Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The first full week of XRP’s ETF era did not unfold the way the community expected because, instead of a continuation of the long inflow streak that began right after XRP was ruled not a security in 2023, the market delivered the exact opposite — a $15.5 million outflow from XRP-tied investment products, the largest single-week reversal since the asset reentered institutional rotation last year.

XRPC’s debut on Nov. 13 produced no net creations on day one, but the next session pulled in $243 million through cash and in-kind flows, and trading volume hit $58 million, the highest opening print of any ETF launched this year out of more than 900 products. It even edged past the spot Solana ETF launch, which landed at $57 million.

Historically, inflows tended to follow these kinds of liquidity bursts. Across the last 12 months, XRP ETPs added roughly $2 billion in net allocations, while the price climbed from $0.50 to $3.50 — a 700% surge.

Sell-the-news for XRP ETF

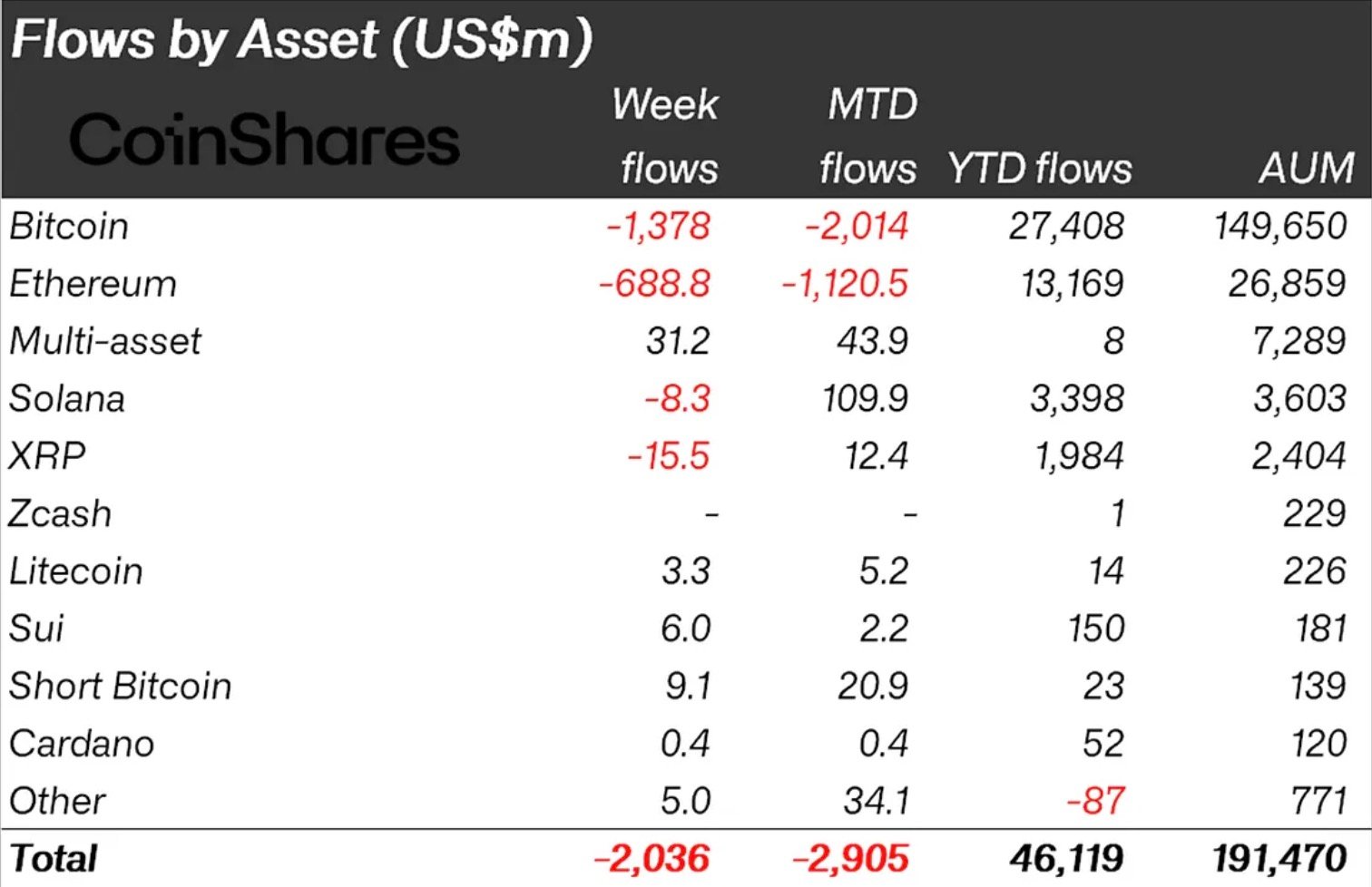

But the CoinShares data shows the first break in that pattern arriving immediately after the ETF went live, at the same moment the entire ETP market logged $2 billion in outflows driven by monetary-policy uncertainty and large crypto-native sellers. Bitcoin lost $1.38 billion, Ethereum shed $689 million and XRP’s $15.5 million outflow sits inside the same liquidation wave.

The structure implies that investors treated XRPC’s launch as a sell-the-news pivot rather than an entry point, and the assumption that inflows will arrive simply because the ETF now exists has no support in this environment.

Now the main scenario is that If crypto ETP outflows continue in general in the same direction, XRP’s post-launch bleed can extend further.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin