Ethereum (ETH), the second-largest cryptocurrency, has seen its price dropping today amid a general market collapse. While it registers almost 70% bigger liquidations compared to Bitcoin (BTC), it still looks strong compared to Solana (SOL).

$507,000,000,000 in ETH positions erased, 95% longs

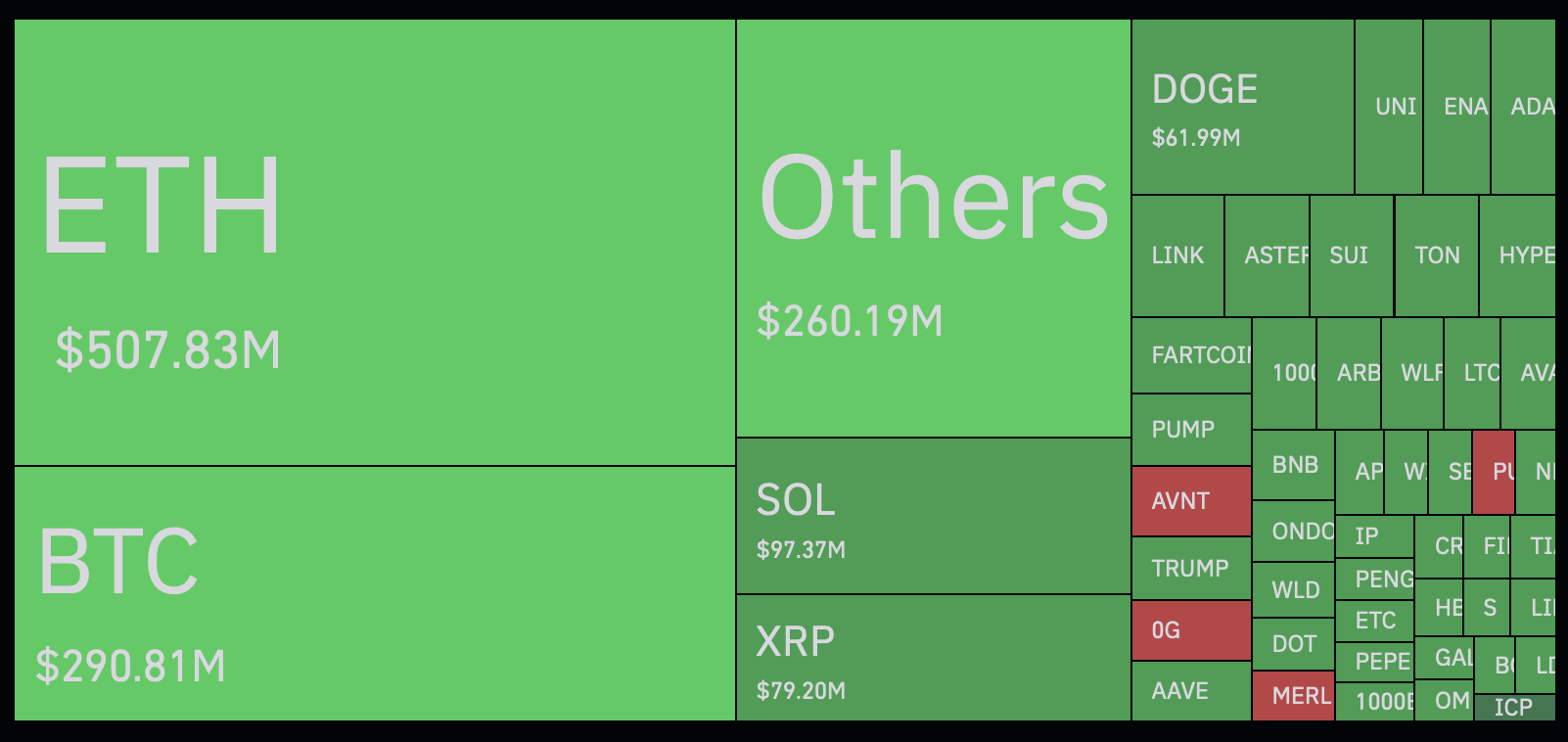

In the last 24 hours, over half a billion in Ethereum (ETH) futures positions were liquidated. According to the data by CoinGlass, the net volume of Ether contracts erased by the liquidation storm exceeded $507 million.

Out of this monstrous volume, the biggest in 2025, 95% were long positions. As such, Ethereum (ETH) bulls were the ones who lost $482.6 million in equivalent.

Bybit, the second-biggest cryptocurrency exchange by trader count, is responsible for over 52% of today's Ethereum (ETH) liquidations.

During the ongoing bloodbath, 402,369 traders were liquidated, the total liquidations exceeding $1.71 billion, CoinGlass data shows. To provide context, for some currencies, today's drop was more painful than Crypto's Black Thursday, March 12, 2020.

It is interesting that the liquidations of such volume were triggered by mediocre price swings. Ethereum (ETH) lost 6.5% in 24 hours, while Solana (SOL) is down by 7.2%.

The Ethereum (ETH) price dropped to $4,150 while Solana (SOL) dropped to $220. Both cryptocurrencies are already recovering from these painful collapses.

Ethereum futures Open Interest drops by $3 billion

Ethereum Open Interest, i.e., the USD-denominated volume of Ethereum (ETH) contracts, which are not closed yet, lost $3 billion in hours, dropping by over 10% overnight.

Prior to today's price plunge, it was estimated at $30.3 billion in equivalent, according to Coinalyze data. In a few hours, Ethereum (ETH) contracts open interest dropped to $27 billion in equivalent.

Out of this drop, half a billion was caused by liquidations. In other cases, traders decided to close their positions to avoid extending losses.

Out of an actual $27 billion in Open Interest, Ethereum (ETH) perpetuals constitute $26.4 billion, while Ethereum (ETH) futures with fixed expiration dates only account for $906.1 million.

For Bitcoin (BTC), net Open Interest sits around $80 billion; Binance Futures are responsible for $15 billion here.

Ethereum cofounder Vitalik Buterin endorses "low-risk DeFi": What to know

The Ethereum (ETH) community is still discussing possible ways to accelerate the adoption of the second-largest cryptocurrency globally. As covered by U.Today previously, Ethereum (ETH) cofounder Vitalik Buterin indicated "low-risk DeFi" as a potentially attractive opportunity for a new cohort of users.

According to him, low-risk and low-interest decentralized finance protocols might become for Ethereum (ETH) the same catalyst that digital search became for Google.

Ethereum (ETH), therefore, should distance itself from speculative "degen" narratives, evolving into a platform for predictable, stable income tools.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin