Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Shiba Inu is still having trouble on the market, but at least funds have started moving away from exchanges. After failing to hold multiple technical support zones, SHIB is continuing its wider downward trend. Fresh local lows were reached by the token in recent sessions, and it briefly dropped close to the $0.000006 region as selling pressure persisted throughout the meme coin market.

On-chain behavior changing

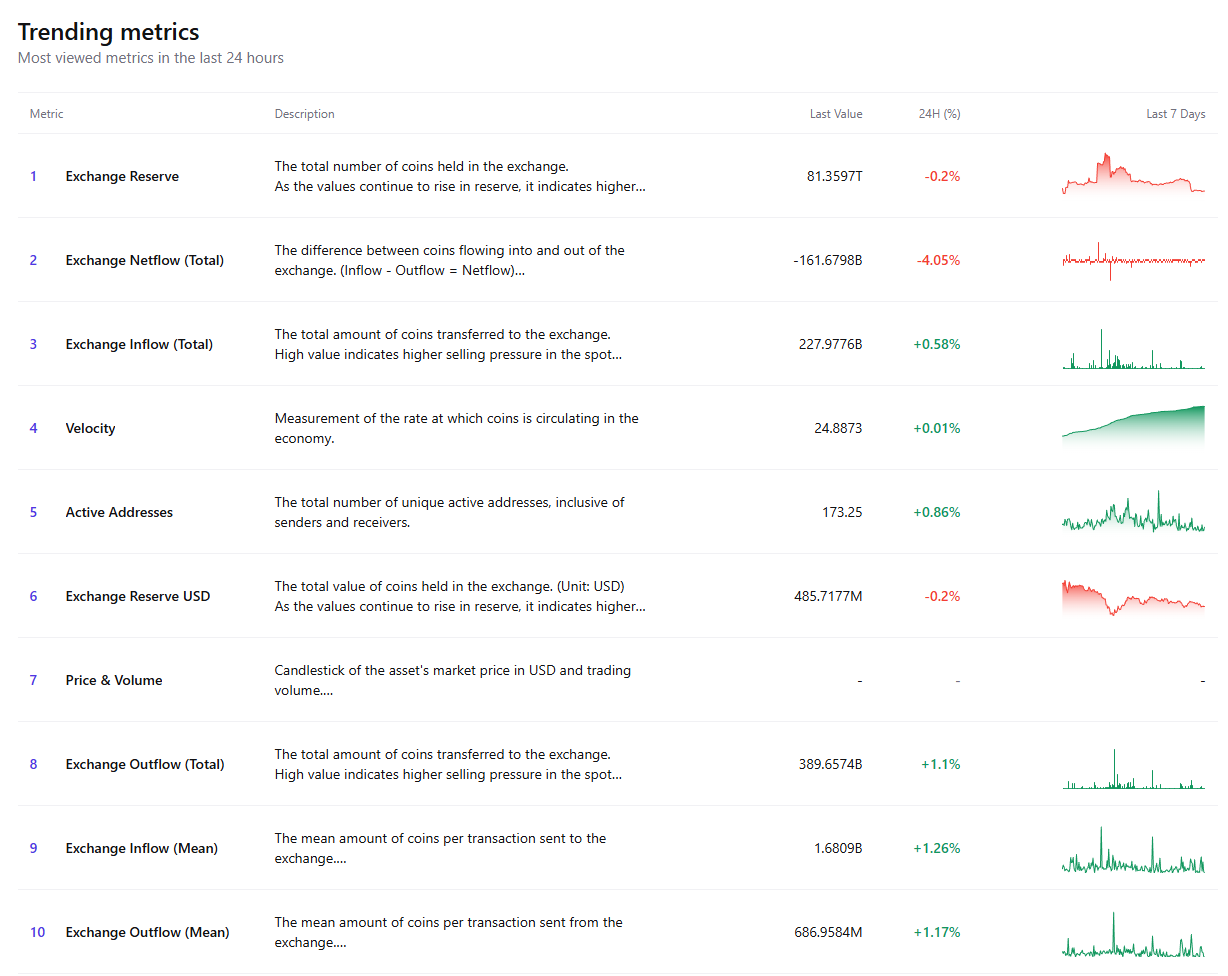

On-chain metrics, however, are starting to reveal a more subtle change in holders' behavior beyond price action. One significant change is that fewer tokens are now being held on centralized exchanges as exchange reserves have dropped below the crucial 82 trillion SHIB threshold.

Declining exchange balances in the past have frequently indicated that coins are shifting from exchanges into private wallets, which is frequently taken to mean a move toward self-custody or longer-term holding.

Other exchange metrics lend credence to this notion. While exchange outflow metrics have recently increased, netflows display the times when coins have left exchanges. Network velocity and active addresses, on the other hand, stay largely constant, indicating that despite poor price performance, the ecosystem is still growing.

Retailers getting active

On the surface, this might appear to be a wave of withdrawals driven by retail, in which smaller holders transfer money into personal wallets when the market is volatile. But the circumstances are probably more complicated. Not all exchange outflows directly reflect the choices of retail investors because large holders and custodial platforms frequently transfer assets between storage solutions for operational or security reasons.

Going forward, SHIB's price trajectory is still largely influenced by the mood of the overall market. Technically, there is still pressure on the asset, and if the current support breaks, even more decline is not ruled out. However, dwindling exchange reserves can also lessen the supply of goods available for sale right away, which could aid in price stabilization after general market conditions improve.

In other words, on-chain indicators imply that holders might be positioning for longer-term storage rather than immediate selling, even though SHIB's chart still shows weakness. It will be determined by how the larger cryptocurrency market develops over the next few weeks whether this ultimately encourages recovery or just signals caution.

Arman Shirinyan

Arman Shirinyan Yuri Molchan

Yuri Molchan Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide