Ethereum (ETH), the second largest cryptocurrency, is sending mixed signals to investors. While validators are gearing up to withdraw ETH from staking, major DeFi confirms that Ethereum (ETH) mainnet still remains the building block of its revenue.

$12,000,000,000: Ethereum (ETH) exit queue hits all-time high

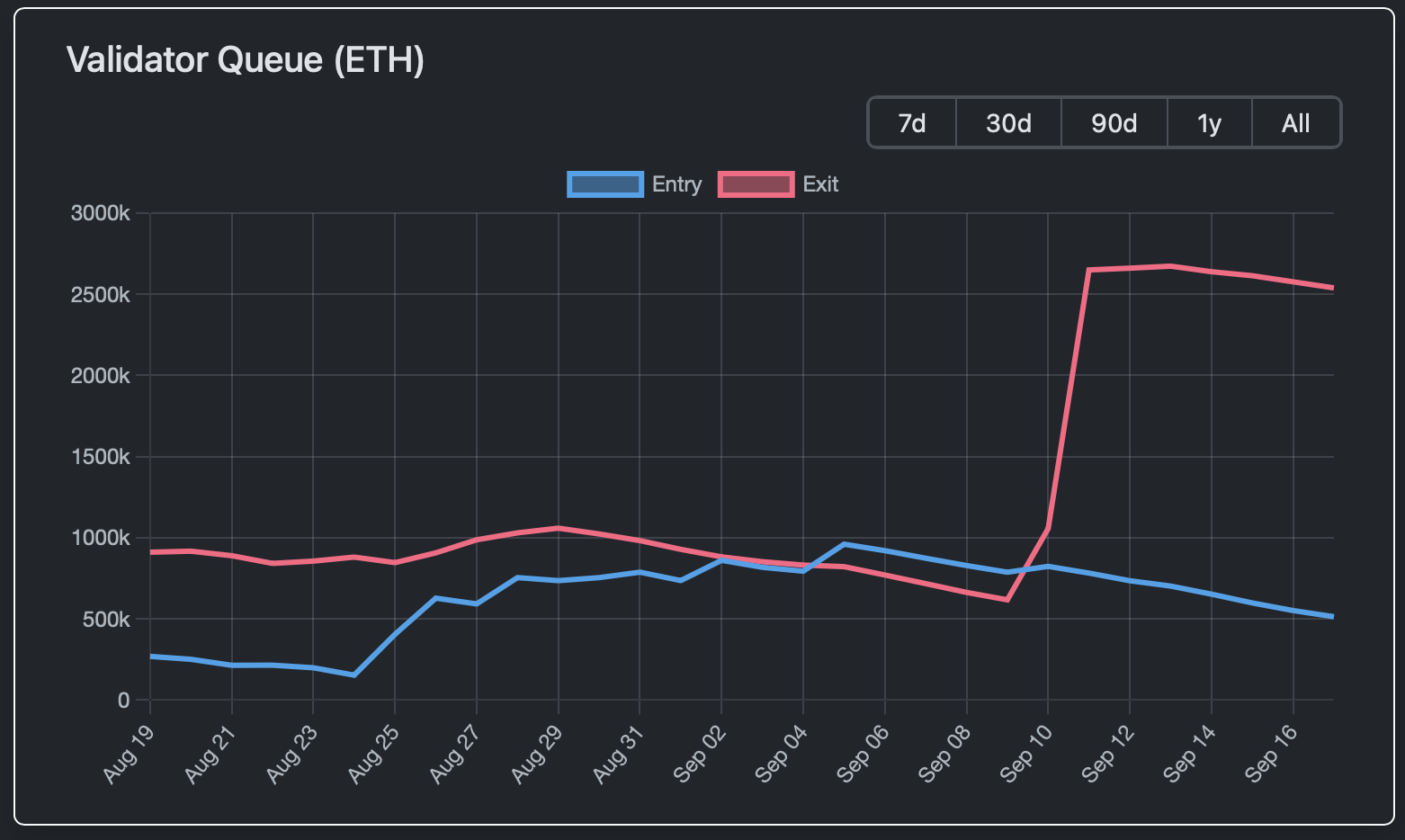

The Ethereum (ETH) validator exit queue jumped to a record-breaking high today. As of press time, over 2,600,000 Ethers (ETH) — or over $12 billion in equivalent — are waiting in line to be unstaked by Ethereum (ETH) validators.

As such, the exit queue will be clean in 44 days minimum, which is by far the longest wait time ever registered on the Ethereum (ETH) network.

By contrast, the ETH staking queue — the line of ETH holders interested in locking their funds for staking — dropped below 500,000 ETH.

This discrepancy is potentially dangerous for Ethereum’s (ETH) price performance. ETH unstaked from validators' contacts might be sent to the market, which would create enormous selling pressure.

At the same time, this might be the signal of institutions interested in adding ETH to their corporate balances. As the euphoria around digital asset treasury companies (DATs) is only getting stronger, ETH might be just changing hands.

Ethereum (ETH) blobs full: What does this mean?

Meanwhile, the other indicator of Ethereum (ETH) network activity is also surging. As noticed by long-term Ethereum (ETH) ecosystem investor and enthusiast Ryan Sean Adams, cofounder of Bankless media platform, the demand for Ethereum (ETH) blobs is going through the roof.

Ethereum (ETH) blobs — binary large objects — are huge chunks of data used by L2 platforms on the top of Ethereum (ETH). Unlike calldata, which is stored on the Ethereum (ETH) mainnet permanently, blobs are temporary data structures. Introduced by EIP 4844, they significantly optimize L1/L2 interactions in the Ethereum Virtual Machine ecosystem, making its data logistics more resource efficient.

The increased demand for blobs is an indicator of growing transactional and smart contracts activity. Ethereum (ETH) has the option to increase blob space to keep its L2 operable and ensure that it can verify data on L1s with zero delays. Also, the growing demand for blob data is accompanied by ETH burns speeding up.

Ethereum (ETH) mainnet still responsible for 87% of Aave revenue

Marc Zeller, the founder of the Aave Chan Initiative (ACI), a leading service provider for the Aave DAO, unveiled a major ecosystem report. Based on its data, Ethereum (ETH) mainnet remains the dominant blockchain for the protocol that is now deployed on dozens of EVM blockchains.

According to his data, collected in the last 12 months of Aave’s operations, transactions on the Ethereum (ETH) mainnet generated 86.6% of the protocol's revenue. As such, all other blockchains Aave is operating on might be characterized as "side quests."

The most utilized blockchains Aave operates on include Polygon, Avalanche, Arbitrum, Optimism and Harmony. Compared to Ethereum’s (ETH) mainnet, all of them guarantee lower fees and faster transactions, but Ethereum (ETH) adoption is still much higher among DeFi users.

In the last year, more and more Ethereum (ETH) enthusiasts are calling for L1 scaling as the next priority in Ethereum (ETH) development.

Ethereum (ETH) price attempts to stay above $4,500

Amid all of these mixed messages sent by the Ethereum (ETH) ecosystem, Ether, its core cryptocurrency, is attempting to stabilize over the critical level of $4,500. In the last 24 hours, the Ethereum (ETH) price added 0.51% on surging trading volume.

As of press time, Ethereum (ETH) is changing hands at $4,483 on major spot trading platforms. Open Interest (OI) on futures exchanges is high, which confirms that interest in ETH remains high.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin