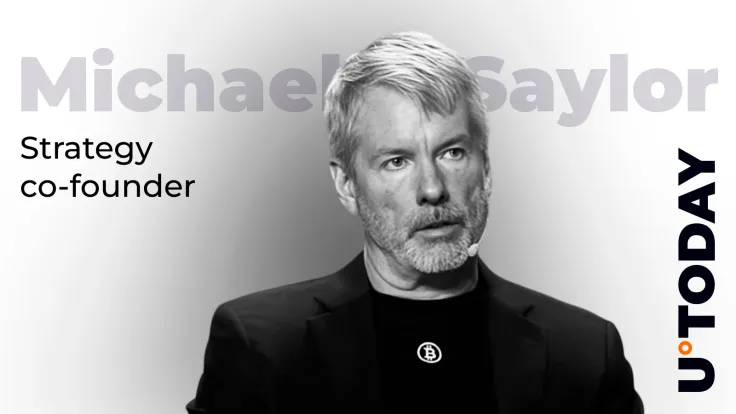

According to Strategy co-founder Michael Saylor, Bitcoin O.G.s are responsible for the recently observed selling pressure.

"Right now, I think that the selling is [done by] crypto OGs that have had a lot of money for a long time," he said during a recent podcast appearance.

Moreover, the market is absorbing all these coins and building its support level.

"Bitcoin rich, fiat poor"

During his podcast appearance, Saylor explained why long-term holders are suddenly selling their holdings.

"You’ve got a lot of people that own a lot of Bitcoin, but they can’t get a loan against it. And because they can’t get a loan against it, the only, you know, at the point that you all of a sudden find yourself Bitcoin rich, but fiat poor, you don’t have a lot of dollars, but you have a lot of Bitcoin, and you can’t borrow against it, then you think, I have to go sell it," Saylor explained.

According to Saylor, Bitcoin resembles a Magnificent 7 startup, where all of a sudden all the employees got insanely rich on penny stock options, but they can’t borrow against them, so they have to sell them.

However, this does not necessarily mean that they have no confidence in the company.

"It’s just they have kids to go to college. They want to buy a house right they want to live comfortably," Saylor said.

Reducing volatility

According to Saylor, Bitcoin O.Gs selling as "much as they need" is actually beneficial for BTC since it helps to reduce the volatility of the leading cryptocurrency.

This will ensure that institutions will feel more comfortable when entering BTC.

"You want the volatility to decrease so the mega institutions feel comfortable entering the space in size," Saylor explained.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin