In order to give users real-time access to platform features, market data and account insights, Nexo has introduced an AI Assistant within its app. Nexo goes beyond static help resources or preprogrammed support responses with this release, expanding its strategy for incorporating AI into client interactions.

Fully integrated and transparent

The AI Assistant is fully integrated into the Nexo app and can be accessed via the Nexo logo on Android devices and a sliding notch on iOS devices. Without gathering private information like phone numbers or email addresses, it offers account-specific responses. Data integrity and privacy are still key components of the design.

Several data sources are used by the assistant. It incorporates information from the Nexo Help Center, real-time cryptocurrency market feeds, internal account and product data and outside learning resources like Investopedia. This makes it possible for the system to respond to user inquiries while balancing account-level specifics with broad market expertise.

Making AI useful for users

The AI Assistant can be questioned by users regarding recent transactions, loyalty levels, interest earned, cryptocurrency prices and general market trends. It not only shows numbers but also contextualizes them, such as APY rates or interest accrued across various holdings within the client’s account. The interface also offers direct links to pertinent platform functions like trading or Earn.

The product is in public beta testing. In order to improve performance and decide which features should be given priority for future development, Nexo is gathering user feedback. Support for conversations with multiple turns and more individualized insights over time are among the planned enhancements.

Nexo's steps to modernization

This update comes after Nexo previously unveiled AI News Summary, a service that distills news about cryptocurrencies into daily alerts. Nexo’s larger strategy to grow intelligent services that simplify digital asset management includes both tools.

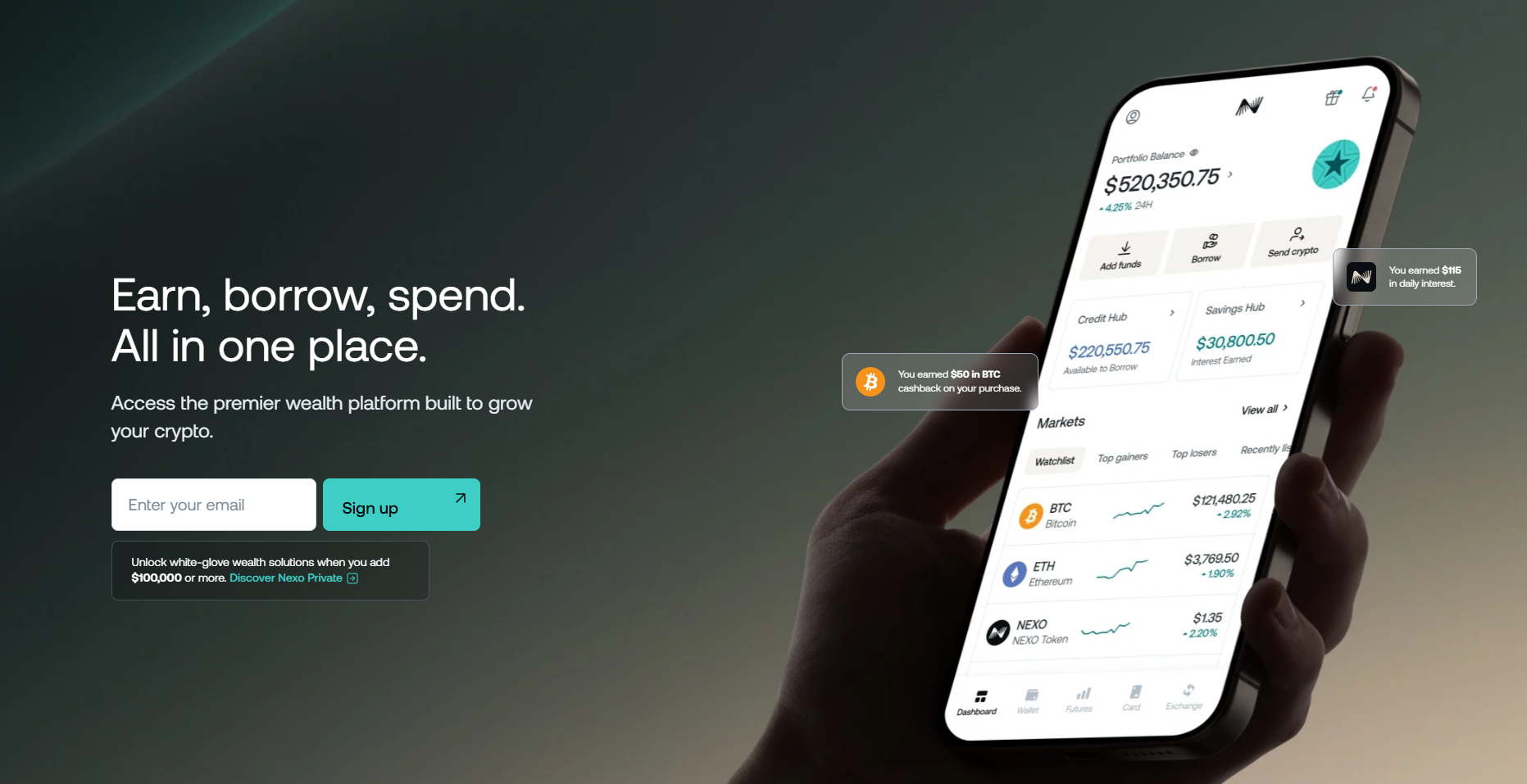

Nexo functions as a digital asset wealth platform. Offering services like interest-bearing accounts, crypto-backed lending, trading, and debit or credit cards, it has over $11 billion in assets under management and $371 billion in transactions processed.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov