Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As Feb. 16, 2026, opens, the crypto market remains in a volatile tug-of-war following recent CPI relief. While institutional appetite pivots toward altcoin ETFs, the Ethereum ecosystem prepares for the pivotal ETHDenver gathering. On-chain, the "ghosts" of the 2014 ICO era are returning, and Ripple’s stablecoin utility is finding a specific, high-velocity niche in Europe.

TL;DR

- RLUSD dominates XRPL auto-bridging, EUROP most active corridor.

- 6,335x Ethereum ICO wallet fails 1 ETH Gemini deposit.

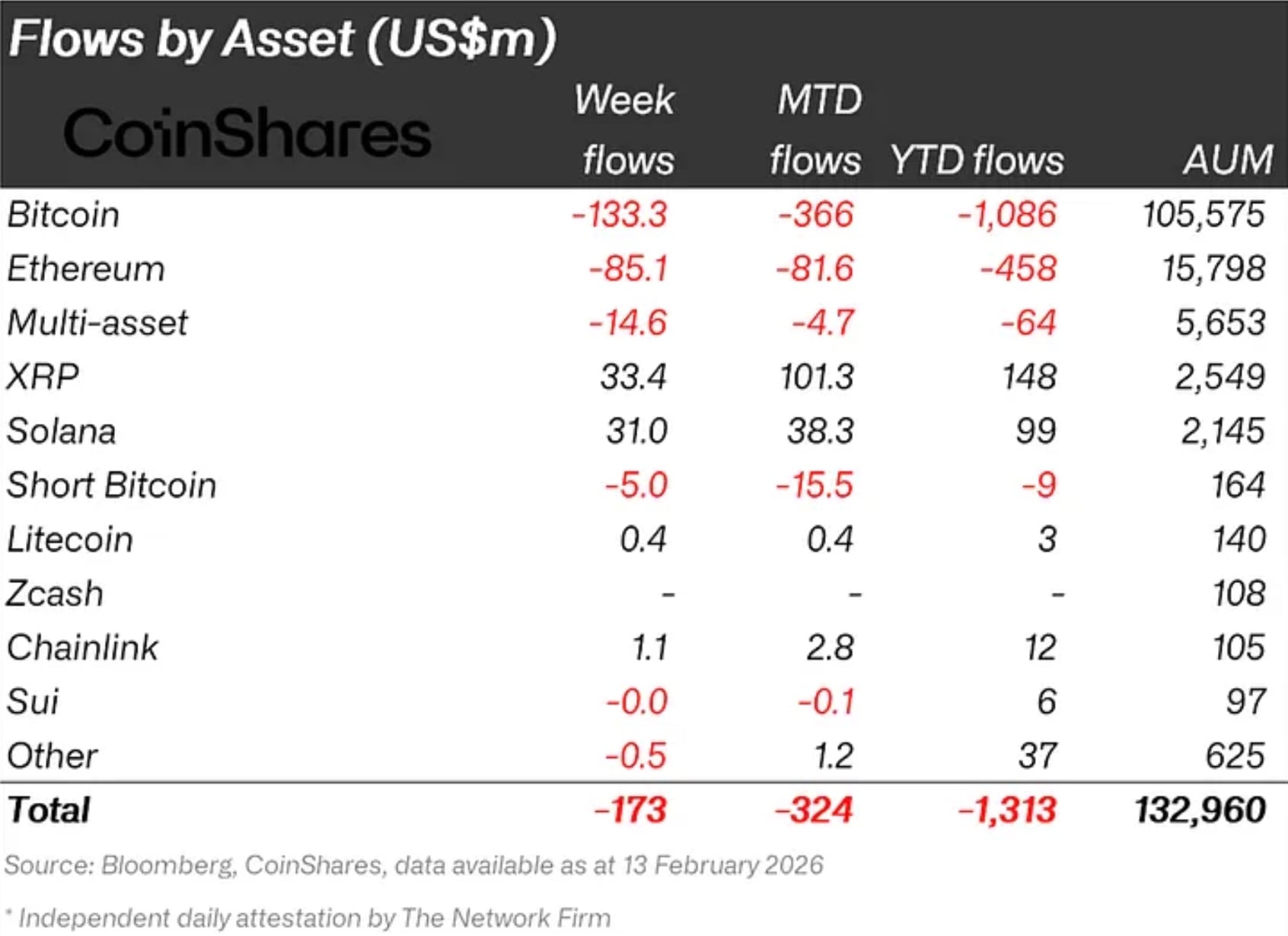

- Solana posts $31 million inflows amid $173 million weekly outflows.

Ripple USD gains traction in Europe via EUROP stablecoin on XRPL

The XRP Ledger (XRPL) is currently demonstrating its structural efficiency as a bridge for tokenized assets, particularly through the increasing use of Ripple USD (RLUSD). Recent data shared by well-known XRPL validator Vet reveals a noteworthy trend: RLUSD is becoming the "connective tissue" for global stablecoin liquidity.

Over a 24-hour period, the network recorded 477 "auto-bridging" events. This feature enables the XRPL decentralized exchange (DEX) to automatically route trades through XRP in order to find the best possible price when direct liquidity between two tokens is limited. Of these, the EUROP/RLUSD pair was the most active, with 124 events, indicating strong demand for Euro-to-USD stablecoin conversions within the XRPL ecosystem.

EUROP’s dominance suggests regulated-under-MiCa European-denominated stablecoin corridors are gaining traction. Combined with ongoing regional divergence in ETF flows, this underscores Europe’s growing influence in digital asset infrastructure at a time when U.S. flows remain negative.

On-chain insights:

- Total liquidity: Approximately 15,000 XRP were used purely to provide liquidity for these exchange rates.

- RLUSD appeared in the majority of auto-bridging events, outperforming USDC/RLUSD (46 events).

- 92% of all trades on the ledger are Token/XRP pairs, confirming XRP’s role as the primary settlement asset for tokenized currencies.

Dormant Ethereum whale with 6,335x profit fails one ETH deposit to Gemini

A fascinating time capsule from the early days of Ethereum opened this week, as reported by Lookonchain, revealing the immense scale of "HODLing" rewards — and the technical hurdles of returning to the modern chain.

An Ethereum wallet from the ICO era, address 0xcBfa, attempted to deposit 1 ETH to the Gemini exchange. The transaction failed after 10.6 years of inactivity. The failure was due to a "low gas" error, a common issue for users who have not interacted with the network since the transition to proof of stake and subsequent changes to fee markets.

The investor initially contributed just $443 during the 2014 ICO and received 1,430 ETH. The stash is now worth approximately $2.81 million, a 6,335x return.

Ethereum currently trades near the $1,960-$1,990 range based on the daily Binance chart by TradingView, reflecting ongoing weakness since late 2025 highs. CoinShares data shows Ethereum investment products recorded $85.1 million in outflows last week, reinforcing institutional skepticism relative to Ether.

Dormant supply activation remains a psychological factor in market sentiment, especially when the price is below prior cycle peaks. If additional tranches from early wallets surface, even small test transactions can generate narrative pressure. Until then, the impact remains theoretical.

Solana registers $31 million ETF inflows, outpacing Bitcoin and Ethereum

Institutional investors are showing a "divergence in sentiment," according to a CoinShares report, by Feb. 16. Solana (SOL) and XRP are standing out as institutional favorites.

Solana recorded $31 million in weekly inflows, significantly outperforming Bitcoin and Ethereum, which saw outflows of $133 million and $85.1 million, respectively. XRP saw $33.4 million in inflows.

The week began with $575 million in inflows but reversed into $853 million in outflows, likely driven by price weakness. Friday saw $105 million in inflows following softer-than-expected CPI data. ETP trading volumes declined to $27 billion, down from $63 billion the prior week.

The U.S. market saw $403 million in outflows, likely due to macro uncertainty. Germany ($115 million), Canada ($46.3 million) and Switzerland ($36.8 million) saw healthy inflows. This aligns with XRPL’s EUROP corridor strength and reinforces Europe’s constructive stance relative to the U.S.

Solana’s $31 million in weekly inflows stands out in context. While trailing XRP’s $33.4 million, it materially outperformed Bitcoin and Ethereum. In a week dominated by net redemptions, selective allocation into Solana signals targeted risk appetite rather than broad beta exposure.

Crypto market outlook: Price updates and key levels

The technical and macro calendars are packed for the new week. Bitcoin’s ability to hold the $68,000 level is the primary focus. Ethereum’s price action is expected to be event-driven due to the Colorado conference.

Price reference points:

- Ethereum (ETH): Trading near $1,960. Resistance sits near $2,100 based on recent breakdown structure. Support lies in the $1,850-$1,900 range. ETF outflows add caution unless developer catalysts offset sentiment.

- XRP: Benefiting from $33.4 million in weekly inflows and structural XRPL activity. Sustained tokenization growth may reinforce relative strength if flows persist.

- Solana (SOL): $31 million in inflows positions SOL as a leading alt allocation. Monitoring ETF continuity and network usage metrics will determine sustainability.

- Bitcoin (BTC): Near $68,000-$70,000 post-CPI relief. Continued short product outflows could precede stabilization, but U.S. capital flight remains a headwind.

What to watch next:

- ETHDenver (Feb. 17-21): Watch for layer-2 scaling announcements that could catalyze ETH gas usage and price recovery.

- FOMC Minutes (Feb. 18): Hawkish language regarding interest rates could dampen altcoin sentiment.

- PCE Data (Feb. 20): This inflation metric will likely dictate if the $3.74 billion outflow trend reverses.

The "failed deposit" of the ICO whale often precedes movements by early adopters. Expect a volatile week for Ethereum as technical builders meet in Denver. If Solana’s ETF inflows continue to outpace Bitcoin, a "SOL/BTC" pair breakout may occur before the month ends.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin