Landshare is bringing real estate to the blockchain by offering legally compliant fractional ownership over real estate assets via Tokenized Assets. Asset tokens derive their value directly from the value of the underlying asset, and ownership of the asset token represents a real-world ownership stake of the asset.

Landshare allows investors a way to invest in the real estate market without having to worry about property maintenance, tenants, or rent collection.

How does Landshare work?

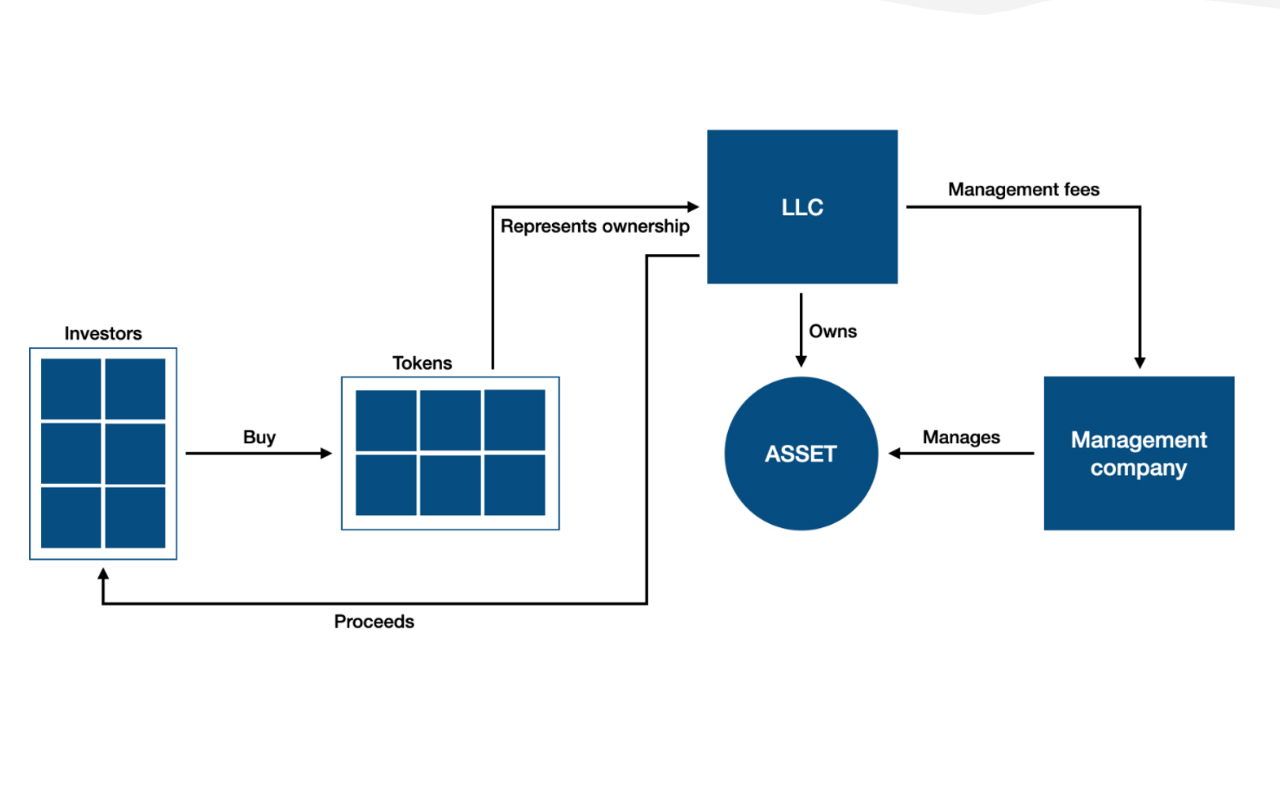

Landshare offers fractional real estate investment through a process called tokenization. Tokenization is the process by which the ownership of real estate assets is represented by tokens on the blockchain. Each tokenized property is held by its own legal entity, and the shares of the entity are represented by tokens. Tokenized assets are managed and rented out to tenants by Landshare to generate yields, which are distributed among token holders.

Asset Tokens will carry additional utilities, such as the ability to use them as collateral in Landshare's upcoming Loan Protocol. Investors can borrow BUSD against the value of their Asset Tokens, freeing up liquid capital without the need to sell their tokens. Investors will also be able to automatically reinvest their rental yields into additional Asset Tokens through auto-compounding, increasing real estate exposure and yields over time.

How Secure Is Landshare?

Investments in tokenized assets offer additional protections compared to traditional cryptocurrencies. Because the purchaser signs a legal agreement to obtain the tokens, they enjoy additional rights such as the ability to have tokens re-issued. For example, if an investor wallet is compromised, Landshare can administratively freeze the assets from the stolen wallet as reissue them to a new, secured wallet belonging to the investor. In other words, ownership is associated to the investor's identity, not the wallet address.

How Do I Purchase a Tokenized Asset?

To purchase a stake in real estate through Landshare, investors must complete a KYC process and become eligible to purchase Asset Tokens. Upon purchasing the Asset Token investors automatically get the individual portion of the ownership in the properties and makes them eligible for monthly payments. These payments, or rental yields, are distributed to token holders monthly in the form of BUSD. The rental yields are sent directly to the wallet that the Asset Token belongs to allowing a stress-free automated process.

Please see the disclaimer at the bottom of the page for details on participation restrictions.

Landshare Token

The Landshare Token, LAND, sits at the heart of the Landshare platform. LAND is the utility token that allows users access to all features within Landshare. The LAND Token is distinguished from Asset Tokens in that it does not derive its value from real estate assets nor is it backed by any real estate, it is strictly the utility of the platform. The Landshare Token has a supply cap of 10,000,000 with a circulating supply of only 875,294 tokens.

The primary utility of the Landshare Token is its use as a payment method for Tokenized Asset investments. In order to purchase an Asset Token, investors must pay 10% of the purchase price in LAND. When using Landshare's Loan Protocol, borrowers incur interest over time which must be repaid in LAND before receiving their asset collateral back. All tokens brought into the platform through these features are burned, permanently removing them from circulation.

The LAND Token also has a governance function, where each token staked represents one vote in Landshare's Governance Protocol. Finally, Landshare Tokens or LAND-BNB LP tokens can be staked to earn rewards and LAND Token holders can access our BUSD vault, which offers rewards in both BUSD and LAND.

Disclaimer

Asset Token offerings are not, and will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”) and may be offered or sold to non-US residents outside of the United States Accordingly, the Securities are being offered and sold only to non-US residents in compliance with SEC Final Rule Offshore Offers and Sales (Regulation S). Additional jurisdictional restrictions apply, please see below.

The following countries are restricted from participation in Tokenized Asset offerings: United States, Afghanistan, Albania, Barbados, Balkans, Botswana, Burkina Faso, Burma, Cambodia, Central African Republic, China, Cote D’Ivoire, Crimean Peninsula, Cuba, Democratic Republic of Congo, Eritrea, Guinea-Bissau, Iran, Iraq, Jamaica, LNR (Luhansk Republic), Lebanon, Libya, Liberia, Mauritius, Mali, Morocco, Myanmar, Nicaragua, North Korea, Pakistan, Panama, Senegal, Somalia, Sudan, Syria, Uganda, Yemen, Venezuela, Zimbabwe, Anguilla, Dominica, Fiji, Palau, Samoa, Seychelles, Trinidad and Tobago, Vanuatu are restricted from participating. This list is not all-inclusive. Additional restrictions may apply. Token lock periods may also apply to certain jurisdictions.

Disclaimer: This is sponsored content. The information on this page is not endorsed or supported by U.Today, and U.Today is not responsible or liable for any inaccuracies, poor quality, advertising, products or other materials found within the publication. Readers should do their own research before taking any actions related to the company. U.Today is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin