Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Thursday begins with Bitcoin fighting back above $109,000 but with a derivatives market twist as, right now, shorts are getting wiped out seven times harder than longs. In the meantime, XRP traders are staring directly at the most feared chart signal, the death cross, just as Ripple CTO Schwartz warns that the single weakest link in crypto right now is not code but human error, with phishing attacks on hardware wallets climbing.

TL;DR

- Bitcoin: $109,449, liquidation imbalance at 700%, resistance at $114,000, danger zones below $106,600.

- XRP: $2.41, trapped under $2.62 resistance, death cross confirms downside momentum to $2 and $1.95 rails.

- Scam alert: Ripple CTO points to phishing scams as crypto’s biggest vulnerability right now, and it is increasingly fast.

Bitcoin is no man's land right now, with 700% liquidation imbalance

Bitcoin seems to find peace at $109,449 after bouncing from $106,000 lows, but the relief candle hides structural fragility. All the big time frame charts show BTC stalling under the $114,000 barrier, a level that aligns with the 0.5 Fib retracement. Above it, $118,000-$120,000 open up, but failure to breach keeps the main coin boxed into a descending channel.

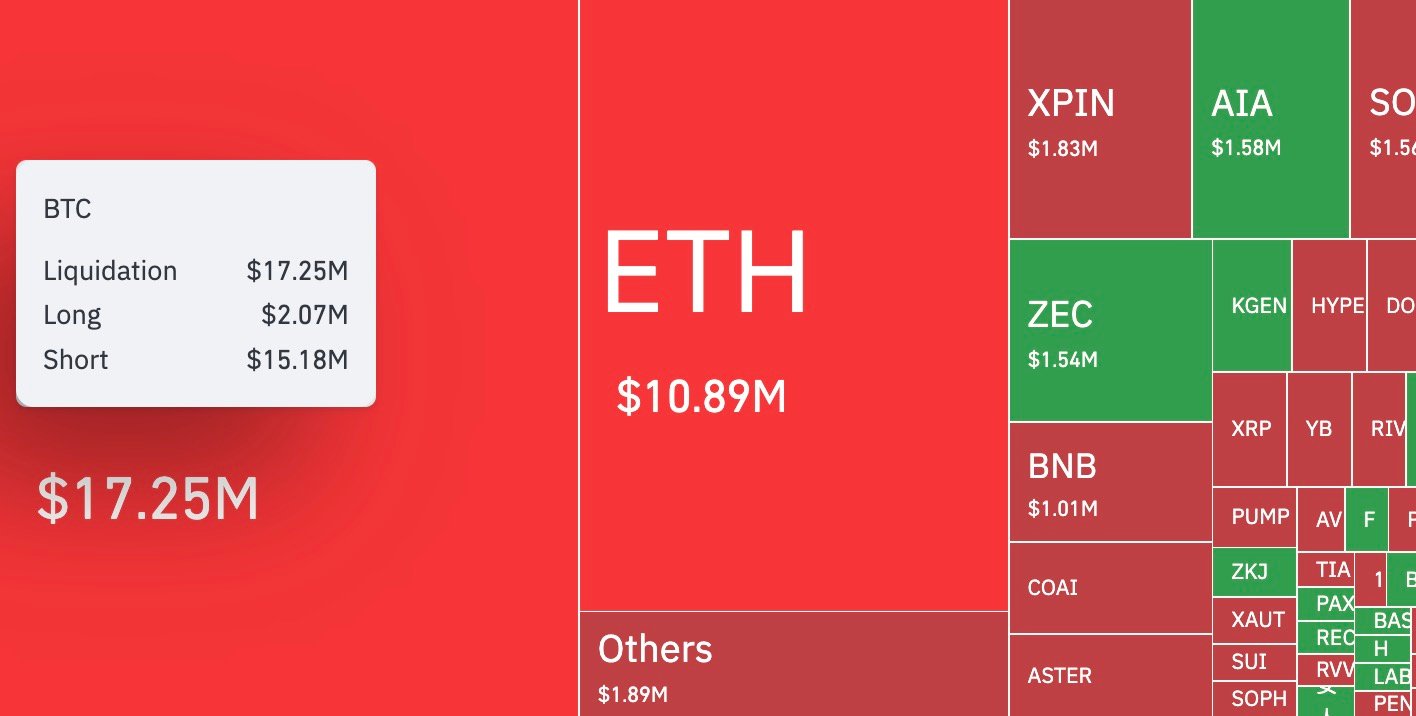

Liquidation data makes the picture only more painful for all market participants. In just four hours, $17.25 million were liquidated, with shorts at $15.18 million versus longs at $2.07 million — a 700% imbalance. This confirms that aggressive short positioning is being squeezed out, but at the same time, long positioning remains unusually thin, suggesting a market unwilling to commit fresh bullish leverage. So, no one is winning — neither bulls nor bears.

Key supports are clustered at $106,600 and $104,000. Lose those, and Bitcoin risks going straight to $96,000 and $92,000, levels that already appeared on August volatility maps. If $114,000 is taken back, a squeeze to $120,000 is realistic, but the current profile looks more like a sideways chop than a fresh rally.

$2 XRP soon to become dream, death cross threatens

As Bitcoin struggles, so does the rest of the market. Thus, XRP trades at $2.41, rebounding from $2.19 but trapped below the $2.62 rejection point, and what's worse — the daily chart is about to confirm a death cross, with the 23-day moving average sliding under the 200-day.

The levels are unforgiving. Immediate resistance sits at $2.62 per XRP, followed by the $2.79 cluster. Support is fragile at $2.20 and breaks clean into the psychological $2 line.

On the weekly chart, the Bollinger Bands place the lower rail at $1.95, making that the technical floor. A move to $1.95 would not even violate "oversold" territory, meaning the market could test it without flashing relief signals. Just a pain for XRP holders.

For context, XRP hit $3.58 at the upper band only a month ago. That same indicator now allows sub-$2 pricing without objection. Unless buyers reclaim the $2.62 midpoint fast, $2 flips from a floor into a ceiling, and $1.95 becomes the new magnet.

Ripple CTO raises alarm on increased phishing attacks

David Schwartz, CTO of Ripple, raised a direct warning this week: phishing attacks have outpaced every other type of threat in crypto, and hardware wallet users are now prime targets. Fake firmware updates, spoofed verification requests and cloned wallet websites are flooding inboxes. Once entered, balances and "lambo" dreams disappear instantly.

With the weak market conditions and investors hedging with stablecoins on cold wallets, more funds are sitting inside cold storage. That makes hardware wallets the new honeypot.

The moral of the warning is simple: cryptography is unbroken, but people are not. The most effective hacks do not bypass math, they exploit trust. Until it changes, the "weak point" of crypto is not blockchain, it is human error.

With bad actors becoming more sophisticated through the use of AI voices, cloned domains and industrial-grade phishing, the market has never needed more vigilance than it does right now.

Evening outlook

The evening session is going to be a bit chaotic, with charts and headlines clashing, creating a few pressure points that traders are going to have to keep a close eye on:

- Bitcoin (BTC): Support at $106,600 remains critical; the break opens $104,000-$102,000, with deeper risk at $96,000-$92,000. Resistance capped at $114,000, upside only above $118,000.

- Ethereum (ETH): $3,800 area with $10.89 million liquidations; outflows from ETH ETFs at -$18.8 million weigh on sentiment.

- XRP (XRP): Stuck at $2.41 and only a move above $2.62 reclaims strength. Otherwise, $1.95-$2.00 becomes the magnet.

- ETF flows: Bitcoin ETFs showed -$101.3 million outflows yesterday despite earlier inflow momentum, underscoring volatility in institutional positioning.

- Macro: Asian regulators signal a new stage of crypto oversight; U.S.-China negotiations include financial technology restrictions.

- Market tone: $652.7 million liquidations in 24 hours, open interest in options now rivaling futures.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov