Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Silver’s collapse on Monday overshadowed even the loudest Bitcoin debates. Prices sank nearly 9% on Dec. 29, marking the largest one-day decline since the pandemic era of 2020. This occurred after silver reached new heights during an extended year-end rally.

By Tuesday, the metal had recovered. Spot silver rebounded 3.1% to $74.49 after reaching a record high of $83.62, with year-to-date gains remaining near 158%.

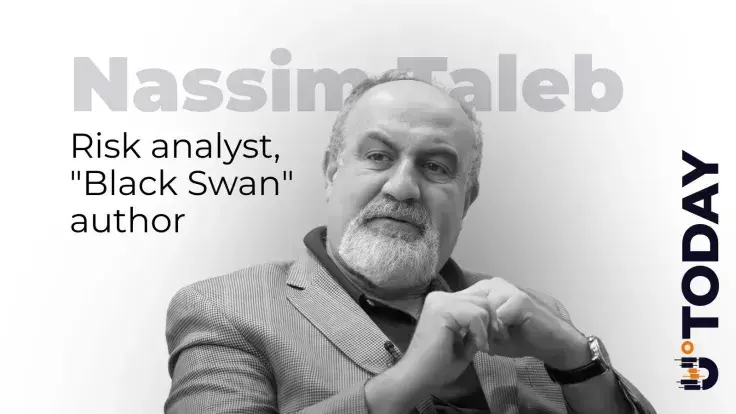

It was that rebound that brought renowned writer Nassim Nicholas Taleb into the conversation. In a new X thread, the longtime Bitcoin critic and the author of "Black Swan" framed the silver move as leverage stress rather than a story about jewelry demand or a sudden industrial shock.

For him, silver has become volatile this year. He noted that volatility and higher margin requirements have moved together. Also, leveraged longs have been reduced as liquidations have pushed the price down by about 10%, leaving fewer participants who are still holding the trade.

Tulip mania

Mainstream market explanations aligned with this logic. After the surge, the CME raised margin requirements for precious metals contracts, a change that increases the cash needed to hold futures exposure and often accelerates profit-taking in crowded trades.

Taleb’s comments on silver also align with his long-standing view on Bitcoin: that it failed as a currency and belongs in the “electronic tulip” category.

In the short term, the situation is a matter of mechanics. If volatility stays elevated and margin stays tight, silver could experience more waves of forced de-risking. However, if liquidation pressure fades, the rebound could extend. Some analysts are already projecting a higher 2026 trajectory, with targets near $90.90.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov