Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The price by itself cannot adequately explain the signal that XRP is flashing. The network is actually slowing down even though the chart still indicates consolidation close to key support. XRP payments surged to 1.346 million in the last day, a level that clearly exceeds recent activity ranges and demonstrates that usage is increasing rather than stagnating.

Ledger still moving

Two essential components of XRP are the number of payments and transactions. They do not represent conjecture but actual settlement activity. Together with the increase in payments, the network's overall transactions increased to 2.57 million, significantly exceeding its short-term baseline. Together these metrics show throughput demand rather than random wallet shuffling.

This type of behavior has historically been observed during continuation phases rather than at tops. When fundamentals diverge from price, markets typically peak when activity declines and prices remain flat. It is the reverse here. XRP's network usage is exceeding several local ceilings in spite of technical pressure and general market weakness. That makes a compelling case against the notion that the rally is done.

Usage stays up

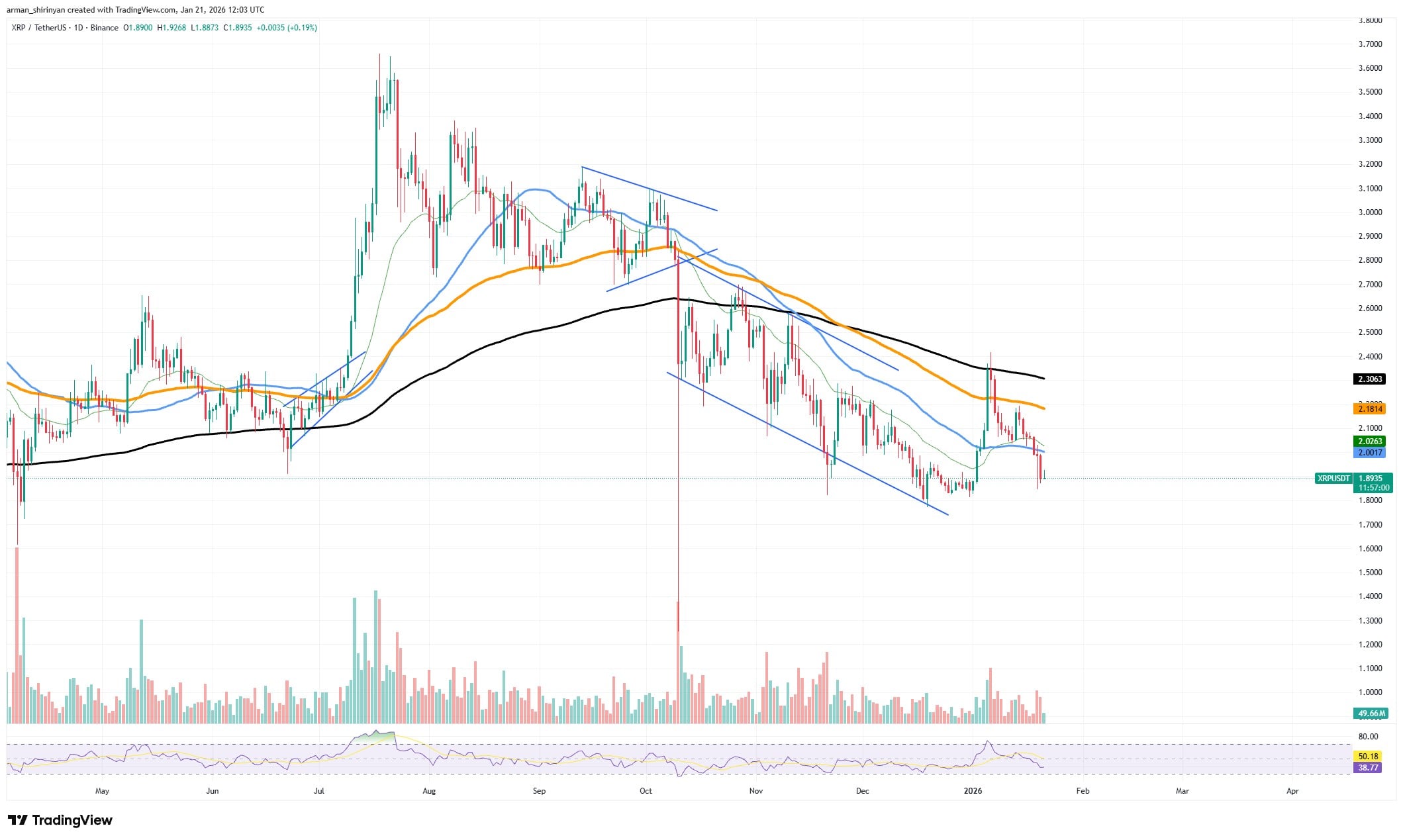

Context is important, but price action appears to be heavy. While fundamentals are printing higher highs, XRP is trading close to its lower range. That is not failure, but compression. As on-chain activity increases and an asset absorbs selling pressure without collapsing, this usually precedes resolution upward rather than breakdown.

Over the past few weeks, payments and transactions have been trending upward; the most recent increase merely confirms rather than creates momentum. Instead of retail noise, that kind of consistent growth points to institutional or enterprise flows. The key lesson for investors is simple. Technical levels are still significant, particularly in the $1.90-$2.00 range, and short-term volatility may continue.

However, it gets more difficult to defend betting on a complete rally stoppage as long as network activity keeps exceeding previously capped levels. To confirm its trend, XRP does not require a quick vertical move. Under the surface, it needs confirmation — which it already has.

Because of this, XRP is in a situation that many other assets are not in at the moment: the price is uncertain, but the network is. Continuation is preferable to collapse if this divergence is resolved in the typical manner.

Denys Serhiichuk

Denys Serhiichuk Godfrey Benjamin

Godfrey Benjamin Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide Alex Dovbnya

Alex Dovbnya