Grayscale’s newly appointed CEO, Michael Sonnenshein, recently told Bloomberg that the firm plans to double its staff this year. It currently employs 24 people.

The firm will continue to focus on advertising, with its new cryptocurrency commercial debuting soon.

Making Bitcoin even scarcer

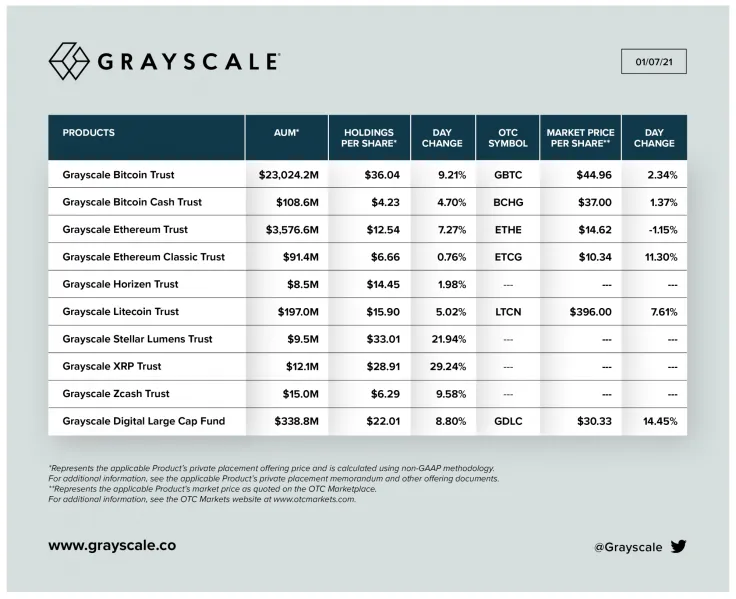

According to its Jan. 7 update, Grayscale’s family of products currently has $27.4 billion worth of cryptocurrencies under management. Its Bitcoin trust alone has surpassed $23 billion.

Sonnenshein said that his asset management firm planned to unveil six new products in 2021.

He went on to mention that growing inflows into Grayscale Bitcoin Trust are making the world’s largest cryptocurrency even scarcer:

“This is a verifiable scarce asset and so when there are mechanisms that are removing them from circulation, that’s inherently making it an even scarcer asset.”

Crypto Market Review: Shiba Inu's (SHIB) Back in Business, Ethereum (ETH) Must Decide, XRP Locked in on $2U.Today Crypto Digest: XRP Hits ‘Extreme Fear’ Zone, Shiba Inu (SHIB) Volume Collapses to Lowest Level of 2026, Dogecoin (DOGE) Price Eyes 30% BreakoutFidelity Warns of Bitcoin ‘Rebalancing’ Amid Gold RushMorning Crypto Report: Dogecoin to the Moon? $1.10 DOGE Price Scenario Revealed, Solana Phone Coin Explodes 400%, $1.37 Billion in XRP Risk Flooding Market

On-boarding pension funds and endowments

Sonnenshein also added that pension funds and endowments, not just hedge funds, were seeking exposure to Bitcoin:

“We’ve started to see participation not just from the hedge fund segment, which we’ve long seen participation from, but now it’s recently from other institutions, pensions, and endowments.”

Advertisement

Furthermore, he claimed that the sizes of their allocations were increasing at a rapid pace.

Arman Shirinyan

Arman Shirinyan Dan Burgin

Dan Burgin Alex Dovbnya

Alex Dovbnya Caroline Amosun

Caroline Amosun