Exchange-traded funds on spot Bitcoin and Ethereum — publicly traded products providing institutional investors with the opportunity to invest in crypto without holding it directly — are witnessing massive outflows of funds.

Bitcoin ETFs on track to worst month ever

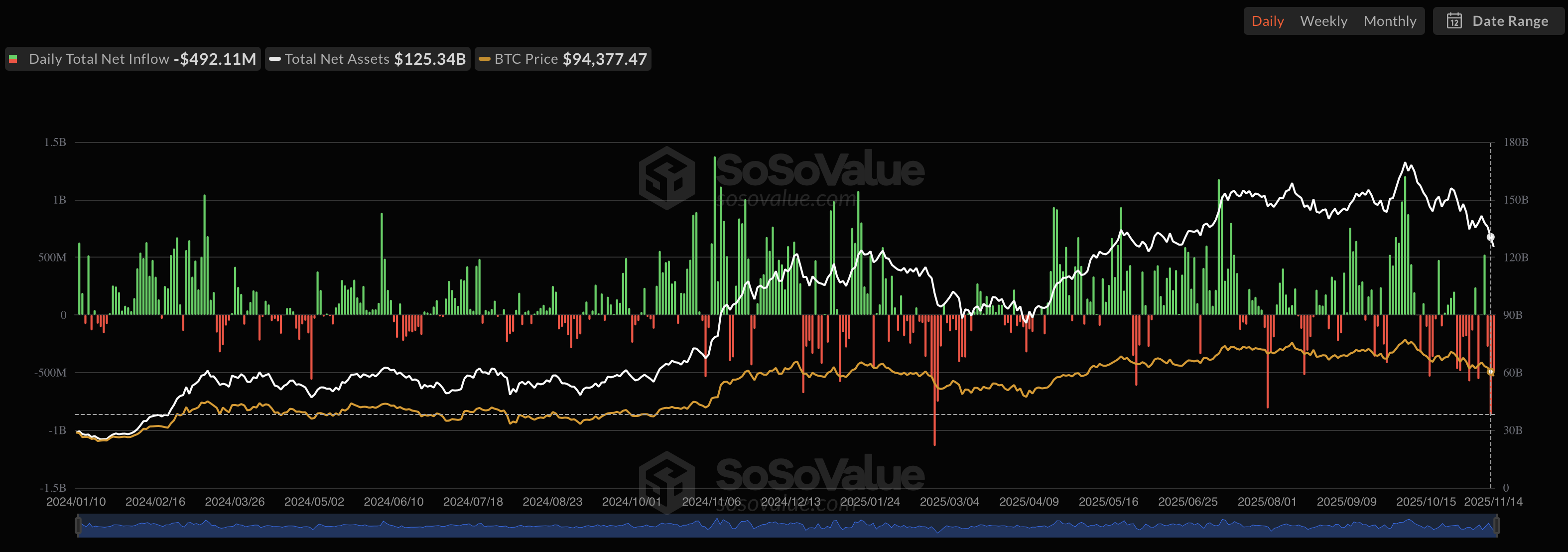

Spot Bitcoin ETFs have been losing liquidity for three days in a row, with the Nov. 13 session being the worst in almost nine months, SoSoValue data says. In just three days, spot Bitcoin ETFs lost $1.6 billion in funds. This paves the path for November 2025 to be the worst month in the history of this class of assets.

So far, spot Bitcoin ETFs lost $2.33 billion in November. This is already the second worst outflow while the market is only halfway through the month. February 2025 has brought maximum pain so far with $3.56 in combined outflows caused by market panic triggered by Bitcoin's (BTC) drop from $105,000 to $84,000.

Ethereum spot ETFs demonstrate an even worse streak, being red for four days in a row. Combined with the neutral session of Nov. 10, it is safe to say that Ether spot ETFs were positive only once since Oct. 27. With $1.24 billion lost, November 2025 is already the worst month for these funds.

Both Bitcoin (BTC) and Ethereum (ETH) are affected by the market uncertainty in the U.S. Markets failed to rocket after the U.S. government shutdown was lifted, and investors are frustrated right now.

Bitcoin's (BTC) price plunged below six-month lows at $94,175. In the last month, it lost 13.3%. At the same time, Bitcoin (BTC) is trading only 24.8% below its ATH, while 35-45% corrections are considered to be healthy in every bull market.

XRP ETFs are off to a good start, but not ready to siphon liquidity yet

Ethereum (ETH), the second-largest cryptocurrency, touched the $3,070 level twice in the last 24 hours, the lowest level since mid-July.

Meanwhile, minor ETFs on spot XRP, Solana (SOL) and Litecoin (LTC) are not ready to absorb liquidity outflows from the top funds.

XRP ETF by Canary Capital registered a record-breaking $243 million inflow in the first trading session — way higher than any other ETFs in the inaugural session. To provide context, it is more than Solana ETFs and Litecoin ETFs attracted in the past two weeks.

The total capitalization of the cryptocurrency market is down by 0.74% today.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov