Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Tuesday brings news of a 589 from Solana, which immediately gets the XRP crowd going, while Ripple's CTO reminds everyone that the market still does not put much emphasis on its XRP holdings in secondary deals. On top of that, Andrew Tate is curious about how Bitcoin purchases by Michael Saylor manage to stay off the chart.

It seems that everyone's waiting for tomorrow's decision, and the conversation is being driven by stories while the actual situation is not changing much.

TL;DR

- Solana dropped 589 and started another XRP discussion.

- Ripple's CTO says the market does not value XRP holdings enough.

- Andrew Tate wonders why big BTC buys do not make a difference on the price chart of Bitcoin.

Solana drops surprising XRP hint

Solana's account posted one number — 589 — and it took less than an hour for the entire XRP crowd to react. The number is not random, even though outsiders often treat it as such. It comes from an old XRP myth tied to a fabricated price prediction in Simpsons that circulated years ago and never died.

The post received 3.2 million views, 9,700+ likes and 2,500+ replies, and it was reposted across every major crypto timeline before the day ended. This was not just a reaction to a meme; it was a reminder of how easily the XRP community rallies around familiar symbols.

What some saw as a joke became proof of "alignment" to others, especially traders tracking cross-chain opportunities. Solana’s low-fee structure and 400 ms block times often come up in discussions about payment integrations, so people quickly made the connection.

Some interpreted 589 as a nod to potential liquidity paths between XRP and Solana. Others viewed it as a subtle marketing strategy designed to divert attention from XRP's unusually active week. Nothing was confirmed or denied — exactly the kind of setup that keeps both communities watching the chart.

Ripple CTO calls XRP holdings undervalued

Ripple's recent $500 million secondary share sale at a $40 billion valuation has sparked some familiar chatter: the company keeps closing big deals, but the market still sees its XRP reserves as more of a side note than a main asset.

This is not a small stash. Ripple controls more than 40 billion XRP in escrow, released in monthly tranches that follow a transparent schedule. But when big investors trade Ripple shares privately, the escrow is barely mentioned in valuation talks. That disconnect has been a problem for XRP holders for years, and this time, Ripple's CTO, David Schwartz, decided to address it head-on.

Schwartz was not saying analysts are wrong — he just talked about the real-world problems investors face. If you are cashing out a lot of XRP, you might have some tax problems. Getting billions of dollars of liquidity out there takes time. Price swings make things uncertain, especially for buyers who do not want their equity tied to crypto volatility. Administrative costs, from custody to reporting, also matter.

But after going through all that, he still came to the same conclusion: the escrow's value gets discounted much more than you would think, especially when Ripple's regulatory situation is as good as it has been in years.

For those who hold Ripple, Schwartz's point is that the market sees Ripple's operations, but it does not take into account the depth of its reserves. The share sale shows that institutional appetite is strong, but the valuation gap tells a different story.

Andrew Tate says he is huge on Bitcoin

Andrew Tate once again claimed his loyalty to Bitcoin, but now he is baffled as to why huge buys barely move the price. As he points out, Strategy added 10,000 BTC in a single day — a purchase north of $900 million at current levels — and Bitcoin's chart did not even flinch.

With Bitcoin trading at around $92,000 right now, Tate's point gets to the heart of the issue with the cryptocurrency during its institutional era. Supply is supposedly limited. Whale activity is supposed to move markets. But the biggest corporate buyer in Bitcoin history can stack coins without causing the kind of price reaction retail traders are used to.

Strategy now has over 200,000 BTC, and the average price was much lower than today's prices. The company's equity is like a leveraged Bitcoin instrument, meaning that every major purchase tightens the linkage. As Tate said, it's ironic that the asset has matured to the point where even billion-dollar buys are just a regular line item in a daily order book.

Retail traders want to see a visible impact, institutions want things to go smoothly and those interests rarely match. Tate's frustration shows how a lot of people still want Bitcoin to be like it was back in the day, when one big player could move the whole market.

Crypto market outlook

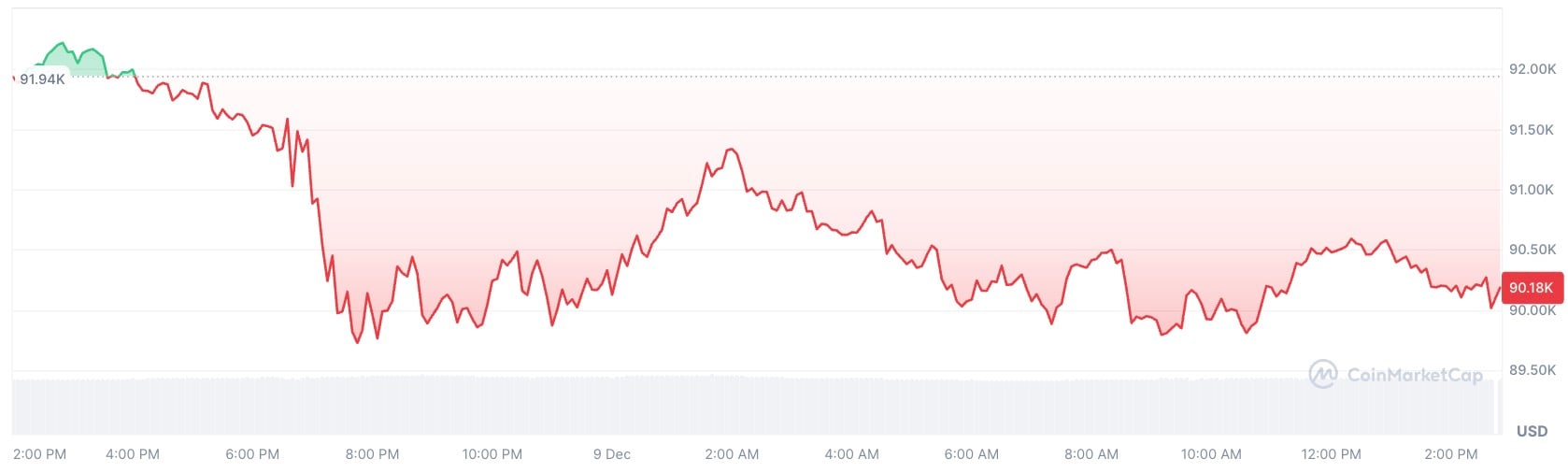

All in all, the crypto market sits in a setup where Bitcoin’s reaction to tomorrow’s Fed signal decides whether this rebound holds or folds into another bull trap.

- Bitcoin (BTC): Right now at $90,200, resistance sits near $92,000 and support builds at $88,500, with $84,400 as the deeper line.

- XRP: Right now at $2.06, resistance stands at $2.10 and support holds at $2, with $1.92 as the next zone.

- Solana (SOL): Right now at $132.7, resistance is at $138 and support forms at $130, with $122 below it.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov