Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

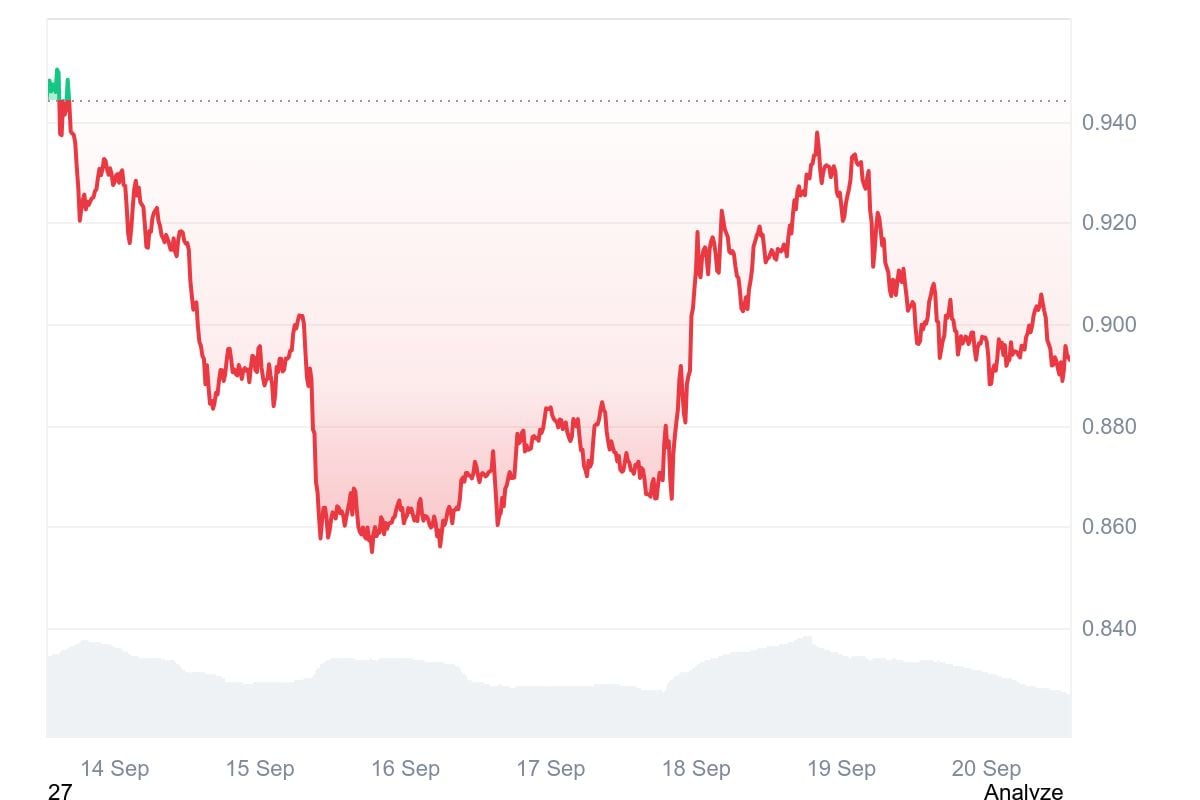

Cardano (ADA) has succumbed to a market-wide crash as its price dropped from an intraday peak of $0.9082. This dip has once again derailed its hopes of hitting the much-anticipated $1 target. Also, Cardano has recorded a significant volume drop in the last 24 hours.

Exchange delistings and profit-taking weigh on ADA price

As per CoinMarketCap data, Cardano’s trading volume has plunged by a massive 36.5% to $1.13 billion. The dip indicates market participants are not enthusiastic about the coin’s price outlook. They could have pulled back to minimize losses that might accompany trading the asset amid its ongoing volatility.

As of this writing, Cardano's price was trading down at $0.8897, which represents a 0.85% decline within the last 24 hours and 5.77% in seven days. It earlier dropped to a low of $0.8874 before a slight recovery within this time frame.

Several on-chain factors were responsible for the price action of Cardano. Notably, most of the asset’s investors decided to go for profit as soon as it topped $0.90. This surge in profit-taking prevented its upward movement to the psychological $1 level.

Additionally, Bitget exchange has decided to delist a couple of ADA pairs, which triggered sell-offs in the market. This reduced exchange support has clearly impacted Cardano negatively amid the broader crypto market struggles. Bitget’s decision to delist the pairs might have been performance-based.

Earlier this year, Tim Harrison of Input Output EVP noted that Cardano has a "marketing problem" and lacks the creativity to sell its value to potential investors. Harrison believes that if the blockchain is able to simplify its communication messages, ADA could gain more traction among crypto users.

This gap in communication clarity for investors might be contributing to the asset’s stagnation, even as other altcoins continue to outperform ADA in the crypto space.

Cardano's marketing challenges and investor criticism

Meanwhile, Cardano founder Charles Hoskinson has attempted to promote ADA, but it has fallen flat among users in the space. Reacting to his X post that "Cardano is going to break the internet," many responded with criticism. They highlighted the poor performance of ADA among other crypto projects in the market.

Cardano has been struggling to climb up the ranking of crypto assets by market capitalization. Its previous attempt at the ninth position was short-lived as Tron reclaimed the spot, pushing ADA to the 10th place.

However, with the buzz around exchange-traded funds (ETFs) and Grayscale’s recent S-1 registration, there might be a shift in price outlook.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov