Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

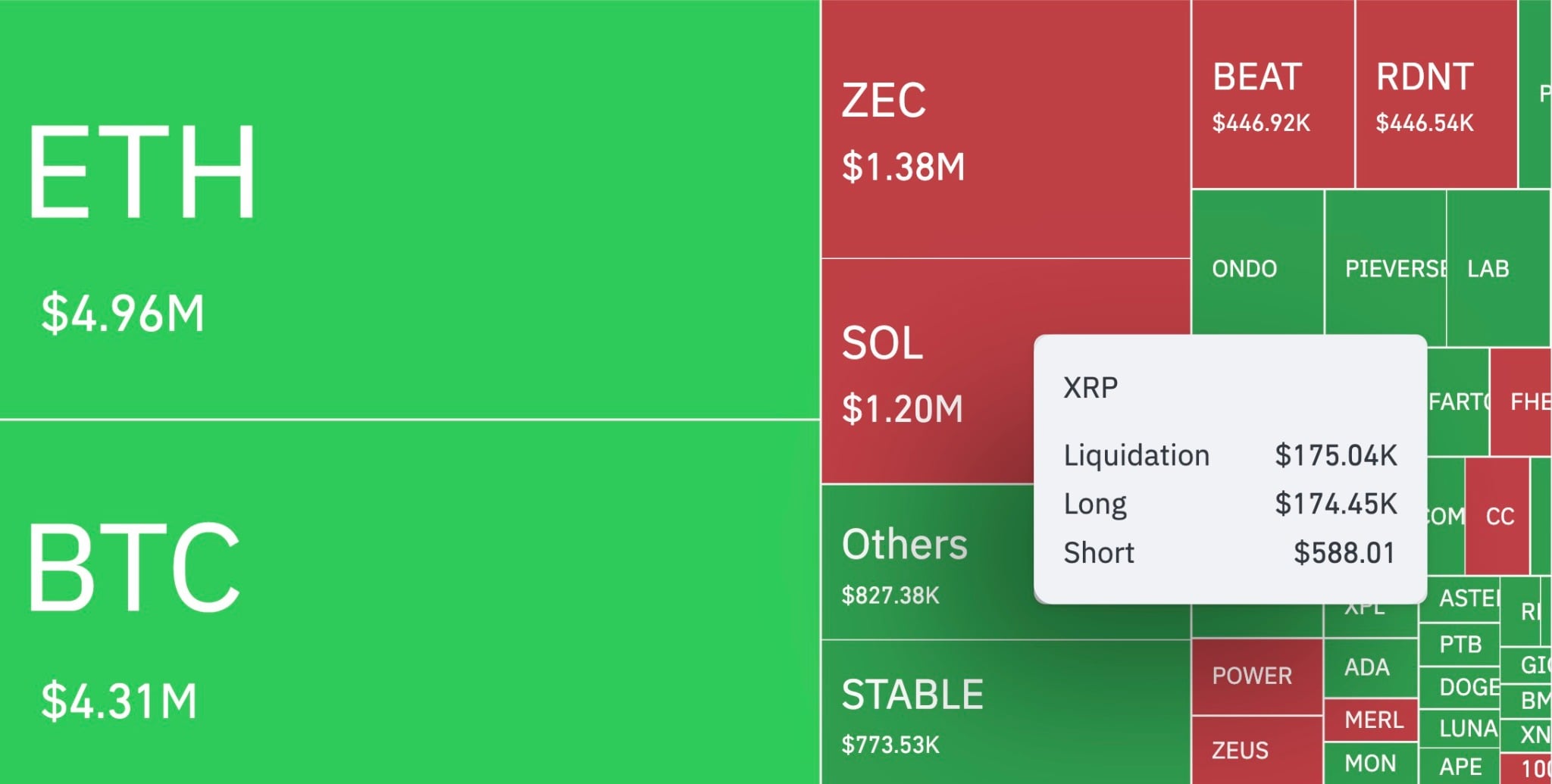

The derivatives market for XRP just delivered one of those statistical outliers that forces you to pause and check if the number is real. As revealed by CoinGlass's liquidations heatmap, a liquidation imbalance of 29,668,367% appeared on the four-hour map as long liquidations reached $175,000, while shorts generated only $588.

The spread is so one-sided that it basically confirms the main thing the chart keeps signaling: bears are not putting real weight on XRP right now.

The price action of XRP softening earlier in the session did not change that. XRP dipped from its intraday range, spiraling through a couple of levels, and still failed to attract any serious downside flows. No wave of fresh shorts, no pressure buildup, no attempt to force a cleaner breakdown.

The market only flushed longs and moved on.

Why is no one shorting XRP?

The max pain table repeats the same message, with the short max pain price sitting 9.71% above spot; this cluster is worth $12 million in exposure right now, and that alone is enough to keep short sellers from getting aggressive, as taking early positions for bears risks walking straight into their own loss zone, so they are staying light and picking their moments.

All of this leaves XRP in a strange setup: the price is going down, but the downside is not being driven by bears. It is being driven by the lack of leverage support on the long side.

Until short interest actually steps in, XRP’s price pullbacks will look more like routine resets than controlled trend moves, because a market without pressure can fall — but it cannot fall with intent.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov