Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

According to the most recent social-volume analytics, XRP has solidly established itself as one of the top five most-talked-about cryptocurrencies on the market. Additionally, the introduction of several XRP-linked ETFs and the general narrative shift toward institutional products are the real causes of XRP's rise in popularity, in contrast to speculative surges that are usually fueled by influencer hype.

Other contenders

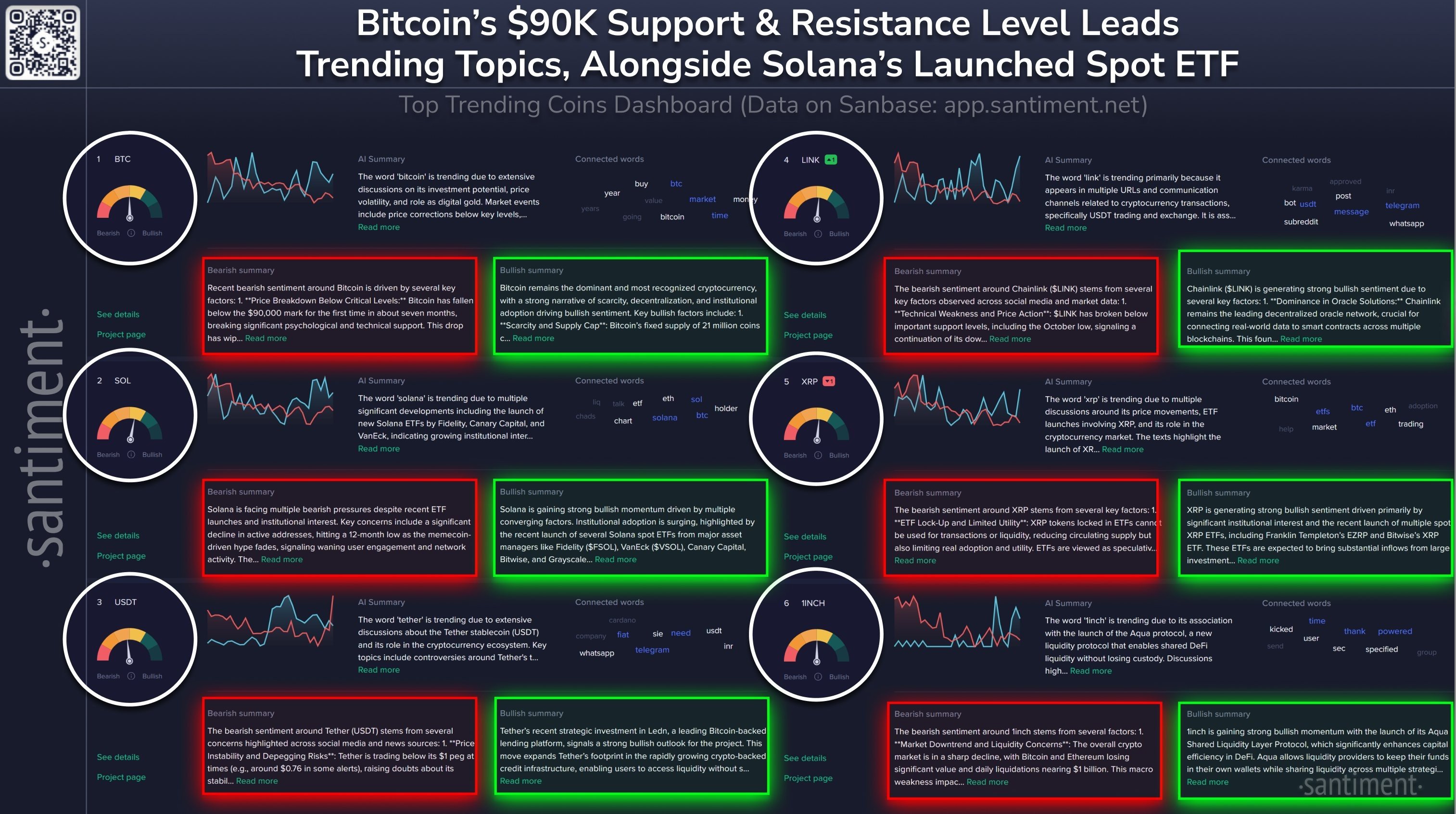

Unsurprisingly, the data reveals that Bitcoin is still the most-talked-about topic as traders become fixated on its break below $90,000 and the consequences for a possible macro downturn. With strong whale participation increasing staking inflows and a wave of ETF launches from Fidelity, VanEck and Canary Capital, Solana is following closely.

Due to disagreements over transparency and regulations USDT is also a hot topic. The strong presence of Chainlink across trading platforms and liquidity channels is the reason for its appearance. However XRPs position is the most intriguing aspect of the dataset because it isn't here by coincidence. A combination of price volatility and Amplify's launch of the first XRP option-income ETF led to an increase in XRP discussion volume.

The ETF effect

The market is currently arguing over whether ETFs will ultimately lead to significant institutional involvement or if they will only create new speculative vectors that increase volatility without encouraging adoption. Although not yet at a scale that could significantly change the direction of prices, the ETF inflows data mentioned in discussions indicates sincere interest from larger entities testing exposure. This narrative is supported by the chart action.

Instead of panic selling XRP is exhibiting a controlled and technical downtrend as it stays firmly within its declining channel. XRP hasn't broken structure despite the weakness and the lower trendline still serves as support. This is important because traders know exactly where the chart is headed and this predictability is one of the reasons that interest in XRP is growing rather than decreasing.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin