Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Gems Trade, a mainstream regulatory-compliant centralized crypto exchange, shares details of its new instrument, Crypto Basket. Now, customers can buy diversified portfolios of this or that segment in a single click, owning both the whole basket and every underlying asset.

Gems Trade now supports Crypto Basket option: What to know

According to an official statement of Gems Trade, a top-tier crypto exchange for spot and futures trading, its Crypto Basket feature is now live for all accounts. Using Crypto Basket, customers can purchase portfolios of tokens from this or that category in a single click.

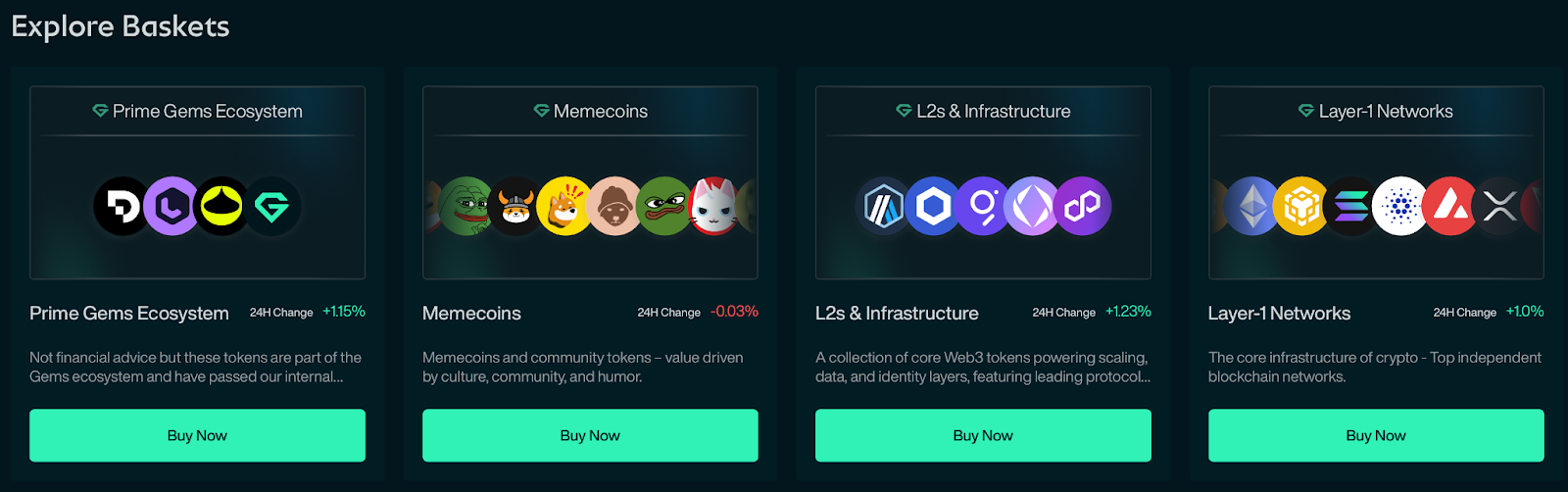

At launch, Baskets will include segments such as Layer-1 networks, Layer-2s, Web3 infrastructure, DeFi protocols, gaming and metaverse tokens and top-performing meme coins. Also, the Prediction Markets category is set to provide exposure to all trending altcoins here with reduced friction.

Each Basket contains a fixed set of assets, such as the top 10 meme coins, and users buy or sell the entire bundle as a single unit while holding each token directly in their own account.

By reducing dozens of manual steps into a single step, Baskets minimizes execution time, slippage and the extra work required to build a diversified portfolio. Besides that, sharing capital allocation between various assets of the same group makes the entire strategy more resilient, balanced, and reduces risks.

While being a newcomer-friendly tool for retail investors, Crypto Basket also helps institutions in their journey in Web3. With more than 80% of institutional investors already relying on derivatives to manage crypto exposure, traders are doing far more than just trading. They are constantly switching between research, operations and portfolio management as they build positions across a scattered set of assets.

This creates a time-consuming, fragmented process that is difficult to maintain, leaving users with uneven token performance and limited ability to keep their positions aligned as the market moves.

Building diversified portfolio of tokens in a few clicks

Crypto Basket enhances trading and investing experience for institutions at every step.

Omri Hanover of Gems Trade is excited by the opportunities the new tooling unlocks for traders and investors:

From researching tokens, timing traders, and adjusting positions to keep positions aligned, there is a significant amount of work that goes into building a diversified portfolio, and traders end up taking on several different roles to do it.We heard and understood this pain point, which is why we created Baskets: a simple way to take a position across several tokens at once

He also stressed that the exchange's strategy is to help traders strengthen their position by providing them with tools that let them focus on strategy rather than on tedious, time-consuming tasks.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov