Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

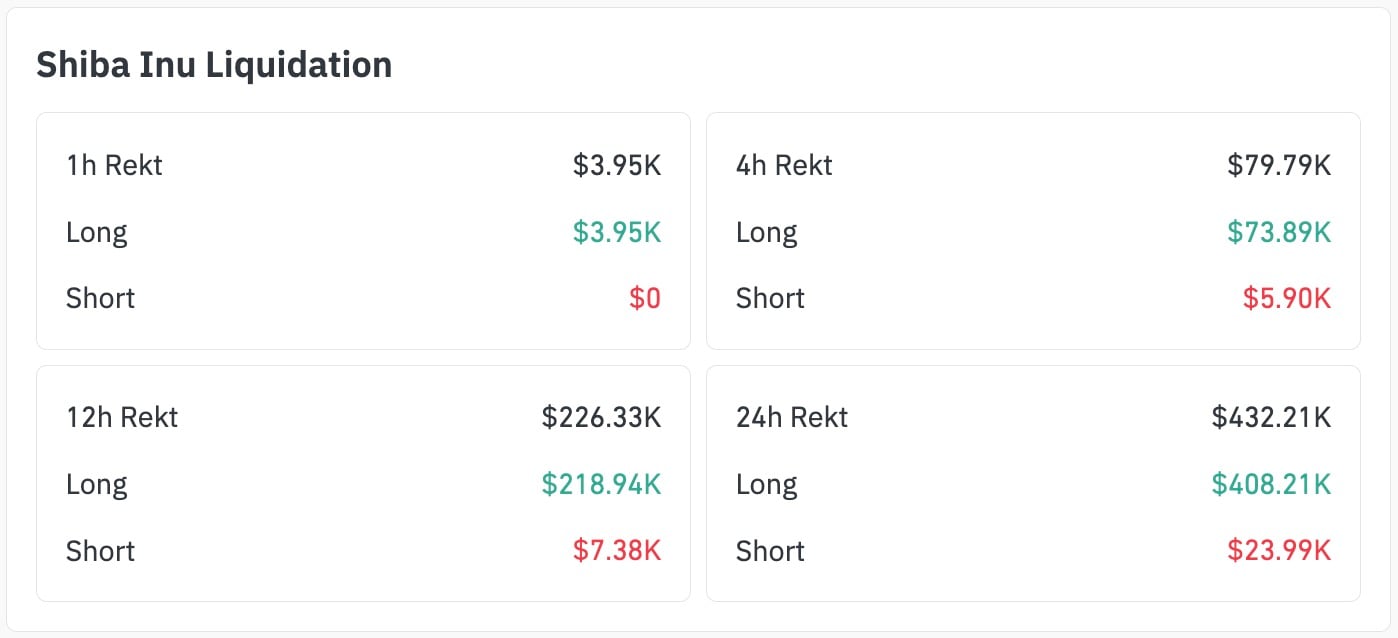

Ethereum's most popular meme coin, Shiba Inu (SHIB), just had a trading anomaly as, across a full hour of downside, not a single short position was liquidated. While the price dropped to around $0.00000855, the one-hour liquidation data showed that long traders lost $3,950, but short traders did not lose a penny, according to CoinGlass.

That trend carried through the rest of the session for the meme cryptocurrency. On the last day, SHIB long positions lost $408,210 in liquidations, while shorts only took $23,990 in hits. The 12-hour window was even more one-sided, with long-side liquidations at $218,940 and just $7,380 cleared from shorts.

The chart action supports this as the price of the Shiba Inu coin has been marking lower highs since topping near $0.00000925, with a slow drift lower and no signs of a proper squeeze.

Even small rebounds didnl not create the kind of upward pressure that usually puts short positions under stress.

Why did this happen to Shiba Inu (SHIB)?

The lack of short-side liquidations probably points to two effects that overlap: either the short interest was small enough to avoid big losses, or SHIB's downward moves were too orderly to force any major short exits. Another possibility is that short sellers got in late, after the drop was already happening.

Either way, the imbalance speaks volumes. Liquidation data usually shows volatility symmetry, especially on tokens like SHIB that are mostly made up of retail investors. This time, the chart moved, long traders got hit and shorts stayed untouched.

That does not last forever — but for now, it is only one side feeling the risk.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov