After struggling to hold steady at the $3 resistance level despite strong market momentum, XRP has finally returned to the red zone, recording a sharp price drop in the last hour.

Amid this sudden shift in investor sentiment, XRP has seen a massive wipeout of long positions in its hourly liquidation activity, according to data provided by Coinglass.

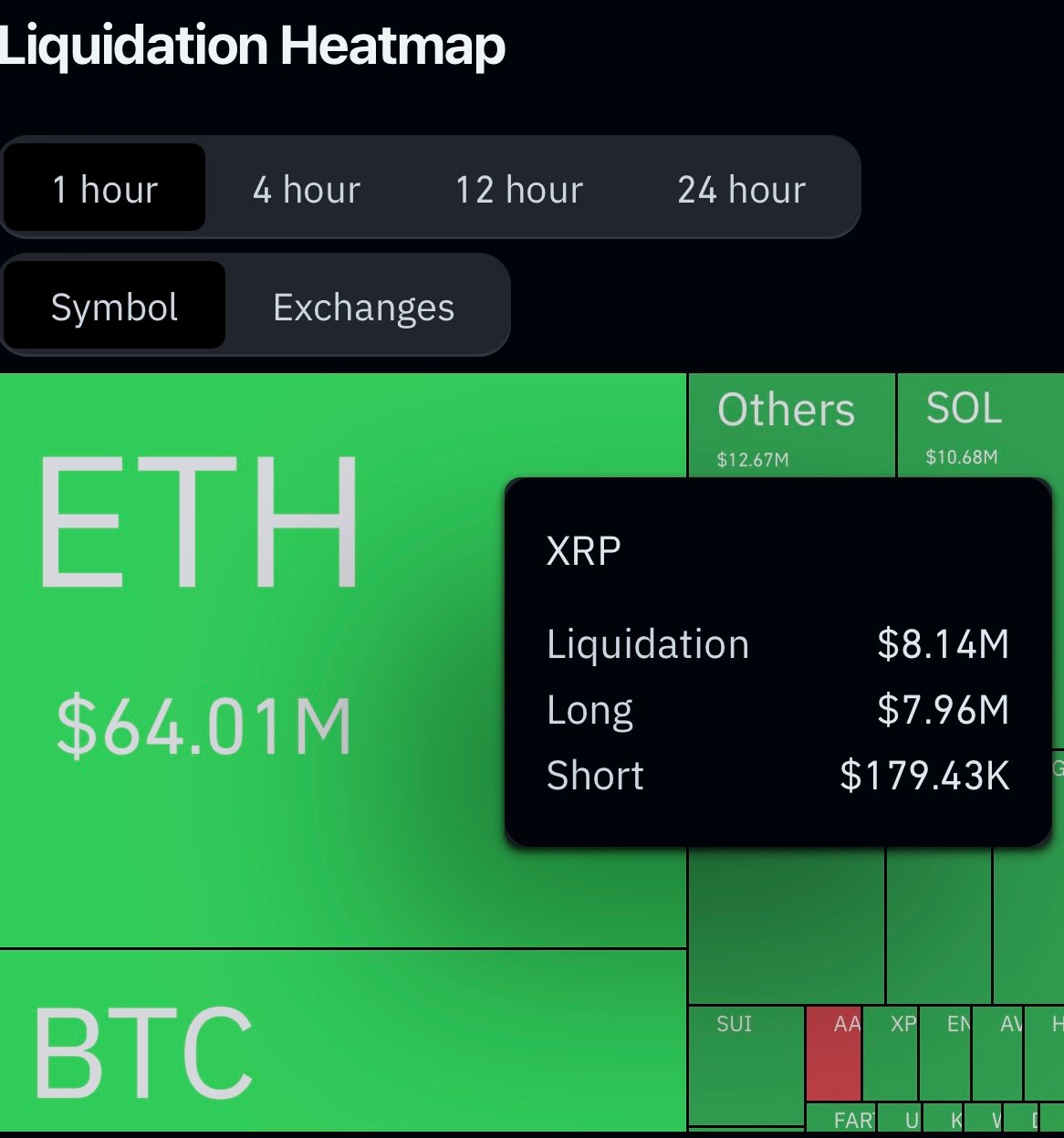

Notably, the data shows that XRP bulls had staked heavily in its derivatives market amid optimism for a continued price upsurge. With these expectations now shattered, the Ripple-associated cryptocurrency has seen a total of $8.14 million wiped out in the last hour, with long positions suffering the heaviest portion of the losses.

While only $179,430 were erased in short positions, a massive $7.96 million in long positions were liquidated, marking an hourly liquidation imbalance of 4,335%.

XRP loses top 3 spot

Just a day after XRP stirred reactions across the crypto market by surpassing BlackRock in market capitalization, the leading altcoin has suddenly seen an unexpected shift in market sentiment, with its price plunging by over 4% in just one hour.

The epic price reversal has raised eyebrows, sparking curiosity about where the altcoin might be headed next. Following this massive price plunge, XRP has not only lost momentum but has also dropped from its position as the third-largest cryptocurrency by market capitalization.

With its market capitalization declining by over 5% in the last 24 hours, XRP has lost its top-three ranking to BNB, which has now emerged as the third-largest cryptocurrency after achieving multiple all-time highs in less than 24 hours.

Amid the declining momentum, XRP saw its price plunge by 5.16% over the last 24 hours, trading at $2.88 as of press time. While investors remain curious about XRP’s next price move, many have lost confidence in the asset’s ability to retest its 2018 all-time high of $3.84.

The price decline witnessed today marks the sharpest drop since the “Uptober” rally began on October 1. During the unusual trading session, XRP’s price fell from an intraday high of $3.05 to a deep low of $2.88.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov