Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The Halloween session is starting out with the market still processing last week's cleanup after $600 million left ETF products and a wave of over-leveraged longs were cleared out. Bitcoin is trading around $110,000 right now — that is right between the buy orders stacked near $107,000 and the sell walls forming closer to $114,000.

ETF data tells the story. On Oct. 30, U.S. Bitcoin funds lost $488 million, with no inflows. In the same period, investors pulled in $184 million from Ethereum products. Solana was the only one in the green, adding $37 million and holding the $190 zone firmly.

Strategy's quarterly numbers brought some structure back to the week. Earnings per share were $8.42, revenue was $128.7 million and the balance sheet showed 640,808 BTC valued at $47.44 billion.

The company has not changed Michael Saylor's script — the target price is still $150,000 by the end of 2025.

TL;DR

- XRP ETF countdown running — Nov. 13 now real target.

- Michael Burry returns after two years with "bubbles" warning.

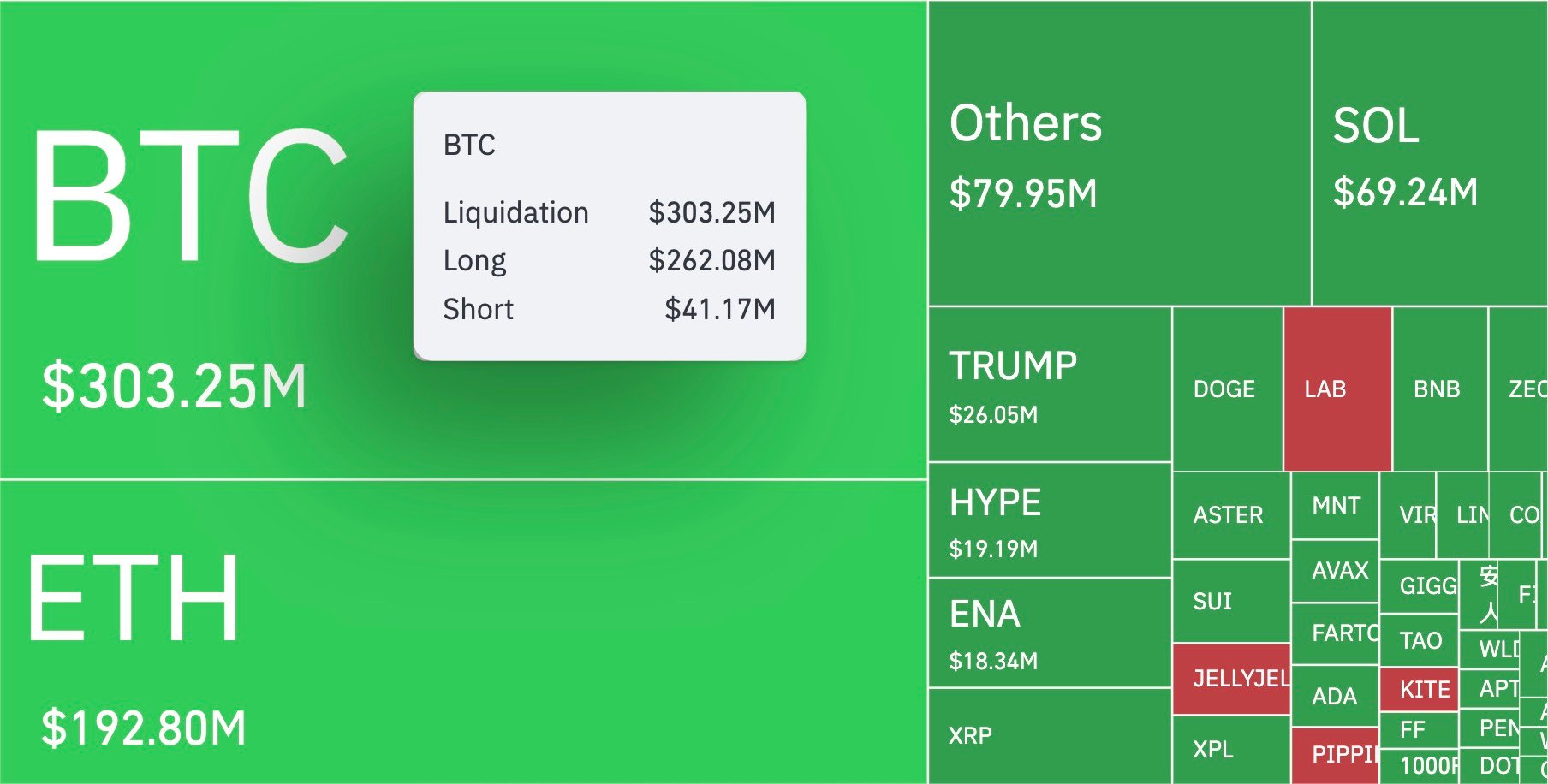

- Bitcoin long liquidations outnumber shorts six to one.

- Strategy keeps $150,000 target and $47 billion stack.

XRP ETF countdown: Why Nov. 13 is a significant date

The XRP filing from Canary Capital dropped the "delaying amendment," which means the 20-day clock started ticking. If the SEC does not step in again, the first true spot XRP ETF can go live on Nov. 13.

Once Nasdaq approves Form 8-A for trading, Canary will have the first direct XRP ETF in the U.S. Unlike the REX Osprey XRPR fund, this one is fully backed by the token, not a 1940 Act structure.

That change means real liquidity, real price tracking and direct exposure for institutional buyers. Analysts like Nate Geraci expect a strong start, similar to what Bitwise saw with its Solana ETF. Franklin Templeton and Bitwise also have their own XRP applications ready, but Canary is first in line.

XRP trades at $2.50, up about 3% on the day. Support holds at $2.45, and resistance around $2.73, with that line being the ceiling since September. A close above $2.73 opens the way to $2.90-$3.00.

If the ETF goes live midmonth, that upper band becomes the liquidity test zone for the rest of Q4.

"Big Short" hero Michael Burry comes back and markets pause

Michael Burry broke a two-year silence, and it was enough to freeze risk trading for a day. When he speaks, it is never for nothing. He returned right as AI valuations and crypto leverage hit fresh highs. So, the timing told its own story.

Nvidia crossed a $5 trillion valuation this week, and its tight loop with OpenAI brought back the same concerns he once had with subprime mortgages — money feeding money. For many traders, the message was clear: valuations are now beliefs, not prices.

Burry had loaded up on Alibaba, JD.com and Baidu through Scion Asset Management early in the year. Those positions paid off after China’s DeepSeek AI launch. But his reentry to the conversation right as tech and crypto froth peaks was a signal.

Funding rates on Bitcoin and Ethereum contracts dropped overnight. Open interest fell 8%, and some traders started paying for puts again. The crypto market did not crash, but it "blinked."

Bitcoin: 600% liquidation imbalance on Halloween

CoinGlass data shows that $303 million in Bitcoin positions were closed in the past day. A total of $262 million of that came from longs, $41 million from shorts — a 600^ difference. This imbalance shows how tilted the market still is to one side — the bullish side.

BTC is trading between $108,266 and $110,452 over Halloween, nearing a close at around $110,086 with a 1.6% daily gain. Momentum is good, but it is not overwhelming. ETF outflows are still putting pressure on spot buyers.

Support sits near $107,500, which it hit twice this week. Should it break, the next real area is around $105,000, where CME and spot demand meet. The upside starts only after a clean close above $111,200. That would set up a run toward $114,000 and then $117,500 — the October high before the drop.

This month still fits the same pattern Bitcoin has kept for a decade.

- 2015: $312.

- 2020: $13,537.

- 2023: $34,494.

- 2025: $110,000.

Every time October ended in green, November continued the move. As long as macro risk does not break the trend, the $108 000 BTC zone looks more like a reloading than a warning.

Evening outlook

Halloween Friday goes into the U.S. session with a mixed tone. Traders balance Burry’s warning against Strategy’s bullish target. Volume is light but focused on BTC, XRP and SOL. Funding rates have normalized after yesterday’s washout.

Key levels into close of trading

- Bitcoin: Support near $107,500, pivot area at $111,200, first resistance $114,000, then $117,500 if momentum returns.

- Ethereum: Base support around $3,200, resistance zone $3,380.

- XRP: Support at $2.45, breakout trigger $2.73, target zone $2.90-$3.00 if ETF hype extends.

- Solana: Support $180, upper channel $198-$200.

The focus is now on the Nasdaq’s response to Canary’s Form 8-A, and any late-day Fed comments that might touch liquidity or inflation data. If Bitcoin closes the month above $110 000, it locks its fifth straight green month and marks October as its strongest prehalving setup since 2019.

The next headline moment is already on the calendar — Nov. 13, the day XRP either gets its ETF or gets another delay.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin