Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

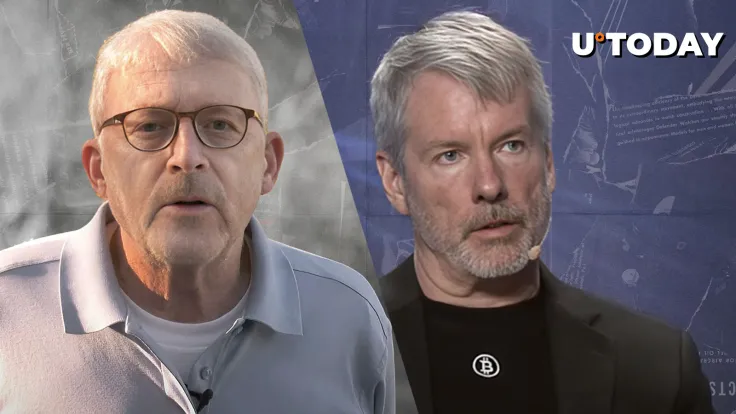

Prominent commodity trader Peter Brandt has opined that Bitcoin (BTC) could end up testing Strategy co-founder Michael Saylor "severely."

Brandt has not ruled out that the price of the leading cryptocurrency could potentially plunge to as low as $50,000. That said, he has stressed that this is not a prediction.

MSTR's ugly streak

Earlier this week, Saylor announced yet another Bitcoin purchase (its biggest one since September). It has pushed the company's average purchasing price to $74,079.

The company's shares are down another 6% today, reaching the level that had not been seen since November 2024. The stock is currently down 35% on a year-to-date basis, changing hands at $212.

Venture capitalist Jason Calacanis recently predicted that Strategy could go underwater, but the early Uber investor stressed that he would never touch the stock.

Unfazed by volatility

During a recent interview with Yahoo! Finance, however, Saylor made it clear that he is seemingly unfazed by volatility.

"If you’re an investor, it really comes down to what your time horizon is and how much volatility you can stomach. So, if you want max performance, you’re going to take max volatility," Saylor said.

Saylor has also opined that the fundamentals of the industry are so much better today than they were twelve months ago that potential investors have an "extraordinary risk-reward opportunity." "Now is a much better time to invest," Saylor stressed.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov