Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

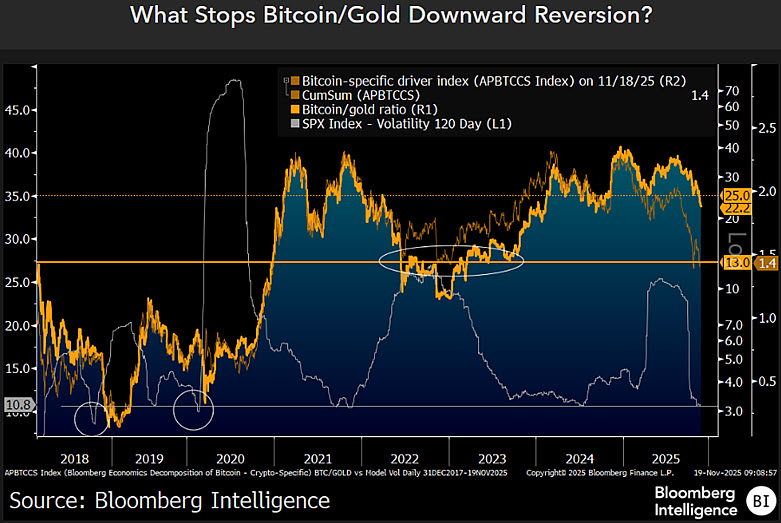

The Bitcoin-to-gold ratio just broke through a support line that has held this market together for years. According to Bloomberg’s Mike McGlone, this is not just a hiccup; it is a warning shot that the BTC/gold market is heading straight toward the 13x zone, which would mean a 30% drop from the current level in the low 20s.

For a metric that typically behaves as a slow, long-term gauge of risk appetite, this kind of decline is unusual and unsettling.

The setup looks almost scripted as Bitcoin’s long-trusted 25x floor failed without hesitation. The internal driver indexes, which Bloomberg uses to track whether BTC is being lifted by its own demand or by the mood of the broader market, rolled over. Equity-volatility overlays show the same downward bend.

Together, these indicators paint an uncomfortable picture for the crypto market: risk buying is fading, not rotating, stresses McGlone.

Clean break

The uncomfortable part is how clean the break is. There was no rebound or fight for the old level; it was just a drop and a flatline under resistance. According to McGlone, when this ratio behaves like that, the market has already made its decision. Gold continues to attract money from funds seeking a safe haven.

After a massive run, Bitcoin is suddenly being treated as an asset that investors lock in profits on, rather than one they rotate into.

McGlone also points out the historical pattern that traders ignore. When the Bitcoin/gold ratio breaks, stocks often follow with a lag. His charts include a reminder that the S&P 500 rarely shrugs this off. If the ratio continues to slide into the low teens, it could pull markets into the same cooling phase.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov