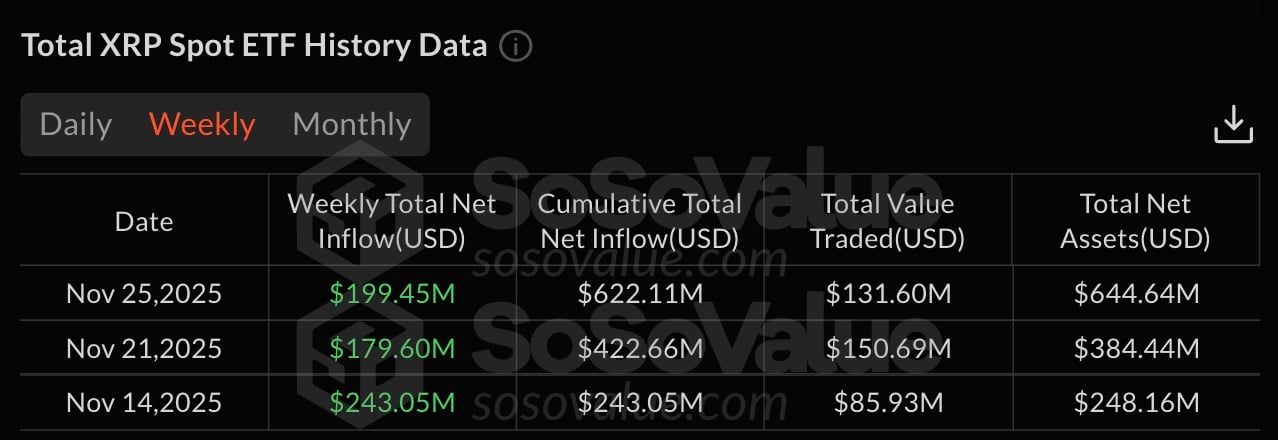

XRP spot ETFs started the new week with a stronger start than the whole previous one, and the updated data from SoSoValue shows it clearly. The new week has only two sessions, Nov. 24 and 25, and the total is already at $199.45 million. That number alone puts these two days ahead of the prior full week's $179.60 million.

On Monday, issuers reported $164.04 million in net inflows. Yesterday, Nov. 25, we had another $35.41 million in the bank. These two days together make up the $199.45 million weekly reading.

By now, the total amount of money invested in all XRP ETFs was $622.11 million. Total net assets climbed to $644.64 million, equal to 0.49% of XRP's market cap. The issuer breakdown shows consistent participation: Bitwise added $21.30 million on the latest day, Canary added $6.99 million and Franklin printed $7.12 million.

Every major player had good results during this time, which gave the weekly print a boost rather than just a few spikes here and there.

XRP trading activity also increased

The most recent session closed near $44 million in value traded, while early-November sessions were operating closer to $20-25 million. That rise lines up with the stronger inflow numbers.

XRP's price stayed within a range of $2.16 and $2.29, showing no clear reaction to the ETF inflows. The flows came in, no matter what the short-term price action was doing.

Thus, two sessions was all it took for XRP ETFs to beat the whole previous week, which is the strongest start since they launched. Now all eyes are on the price.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov