Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

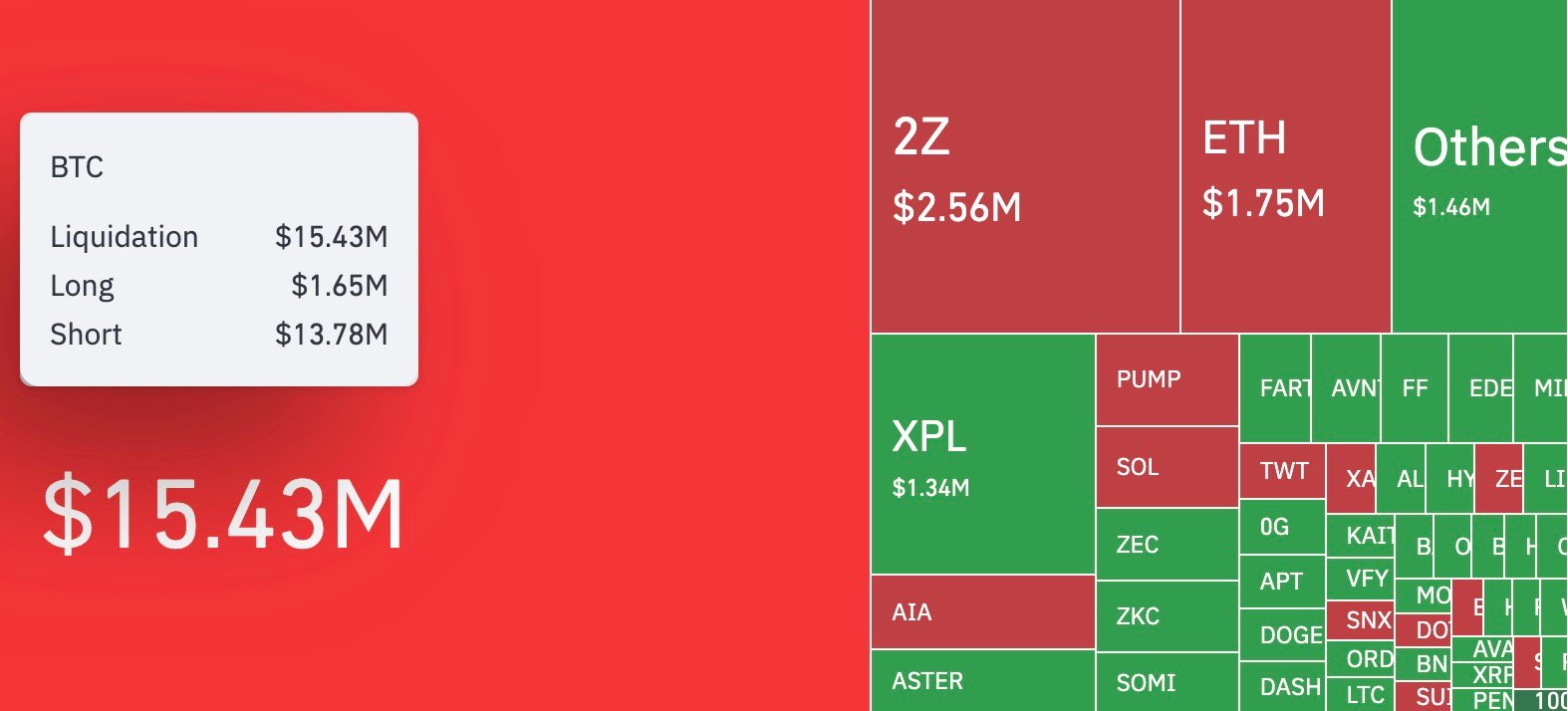

Bitcoin’s derivatives market just delivered a rare setup as an hourly liquidation heatmap by CoinGlass showed massive skewing against short positions. Within a 60-minute window, $15.43 million in BTC positions were wiped out, of which $13.78 million came from shorts and just $1.65 million from longs. The numbers mark an 835.15% imbalance.

Bitcoin was dominating the session, but the largest single liquidation came through an ETH/USD position on Hyperliquid worth $11.62 million.

Across the past 24 hours, $364.32 million in liquidations were recorded on crypto markets. Shorts accounted for $266.99 million, while longs absorbed $97.33 million. Bitcoin remained the core driver, carrying over $114 million in liquidations of so-called bears. Funding rates normalized too, showing less appetite for aggressive shorting.

As always, the price is the driver, and BTC made it back quickly after the squeeze, stabilizing just below $120,000. With shorts heavily reduced, for many market participants, the biggest question right now is whether the market can sustain a run at the round-number level during the U.S. session.

Implications

What is for sure is that today’s imbalance leaves the market tilted in favor of bulls, at least in the short term, with forced liquidations affecting positioning across exchanges big time.

If BTC holds above $119,500, it may be suggested that the move could extend toward $120,500-$121,000. This would ensure the imbalance’s impact and be the logical outcome of today's concentrated liquidation waves' influence on intraday crypto market structure.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov