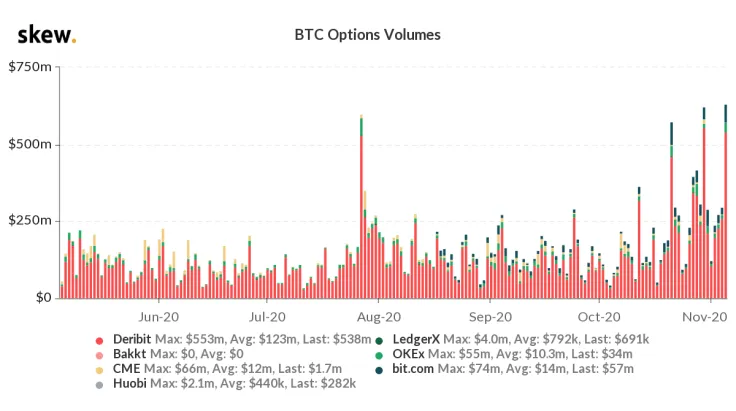

Data provided by cryptocurrency derivatives boutique Skew shows that Bitcoin options have set a new daily record volume following a major Bitcoin move.

As reported by U.Today, the world’s largest cryptocurrency breached $15,000 earlier today for the first time in nearly three years.

After suddenly plunging nearly three percent in a couple of minutes, Bitcoin is now attempting to hold ground above the aforementioned level at the time of writing.

Unregulated Dutch exchange Deribit remains the undisputed king of the options market, logging a staggering $551 mln worth of daily volume. Bit.com is in a distant second place with $57 mln. Malta-based OKEx comes in third place with $34 mln.

CME Group has so far traded $1.7 mln worth of Bitcoin options, a tiny share of the aggregate volume. Nevertheless, its regulated Bitcoin option interest was $258 mln on Nov. 4, which is far ahead of Bit.com ($165 mln) and OKEx ($128 mln).

Deribit, of course, accounted for the largest share of the total open interest yesterday.

As usual, Bakkt registered no trading volume. After racing ahead of CME with the launch of regulated Bitcoin options in December 2019, the ICE subsidiary has seen zero demand for the product since January.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin