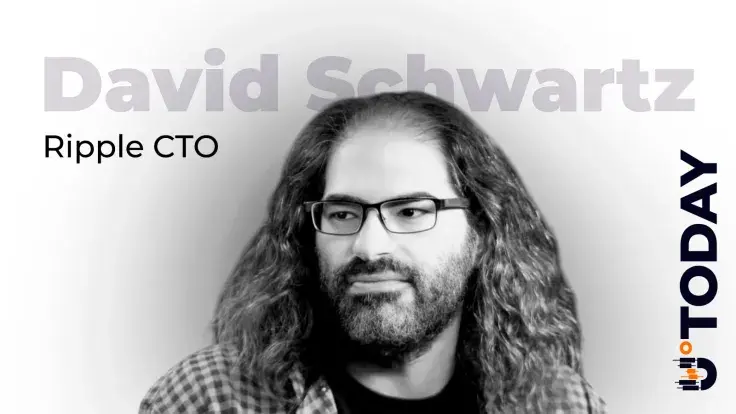

When central bank digital currencies come up, the usual perception is either utopian control or streamlined efficiency, but David Schwartz, Ripple’s CTO and one of the longest-standing cryptographers in the industry, waded into the debate with an opinion that may flip the narrative.

According to him, CBDCs are neither good nor bad; their impact depends on whether they expand freedom or eliminate it.

Ripple, for its part, has been embedded in this trend for years. Pilots with Palau, Montenegro, Bhutan, Georgia and the U.K. gave the company an inside view on what central banks demand, while ex-advisor Welfare admitted those early projects reshaped how XRPL was built to handle not just CBDCs but also stablecoins and tokenized deposits.

That evolution culminated in Ripple’s own RLUSD launch across XRPL and Ethereum, a dollar-backed token now edging toward a $790 million market cap and tied into partnerships with DBS and Franklin Templeton.

Schwartz’s point should be read as follows: CBDCs can expand freedom if they counter disguised discrimination by private financial institutions, but they risk undermining it if weaponized against cash or private alternatives.

CBDC here to stay

The market has largely moved on, yet the question remains not whether CBDCs are coming, but whose freedom they will ultimately serve.

In the meantime, the backdrop is controversial. IMF chief Kristalina Georgieva has already warned that fiat’s digital transition is no longer a debate but a reality, with a clear undertone that Bitcoin and other "unbacked" cryptocurrencies are bad.

India’s central bank went further, openly calling for CBDCs to be used in place of stablecoins for international settlement, and admitting that pilots at both the retail and wholesale levels are already underway.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov