Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

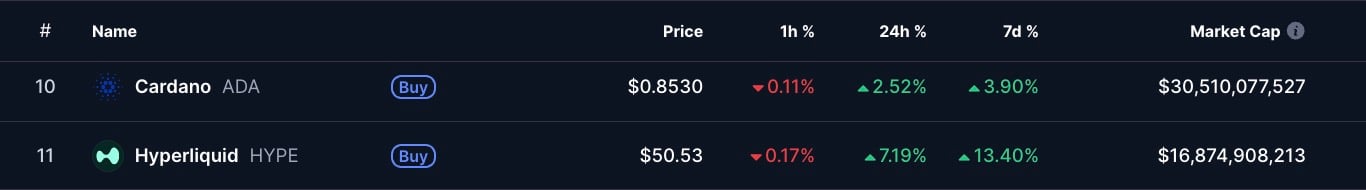

Cardano (ADA) is hanging by a thread in the top 10, and Hyperliquid (HYPE) is the reason why. According to CoinMarketCap, ADA is worth $30.44 billion, but HYPE, now at $16.88 billion after a +256% rally this year, is closing in with numbers that make Cardano look stuck in another era.

Daily DEX turnover is $361 million for HYPE against just $2.89 million for ADA, as per DefiLlama. Cardano is still moving, but the scale mismatch makes it look more like a "dino coin" holding its spot by muscle memory than an ecosystem competing at the front.

For Cardano, that is the existential risk. A network without a stablecoin, without competitive DeFi activity and without real fee revenue is defending a top-10 slot, while Hyperliquid builds the exact mechanics that make tokens rise. ADA's survival now looks less like strength and more like inertia.

The year-to-date price chart shows this split: HYPE has shot up by 254.9%, while ADA has dropped by 29.7%. One line trends up and to the right, while the other drags sideways at the bottom — proof that liquidity and adoption are already flowing in opposite directions.

Biggest problem

The stablecoin gap is at the core, and even Charles Hoskinson has admitted it. Cardano does not have any, but Hyperliquid is getting ready to release USDH with Paxos, the same company that previously issued $25 billion BUSD for Binance. And Hyperliquid is already processing $5.5 billion in stable liquidity, which is currently enriching Circle.

With its own stable, $200-220 million a year could be put back into its ecosystem, and if adoption grows, could scale to over $1 billion in annual buybacks of HYPE.

Cardano gathers the community across the globe to workshops and discussions, but nothing is shipped. It calls itself decentralized, yet three entities still dominate the ecosystem.

Hoskinson may justify this by saying Cardano is playing the long game, but the risk is obvious: every long game turns short if nothing materializes.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov