Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

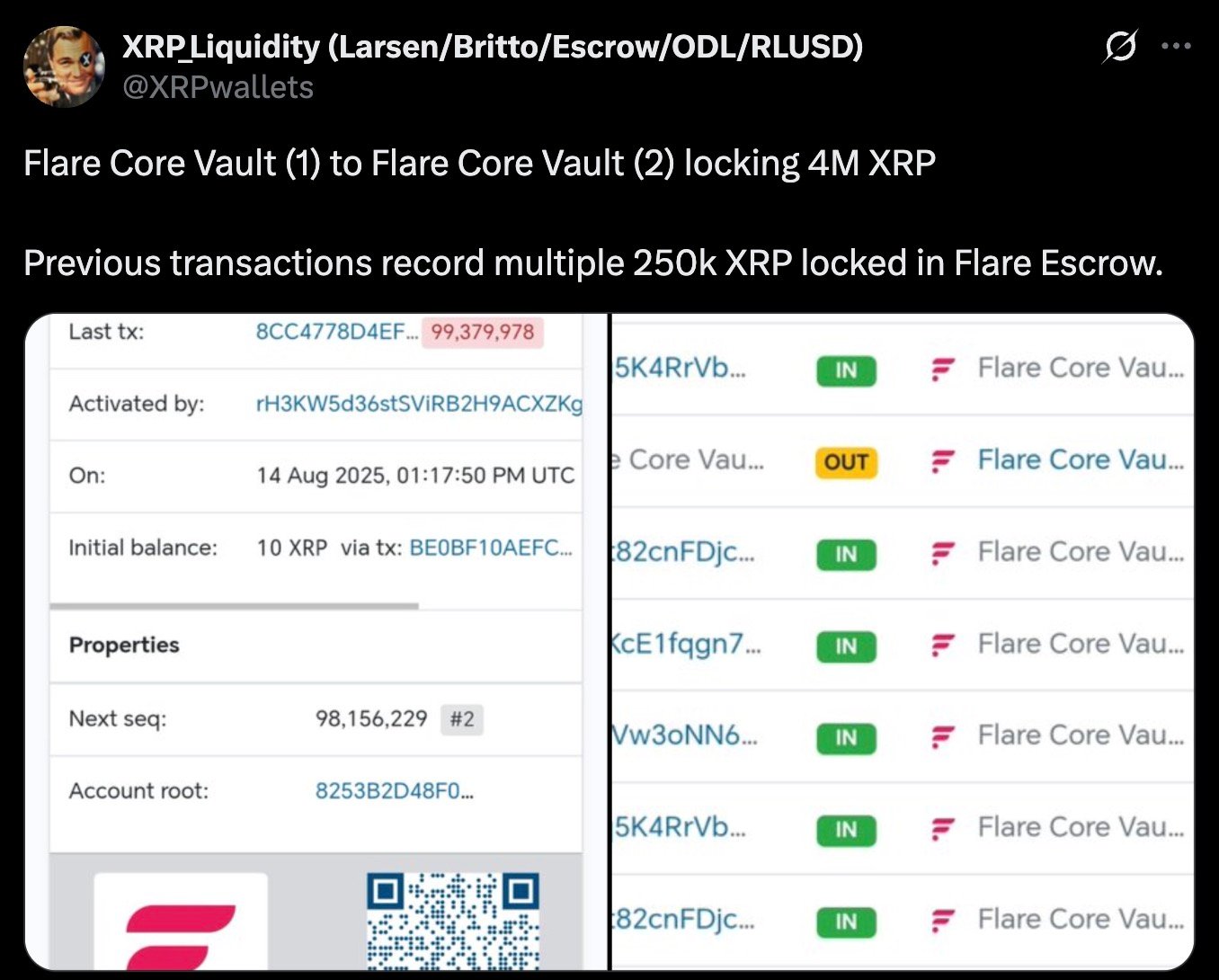

Something unusual just happened on the XRP Ledger, as an unknown wallet locked 4,000,000 XRP worth over $11.48 million in an escrow transaction, as reported by Whale Alert.

For those not familiar with the mechanics, any account on XRPL with sufficient balance can create such an operation and lock tokens away under strict release conditions. These conditions can be either time-based, meaning the escrow ends after a certain date or timestamp, or cryptographic, which requires a specific trigger to unlock the funds.

This feature is open to anyone, not just institutions, as long as the account can pay the transaction fee and configure the release terms correctly. It has been most visible in Ripple’s own operations, when back in 2017 the company committed 55 billion XRP into escrow across 55 monthly releases, a structure that continues to this day with automatic unlocks at the start of each month.

Traders and holders are used to those predictable programmatic movements, not sudden mystery locks appearing out of nowhere.

Potential owner of wallet

In this case, the wallet behind the escrow may not be entirely random. According to tracking by the XRPWallets account, the address is connected to Flare, a blockchain project built to bring smart contracts to non-smart contract chains, with XRP being its earliest point of integration.

Flare operates the so-called XRPFi model, designed to expand XRP’s utility into decentralized finance by allowing it to interact across ecosystems.

Whether this lock is part of a test, a liquidity commitment or a new strategy tied to Flare’s DeFi push is still unclear. What is certain is that the market pays attention whenever millions of XRP are suddenly removed from circulation under unexplained circumstances.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin