Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Solana (SOL) has recorded impressive gains, with its price surging by over 8% on the cryptocurrency market. This positive development, however, has triggered a severe liquidation imbalance in the last hour. A staggering 14,602% liquidation imbalance is on the record, with more losses for short traders.

Solana bulls take charge as longs see minimal liquidation

According to CoinGlass data, those betting short on Solana saw $2.82 million wiped out in the last 60 minutes as the price began an upward journey toward the $180 level. The price increase spiked above the projections that short traders held.

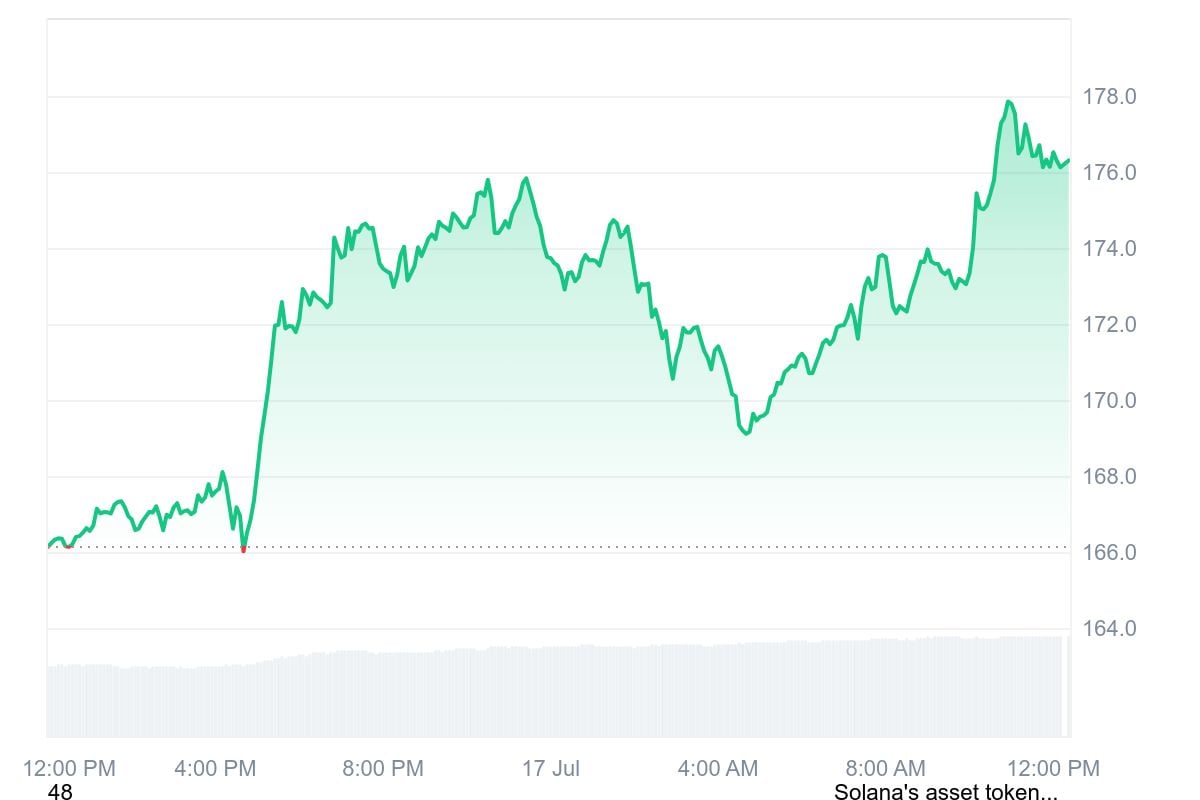

CoinMarketCap data shows that, as of press time, Solana was exchanging at $176.35, representing an 8.23% increase in the last 24 hours. The coin climbed steadily from a low of $166.02 and breached the $170 price mark.

Solana experienced a bullish rally, rising to an intraday peak of $178.07 before correcting slightly to its current price. However, the asset still has potential for further rallies. It was this sudden spike that triggered liquidations for short traders.

Meanwhile, investors who bet long on Solana also experienced some losses, although they were minimal. Long traders lost $19,180 within the hour, bringing total liquidation to $2.839 million.

On-Chain metrics and whale activity support price rally

Solana’s bullish rally has been building up over several days. One crucial indicator was its increasing network revenue, which signaled a surge in user activity. Notably, the coin led Ethereum and Tron, as well as other layer-1 and layer-2 blockchains.

The report showed that Solana raked in $17.37 million and stood over $3 million higher than its closest rival, Tron, in transaction fees.

In other ecosystem developments, Solana also moved up as high-stakes traders’ actions indicated that whales were ready for a bold climb. There are high expectations that SOL could breach the $200 price resistance as it rides on the current rally.

Caroline Amosun

Caroline Amosun Tomiwabold Olajide

Tomiwabold Olajide Dan Burgin

Dan Burgin Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan