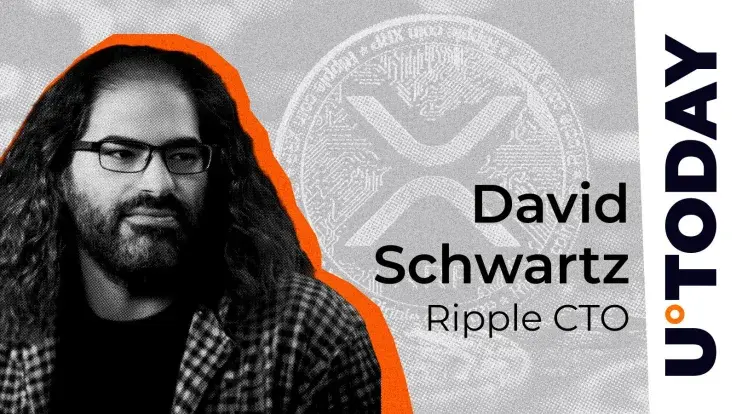

David Schwartz, Chief Technology Officer at Ripple, claims that his social media post about Ripple offering $6 billion to Circle was "a joke."

"I meant it as a joke but deleted it because I was afraid some might take it seriously," Schwartz said.

In late April, Bloomberg reported that Circle had rejected a $5 billion offer from Ripple.

Coinbase was reportedly competing with Ripple for the acquisition, according to Fortune.

There has been a lot of speculation surrounding the informal acquisition talks, with some unfounded rumors claiming that Ripple was willing to fork out as much as $20 billion to buy the USDC issuer.

"We definitely never offered $20 billion to Circle," Garlinghouse quipped at a recent event.

Circle's IPO success

Circle, which is preparing to hold an initial public offering (IPO) this week, has itself shut down acquisition talks.

Its IPO is said to be over 25 times oversubscribed, which shows strong demand for stablecoin products.

The prominent fintech company is currently seeking a $7.2 billion valuation. According to recent reports, asset management behemoth IBIT intends to take a 10% stake in Circle's IPO.

On June 4, Bloomberg reported that the circle IPO has been priced at $31 per share, which is far above the range.

The company's profits will significantly depend on the Federal Reserve's rate cuts. Circle will likely turn unprofitable if the Fed implements 150 basis points of rate cuts through 2026.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov