Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As Wall Street is celebrating the softest Core CPI since 2021 and S&P 500 futures reach record highs, the XRP derivatives market just saw an unbelievable 1,122% short-side liquidation imbalance — a brutal positioning trap that exploded as inflation fears cooled down.

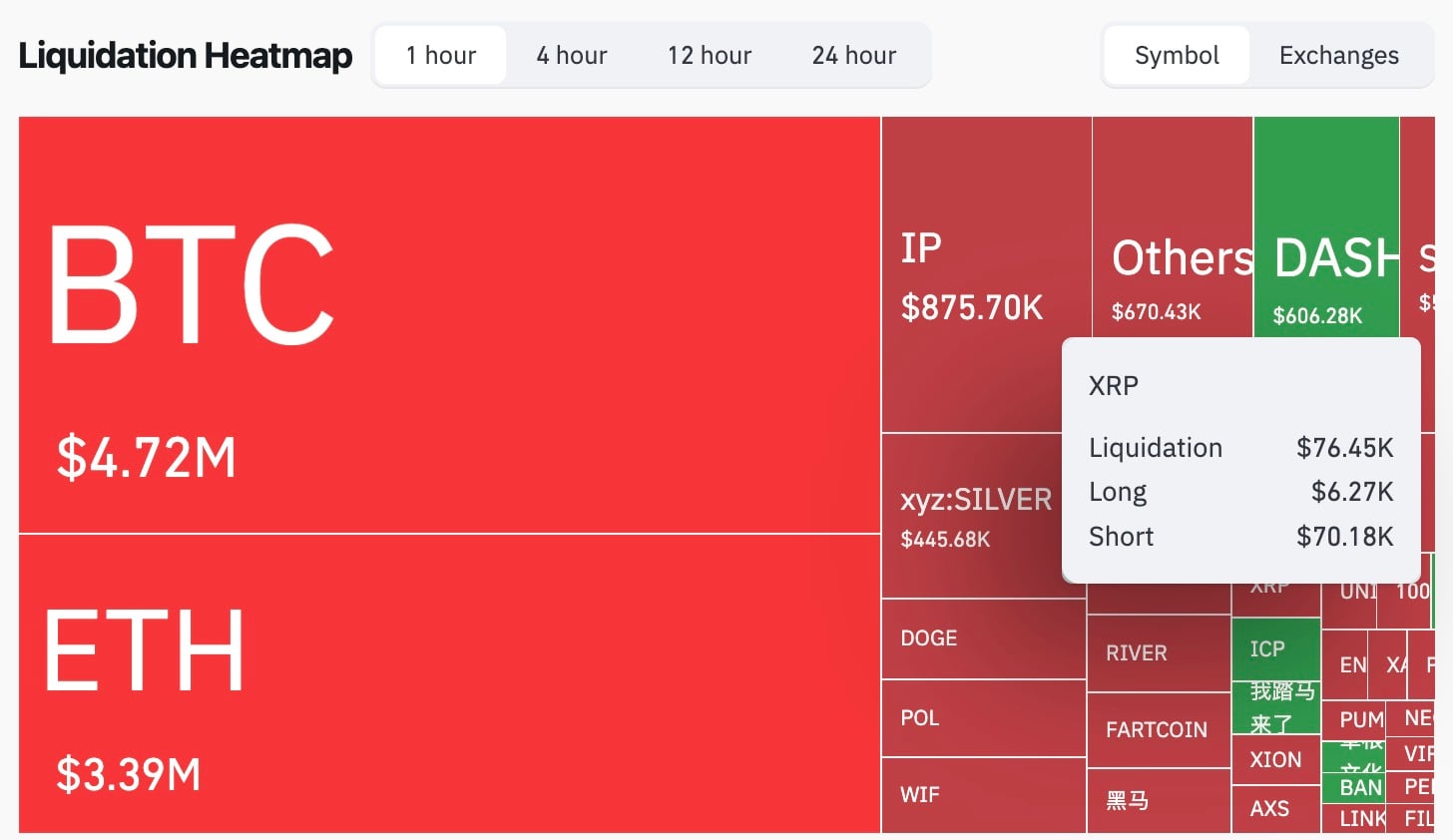

According to CoinGlass's liquidation heatmap, XRP liquidated for $76,450 in the past hour. What's interesting is not the total amount, though, but the structure: $6,270 came from longs, while $70,180 were taken out of short positions.

That is an 11x asymmetry, telling us that short sellers were caught off-guard by a sudden upward spike, which you can see on the XRP price chart.

Bitcoin and Ethereum were the main targets of liquidations — $4.72 million and $3.39 million, respectively — but it is XRP's microstructure that was unique, with a short squeeze over capitulation.

CPI delivers bullish surprise

Just minutes before the move, the U.S. Bureau of Labor Statistics confirmed that Core CPI fell to 2.6% YoY, which is below consensus. Derivatives traders immediately adjusted their expectations for a more significant Fed cut, leading to a surge in bids for short-term interest rate futures.

What happened is a textbook example of how macro volatility met leveraged mispositioning — and XRP, once again, moved as a liquidity proxy rather than a trend follower.

Whether this liquidation imbalance sets the stage for a breakout above the $2.08 resistance depends on how spot flows react after the CPI. One thing is clear, though: XRP's short side just got destroyed in real time, and the burn rate was not small.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov