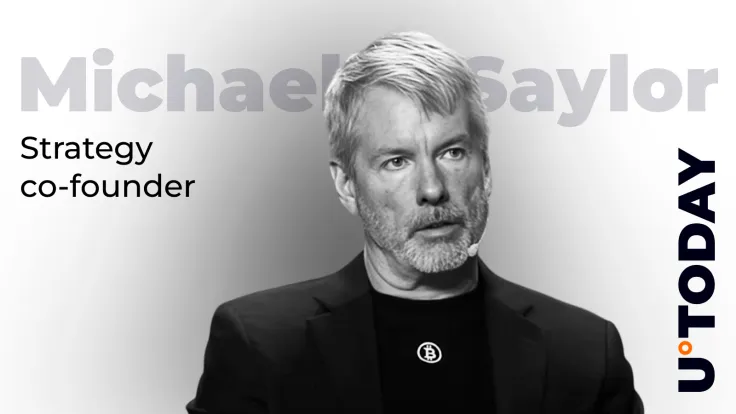

Bitcoin evangelist Pierre Rochard has argued that Strategy co-founder Michael Saylor is currently outperforming Federal Reserve Chair Jerome Powell. Rochard believes that the Fed needs to own the largest cryptocurrency.

"Full reserve banking"

The Fed runs a fractional reserve system that allows banks to keep only a small portion of deposits while lending out the rest.

The interest rate the Fed pays on reserves or Treasuries currently stands at 4.5%.

Hence, Rochard argues that the Fed system carries a lot of risk while offering a relatively low return.

In the meantime, STRC, Strategy's preferred stock, is backed by Bitcoin reserves. Strategy is currently the world's largest holder of the leading cryptocurrency with a total of 636,505 BTC. Strategy's balance sheet has grown by roughly 580% due to its Bitcoin exposure.

Rochard argues that this actually represents "full reserve banking" due to Strategy's vast Bitcoin holdings.

Strategy recently increased the STRC dividend to 10%, which is considerably higher compared to the aforementioned 4.5%.

Fed will not own Bitcoin

Rochard has opined that the Federal Reserve itself should hold Bitcoin after commenting on the soundness of Strategy's treasury reserve strategy.

However, Powell previously rejected the idea of holding Bitcoin, arguing that it would not be possible due to legal restrictions. Furthermore, he stated that the Fed would not be looking for a law change that would make it possible. The statement came after the U.S. government moved to establish a strategic Bitcoin reserve.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov